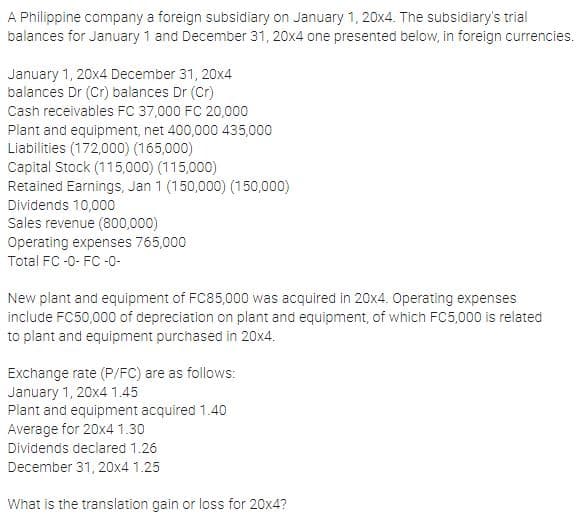

A Philippine company a foreign subsidiary on January 1, 20x4. The subsidiary's trial balances for January 1 and December 31, 20x4 one presented below, in foreign currencies. January 1, 20x4 December 31, 20x4 balances Dr (Cr) balances Dr (Cr) Cash receivables FC 37,000 FC 20,000 Plant and equipment, net 400,000 435,000 Liabilities (172,000) (165,000) Capital Stock (115,000) (115,000) Retained Earnings, Jan 1 (150,000) (150,000) Dividends 10,000 Sales revenue (800,000) Operating expenses 765,000 Total FC -0- FC -0- New plant and equipment of FC85,000 was acquired in 20x4. Operating expenses include FC50,000 of depreciation on plant and equipment, of which FC5,000 is related to plant and equipment purchased in 20x4. Exchange rate (P/FC) are as follows: January 1, 20x4 1.45 Plant and equipment acquired 1.40 Average for 20x4 1.30 Dividends declared 1.26 December 31, 20x4 1.25 What is the translation gain or loss for 20x4?

A Philippine company a foreign subsidiary on January 1, 20x4. The subsidiary's trial balances for January 1 and December 31, 20x4 one presented below, in foreign currencies. January 1, 20x4 December 31, 20x4 balances Dr (Cr) balances Dr (Cr) Cash receivables FC 37,000 FC 20,000 Plant and equipment, net 400,000 435,000 Liabilities (172,000) (165,000) Capital Stock (115,000) (115,000) Retained Earnings, Jan 1 (150,000) (150,000) Dividends 10,000 Sales revenue (800,000) Operating expenses 765,000 Total FC -0- FC -0- New plant and equipment of FC85,000 was acquired in 20x4. Operating expenses include FC50,000 of depreciation on plant and equipment, of which FC5,000 is related to plant and equipment purchased in 20x4. Exchange rate (P/FC) are as follows: January 1, 20x4 1.45 Plant and equipment acquired 1.40 Average for 20x4 1.30 Dividends declared 1.26 December 31, 20x4 1.25 What is the translation gain or loss for 20x4?

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter8: Investing Activities

Section: Chapter Questions

Problem 26PC

Related questions

Question

2. Please help me to answer this with solution. thank you

Transcribed Image Text:A Philippine company a foreign subsidiary on January 1, 20x4. The subsidiary's trial

balances for January 1 and December 31, 20x4 one presented below, in foreign currencies.

January 1, 20x4 December 31, 20x4

balances Dr (Cr) balances Dr (Cr)

Cash receivables FC 37,000 FC 20,000

Plant and equipment, net 400,000 435,000

Liabilities (172,000) (165,000)

Capital Stock (115,000) (115,000)

Retained Earnings, Jan 1 (150,000) (150,000)

Dividends 10,000

Sales revenue (800,000)

Operating expenses 765,000

Total FC -0- FC -0-

New plant and equipment of FC85,000 was acquired in 20x4. Operating expenses

include FC50,000 of depreciation on plant and equipment, of which FC5,000 is related

to plant and equipment purchased in 20x4.

Exchange rate (P/FC) are as follows:

January 1, 20x4 1.45

Plant and equipment acquired 1.40

Average for 20x4 1.30

Dividends declared 1.26

December 31, 20x4 1.25

What is the translation gain or loss for 20x4?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning