a) Prepare all journal entries necessary for the investment-related transactions in 2021. 1. b) Prepare all journal entries necessary for the sale of the shares on February 15, 2022.

a) Prepare all journal entries necessary for the investment-related transactions in 2021. 1. b) Prepare all journal entries necessary for the sale of the shares on February 15, 2022.

Chapter19: Deferred Compensation

Section: Chapter Questions

Problem 52P

Related questions

Question

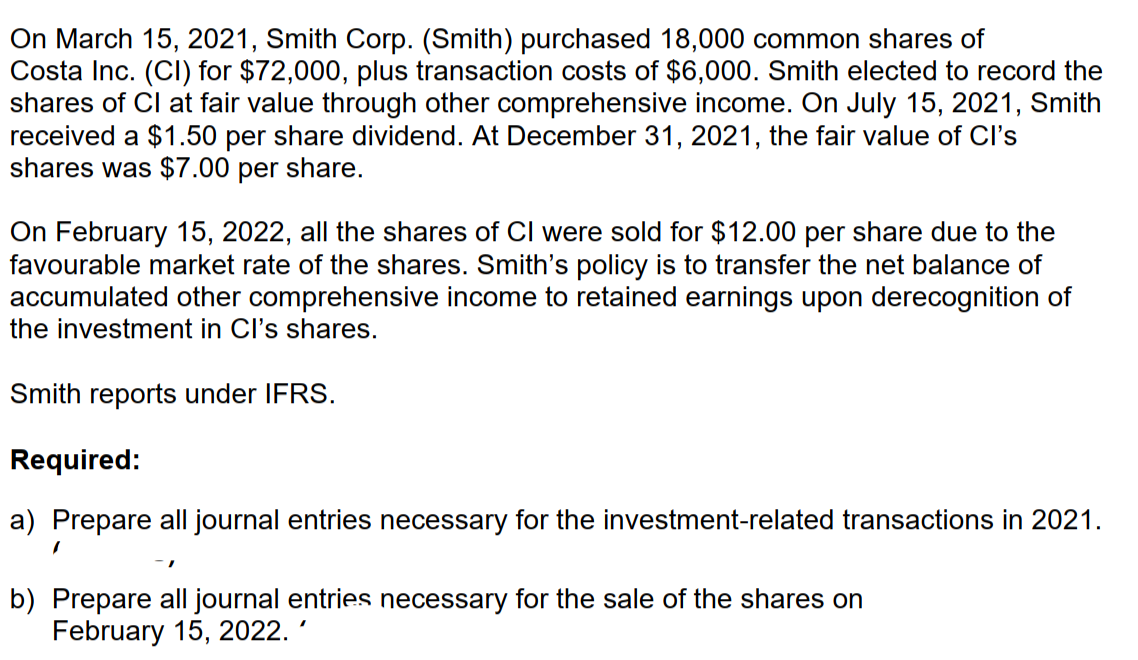

Transcribed Image Text:On March 15, 2021, Smith Corp. (Smith) purchased 18,000 common shares of

Costa Inc. (CI) for $72,000, plus transaction costs of $6,000. Smith elected to record the

shares of Cl at fair value through other comprehensive income. On July 15, 2021, Smith

received a $1.50 per share dividend. At December 31, 2021, the fair value of Cl's

shares was $7.00 per share.

On February 15, 2022, all the shares of CI were sold for $12.00 per share due to the

favourable market rate of the shares. Smith's policy is to transfer the net balance of

accumulated other comprehensive income to retained earnings upon derecognition of

the investment in Cl's shares.

Smith reports under IFRS.

Required:

a) Prepare all journal entries necessary for the investment-related transactions in 2021.

b) Prepare all journal entries necessary for the sale of the shares on

February 15, 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning