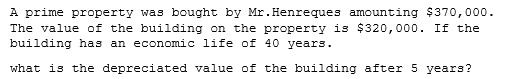

A prime property was bought by Mr.Henreques amounting $370,000. The value of the building on the property is $320,000. If the building has an economic life of 40 years. what is the depreciated value of the building after 5 years?

Q: Bill’s Pizza Kitchen, LLC purchased a new Pizza oven for $9,000. It has a five-year life and $500.00…

A: Depreciation: It refers to a gradual decrease in the fixed asset’s value because of obsolescence,…

Q: Wah Co. has an investment property acquired four years ago at a total cost of P1,000,000. The…

A: Option (b) is the correct answer

Q: On October 1st, you purchased a residentialhome in which to locate your professional office…

A: a) The first question askes to find the depreciation expense for the first year that the person…

Q: In year 0, an electrical appliance company purchased an industrial robot costing $350,000. The robot…

A:

Q: On May 1, Jack Costanza paid $100,000 for a residential rental property. This purchase price…

A: Property is the part of long term asset. It can be an equipment, appliances, furniture, real-estate…

Q: Bridge City Consulting bought a building and the land on which it is located for $195,000 cash. The…

A: The asset is valued at the total cost incurred to bring the asset for being ready to use.

Q: On April 1st, Leo Smith paid $310,000 for aresidential rental property. This purchase price…

A: Definition: Modified accelerated cost recovery system (MACRS): This is a depreciation method…

Q: [The following Information applies to the questions displayed below.] On January 1, Mitzu Company…

A: The lump sum price paid to acquire various assets can be apportioned on the basis of their fair…

Q: A person bought a property for $270,000. The value of the building on the property is $220,000.…

A: Depreciation is an accounting method for assets where they have gone through various wear and tear…

Q: A business’ building has a cost of ₱ 3,340,000 with a useful life of 10 years. On June 25,2020, the…

A: The total property plant and equipment are those that provide long-term economic benefits and…

Q: Twin-Cities, Inc., purchased a building for $400,000. Straight-line depreciation was used for eachof…

A: Depreciation: It refers to a gradual decrease in the fixed asset’s value because of obsolescence,…

Q: Fairfield Properties owns real property that is MACRS depreciated with n = 39 years. They paid $3.4…

A:

Q: The value of the building on the property is $220,000. If the building has an economic life of 50…

A: Depreciation is an accounting method where the assets are gone through wear and tear over the period…

Q: A company purchased a new forging machine to manufacture disks for airplane turbine engines. The new…

A: (a) Determine the book value of the asset at the beginning of each tax year. Workings:

Q: Company J bought a piece of equipment for $200,000. This equipment has a useful life of 10 years and…

A: The carrying amount is also known as the book value of the asset. The carrying amount of the current…

Q: Jason Thompson purchased an office building 10 years ago for $780,000. The building was just…

A: Assets are generally recorded at cost and remain on the accounting records at cost until they are…

Q: An asset with initial cost base of 6 million was bought 5 years ago. At the end of the current year…

A: The assets which possess a natural capability for growing or procreating themselves which lead to…

Q: Bill bought a property for $270,000. The value of the building on the property is $220,000. If the…

A: Depreciation is an accounting method where the entities assets are gone through wear and tear over…

Q: Jack bought a property for $270,000. The value of the building on the property is $220,000. If the…

A: Depreciation = Total Cost of Building - Residual ValueEstimated Useful life

Q: On January 1, 20x1, ABC Co. received 2,000,000 grant from the government to aid in the construction…

A: Depreciation means the loss in value of assets because of usage of assets , passage of time or…

Q: A 33 unit apartment building is purchased for $3.73 million. In addition, the purchaser paid $28,000…

A: Depreciation:-It is the expenses that occur due to the normal wear and tear of an asset and the…

Q: On March 1, 2022, Ayayai Company acquired real estate on which it planned to construct a small…

A: Cost of land = Cash paid + Demolition cost - Salvaged materials + Attorney's fee + Real estate…

Q: On January 1, 2018, Absolutely Bar & Grill purchased a building, paying $57,000 cash and signing…

A:

Q: On October 3, Kim Bailey paid $250,000 for a residential rental property. Thispurchase price…

A:

Q: an asset was purchased at 480,000. it has an estimated life of10 years, and is sold at 50,000. what…

A: Fixed assets are types of assets held by the business for a longer period. Examples of fixed assets…

Q: A distribution center purchased an equipment for $100,000 and has depreciated the equipment using…

A: Hello. Since your question has multiple sub-parts, we will solve first three sub-parts for you. If…

Q: A company purchased a new forging machine to manufacture disks for airplane turbine engines. The new…

A: Modified Accelerated Cost Recovery System (MACRS): MACRS is a current tax depreciation system…

Q: mazon purchased a piece of land for $5 million and plans to build a $25 million distrib rarehouse to…

A: Depreciation refers to the fall in the value of tangible assets over time. Tax is the mandatory…

Q: A company purchased a new forging machineto manufacture disks for airplane turbine engines.The new…

A: Depreciation refers to the fall in the book value of an asset each year. Depreciable amount is…

Q: Smitty Inc. wishes to use the revaluation model for this property: Before Revaluation • Building…

A: The question is based on the concept of revaluation of asset and its impact on calculation of…

Q: An electrical appliance company purchased an industrial robot costing $320,000 in year 0. The…

A: The question involves the calculation of gains/losses from disposal of an asset before its life gets…

Q: Alpha purchased delivery equipment amounting to P100,000 and plans to sell the asset for P10,000 at…

A: The formula to calculate annual depreciation is Cost - SalvageUseful life

Q: You sold an automobile at a price of $14,000.The automobile was purchased three years ago…

A: Economic depreciation means there is a decrease in the value of an asset overtime due to its usage…

Q: Assume that in January 20X6, a Hotcake House restaurant purchased a building, paying $57,000 cash…

A: Income statement forms a part of financial statements of company and is prepared to ascertain the…

Q: Company E recently acquired an asset that has a cost basis of $11,000. The asset’s estimated life is…

A: The depreciable cost is calculated as difference between cost of asset and salvage value.

Q: Compute the amount of depreciation of a building after 5 years with the following informations given…

A: Depreciation is an method where the assets needs to be recorded with present value by deducting an…

Q: Consider a 5-year MACRS asset, which was purchased at $140,000. The asset was disposed of at end of…

A: The Modified Accelerated Cost Recovery System (MACRS) serves as a most appropriate method of…

Q: Nancy purchased new business computers (5-year property) in January for a total of $1,300,000. She…

A: Depreciation refers to the portion of fixed asset which is allocated on the basis of estimated life…

Q: A firm is trying to decide whether to keep anitem of construction equipment for another year.…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: A file server and peripherals are purchased in December by a calendar-year taxpayer for $8,000. The…

A:

Q: On January 10, 1997 NXT CO. Company purchased a building by paying $75,000. The building has an…

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage…

Q: Finx, Inc., purchased a truck for $35,000. The truck is expected to be driven 15,000 miles per year…

A: Depreciation: It refers to a fall in the value of the fixed asset because of obsolescence,…

Q: Shaun Pollok purchased a car wash for $480,000. If purchased separately, the land would have cost…

A: Separate value of asset = Actual value / Overall cost of all asset * Estimated cost of asset

Q: Mr. Sanchez bought a machine costing 600,000, it is believed to have a book value of P24500.65 at…

A: It is done through the trial and error method only. As no other information except the cost and book…

Q: Roma Inc purchased an asset worth $500,000. The useful life of the assetwill be 8 years and it was…

A: The depreciation expense is charged on fixed assets as reduced value of fixed assets with the…

Q: Electric generating and transmission equipment is placed in service at a cost of $3,000,000. It is…

A: The cost of the asset which is spread over the benefits of the estimated useful life of an asset is…

Q: urchasing equipment for $150,000 (7yr MACRS property). The estimated useful life of the equipment…

A: MACRS is modified accelerated depreciation in which there is more depreciation during the initial…

Step by step

Solved in 2 steps

- Montello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.Alfredo Company purchased a new 3-D printer for $900,000. Although this printer is expected to last for ten years, Alfredo knows the technology will become old quickly, and so they plan to replace this printer in three years. At that point, Alfredo believes it will be able to sell the printer for $15,000. Calculate yearly depreciation using the double-declining-balance method.Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for ten years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.

- Akron Incorporated purchased an asset at the beginning of Year 1 for 375,000. The estimated residual value is 15,000. Akron estimates that the asset has a service life of 5 years. Calculate the depreciation expense using the sum-of-the-years-digits method for Years 1 and 2 of the assets life.Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method, and in year one it expects to use the truck for 26,000 miles. Calculate the annual depreciation expense.Kenzie purchased a new 3-D printer for $450,000. Although this printer is expected to last for ten years, Kenzie knows the technology will become old quickly and so she plans to replace this printer in three years. At that point, Kenzie believes she will be able to sell the printer for $30,000. Calculate yearly depreciation using the double-declining-balance method.

- Utica Corporation paid 360,000 to purchase land and a building. An appraisal showed that the land is worth 100,000 and the building is worth 300,000. What cost should Utica assign to the land and to the building, respectively?Montezuma Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montezuma uses the straight-line depreciation method. Calculate the annual depreciation expense. After three years of recording depreciation, Montezuma determines that the delivery truck will only be useful for another three years and that the salvage value will increase to $4,000. Determine the depreciation expense for the final three years of the assets life, and create the journal entry for year four.Jada Company had the following transactions during the year: Purchased a machine for $500,000 using a long-term note to finance it Paid $500 for ordinary repair Purchased a patent for $45,000 cash Paid $200,000 cash for addition to an existing building Paid $60,000 for monthly salaries Paid $250 for routine maintenance on equipment Paid $10,000 for extraordinary repairs If all transactions were recorded properly, what amount did Jada capitalize for the year, and what amount did Jada expense for the year?

- Referring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the purchase of the printer impacts not only depreciation expense each year but also the assets book value. What amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded?Urquhart Global purchases a building to house its administrative offices for $500,000. The best estimate of the salvage value at the time of purchase was $45,000, and it is expected to be used for forty years. Urquhart uses the straight-line depreciation method for all buildings. After ten years of recording depreciation, Urquhart determines that the building will be useful for a total of fifty years instead of forty. Calculate annual depreciation expense for the first ten years. Determine the depreciation expense for the final forty years of the assets life, and create the journal entry for year eleven.Johnson, Incorporated had the following transactions during the year: Purchased a building for $5,000,000 using a mortgage for financing Paid $2,000 for ordinary repair on a piece of equipment Sold product on account to customers for $1,500,600 Purchased a copyright for $5,000 cash Paid $20,000 cash to add a storage shed in the corner of an existing building Paid $360,000 in monthly salaries Paid $25,000 for routine maintenance on equipment Paid $110,000 for major repairs If all transactions were recorded properly, what amount did Johnson capitalize for the year, and what amount did Johnson expense for the year?