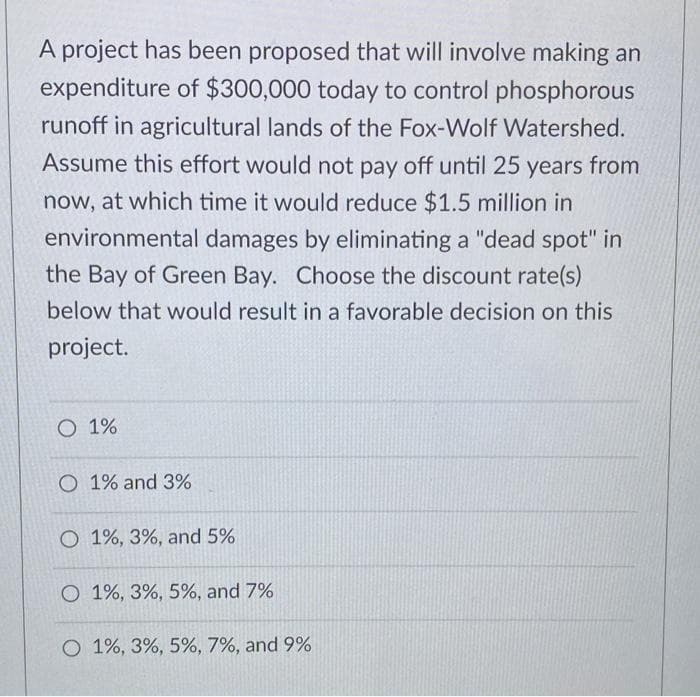

A project has been proposed that will involve making an expenditure of $300,000 today to control phosphorous runoff in agricultural lands of the Fox-Wolf Watershed. Assume this effort would not pay off until 25 years from now, at which time it would reduce $1.5 million in environmental damages by eliminating a "dead spot" in the Bay of Green Bay. Choose the discount rate(s) below that would result in a favorable decision on this project. O 1% O 1% and 3% O 1%, 3%, and 5% O 1%, 3%, 5%, and 7%

A project has been proposed that will involve making an expenditure of $300,000 today to control phosphorous runoff in agricultural lands of the Fox-Wolf Watershed. Assume this effort would not pay off until 25 years from now, at which time it would reduce $1.5 million in environmental damages by eliminating a "dead spot" in the Bay of Green Bay. Choose the discount rate(s) below that would result in a favorable decision on this project. O 1% O 1% and 3% O 1%, 3%, and 5% O 1%, 3%, 5%, and 7%

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 17P

Related questions

Question

Transcribed Image Text:A project has been proposed that will involve making an

expenditure of $300,000 today to control phosphorous

runoff in agricultural lands of the Fox-Wolf Watershed.

Assume this effort would not pay off until 25 years from

now, at which time it would reduce $1.5 million in

environmental damages by eliminating a "dead spot" in

the Bay of Green Bay. Choose the discount rate(s)

below that would result in a favorable decision on this

project.

O 1%

O 1% and 3%

O 1%, 3%, and 5%

O 1%, 3%, 5%, and 7%

O 1%, 3%, 5%, 7%, and 9%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub