A relatively low P/E ratio illustrates

Q: Calculate cost of goods sold and ending inventory for Emergicare's bandages orders using FIFO, LIFO…

A: Inventory valuation refers to the methods used by the company to determine the value of its…

Q: On 10 January 2021, Mrs D Africa sold goods to three different clients, Mr P Lucky, Mrs V Happy and…

A: To account for Cash Receipts for sales made, i.e. where the payment method is cash, a cash invoice…

Q: Coronado Industries had sales in 2021 of $5,698,400 and gross profit of $921,800. Management is…

A: Sales Budget- A sales budget is a plan that outlines the methods and strategies for forecasting…

Q: Suppos utility o

A: 1. a) Mux=20,Muy=24 so,marginal rate of substitution at your utility maximizing…

Q: Calculate the maximum depreciation expense for the current year (ignoring 3179 and bonus…

A: Depreciation is writing down the value of asset as it is used in the business operation. The…

Q: Common Stockholders' Profitability Analysis A company reports the following: Net income $125,000…

A: The return on common equity ratio compares the amount of money received by common shareholders from…

Q: The controller of Feinberg Company is gathering data to prepare the cash budget for July. Heplans to…

A: A cash budget is a forecast of a company's free cash flow over a set period of time. This budget…

Q: You discovered the following errors in connection with your examination of the Chapter 6 -…

A: "Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Harry and Sally formed the Evergreen partnership by contributing the following assets in exchange…

A: As per Sec 721, Harry will not realize any gain or loss on contribution. As per Sec 721, no gain is…

Q: 1. Cash balance according to the company's records at August 31, $25,520. 2. Cash balance according…

A: Introduction: Bank Reconciliation statement: To reconcile the difference between bank book and cash…

Q: to service a minimum

A: Khaki Pants have a higher contribution margin per minute on the cutting machines. As the cutting…

Q: The management accountant at Genus Manufacturing Company, Karen Cranston, is in the process of…

A: The question is related to the Cash Budget. The Cash budget is a summary of cash receipts and cash…

Q: Assets = Liabilities + (Owner, Capital - Owner, Withdrawal + Revenues - Expenses) 2. What is a…

A: The question is related to Basic of Accounting and details are given. Since you have posted a…

Q: On 30 June 2022, the statement of financial position of Brimbank City Council showed the following…

A: The method which is used to adjust the book value of a fixed asset according to the market value or…

Q: Larson, Inc., manufactures backpacks. Last year, it sold 105,000 of its basic model for $20 per…

A: Answer) Calculation of Larsen’s Estimated Sales Revenue for Coming Year Larsen’s Expected Sales…

Q: The Tori Company had budgeted production for the year as follows: Quarter 1 2 3 4 Production in…

A:

Q: At January 1, 2020, Buffalo Company’s outstanding shares included the following. 298,000 shares of…

A: Earning per share is the ratio of earnings per outstanding share of common stock. Weighted average…

Q: True or false: • Line personnel give assistance to staff employees. • Organizational structure is…

A: Line and staff organizational structure: It's the modification of line organization. As per line…

Q: 22. Hot Mama's has prepared its fourth quarter budget and provided the following data: Oct Nov Dec…

A: Cash collections for October: $52,000 Purchases of direct materials: $35,000 Operating expenses:…

Q: At the beginning of 2021, DAI Corp. was organized with authorized capital of 200,000, P500 par value…

A: Share Premium: Share premium is the credited difference in price between the par value, or face…

Q: On January 1, 2019, EXO Corp. purchased BTS Inc. at a cost that resulted in recognition of goodwill…

A: Goodwill: Generally speaking, goodwill is an intangible asset that is related to the acquisition of…

Q: At the beginning of period, Ammar Co. had balances in account receivable of $ 400,000 and allowance…

A: As per the guidelines, since the question has multiple sub-parts, the solution of the first four…

Q: Which of the following best describes the auditors’ approach to auditing property, plant and…

A: As per the guidelines, only one question is allowed to be solved. Please resubmit the question…

Q: Ayayai Company’s net income for 2020 is $52,900. The only potentially dilutive securities…

A: Proceeds from issue of options = 1,040 options x 1 share x $6 per share = $6,240 Number of shares…

Q: Assume that the moving activity has an expected cost of $80,000. Expected directlabor hours are…

A: The cost of Moving Activity will be assigned on the basis of number of moves.

Q: Compute for the Economic order quantity, assuming the no of units of materials required annually…

A: Annual requirement (A) = 120,000 Units Ordering cost per order (O) = P39.00 Carrying cost per order…

Q: Mr Zoo is planning to set up a mini Zoo in Howick. The following relates to different pricing…

A: The contribution margin ratio is the percentage difference between a company's revenue and variable…

Q: On December 22, Travis Company purchased merchandise on account from a supplier for $7,500, terms…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Jean Jones, Robert Martin, and Lee Brown decide to form a new business to be operated as a C…

A: The person transferring the property to a corporation wholly in exchange for the stock of such…

Q: On July 1, 2020, Jason Corporation pledged P5,000,000 of its accounts receivable to Philippine Bank…

A: Accounts Receivable Pledging:- It is the use of accounts receivable as collateral to secure loans…

Q: SA Electrical received a debit card payment of R2 300,00 from A Zulu in full settlement of his…

A: The correct option with proper explanation are as follows.

Q: 2. Rue Company makes several types of graphic tablets. One factory specializes in two types, the…

A: Profit margin is the margin which is left after taking into consideration total cost. Overhead rate…

Q: formed the Evergreen partnership by contributing the following assets in exchange for a 50 percent…

A: Tax refers to the mandatory charge levied by the government over the money earned or gained by an…

Q: 1. Net cash provided by financing activities 2. Net cash used by investing activities

A: 1. Collection of accounts Receivables and payment of accounts payable won't affect…

Q: B. Sovereign debt (issued bonds) are typically considered as proxies for risk free. Discuss the…

A: Public debt is an important way for governments to fund their investments in growth and development.…

Q: Prime Corp acquired 90% of the outstanding ordinary share of Bee Company. On March 31, 2030, Prime…

A: Prime acquired 90% of the shares of Bee Co. So Prime is holding…

Q: Skip to question [The following information applies to the questions displayed below.] The…

A: The bank reconciliation statement is prepared to adjust the balance of cash book and passbook with…

Q: s decided to spend P1,200,000 to provide facilities immediately and to provide P100,000 of capital…

A: Given: The initial amount = $5 million The spendable amount = $1.2 million The amount of capital…

Q: Division A makes a part with the following characteristics: **SEE IMAGE TO SEE DETAILS** a}…

A: Transfer price is the internal price assigned to the purchase of one unit of product produced by…

Q: Cost of goods manufactured $198,240 Selling expenses 66,220 Administrative expenses 35,010 Sales…

A: Formula: Cost of finished goods available for sale = Beginning finished goods + Cost of goods…

Q: Calculate Return on investment (ROI) using the following data: Sales $50,000 Net operating income…

A: Return on investment (ROI) = Net operating income / Average operating assets where, Average…

Q: How many shares are outstanding as of ye ar-

A: Answer:

Q: 1 State four data items relating to the holding of equity shares in a single company that could be…

A: Balance sheet A balance sheet is a financial statement that records the assets and liabilities for a…

Q: Required information Problem 8-4A Preparing a bank reconciliation and recording adjustments LO P3…

A: Solution A journal is the company's official book in which all business transactions are recorded…

Q: Mr. J, Capital Office Equipment Accounts Payable 85 000.00 Notes Receivable 12 000.00 Notes Payable…

A: Formula: Net income = Total revenues - Total Expenses

Q: How did financial management influence your capsim simulation.

A: The planning, organizing, directing, and controlling of a company's financial activities, such as…

Q: a.Harry and Sally formed the Evergreen partnership by contributing the following assets in exchange…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Hussain Company is unable to reconcile the bank balance at January 31. Hussain's reconciliation is…

A: Bank reconciliation statement is prepared by the management at a particular time period. It helps to…

Q: Sunland, Inc. has three divisions: Bud, Wise, and Er. The results of operations for May, 2022 are…

A: The question is related to discontinuing a product. The details are given.

Q: 11a.Harry and Sally formed the Evergreen partnership by contributing the following assets in…

A: Solution:- Calculation of Harry’s tax basis in his partnership interest as follows under:-

Step by step

Solved in 2 steps

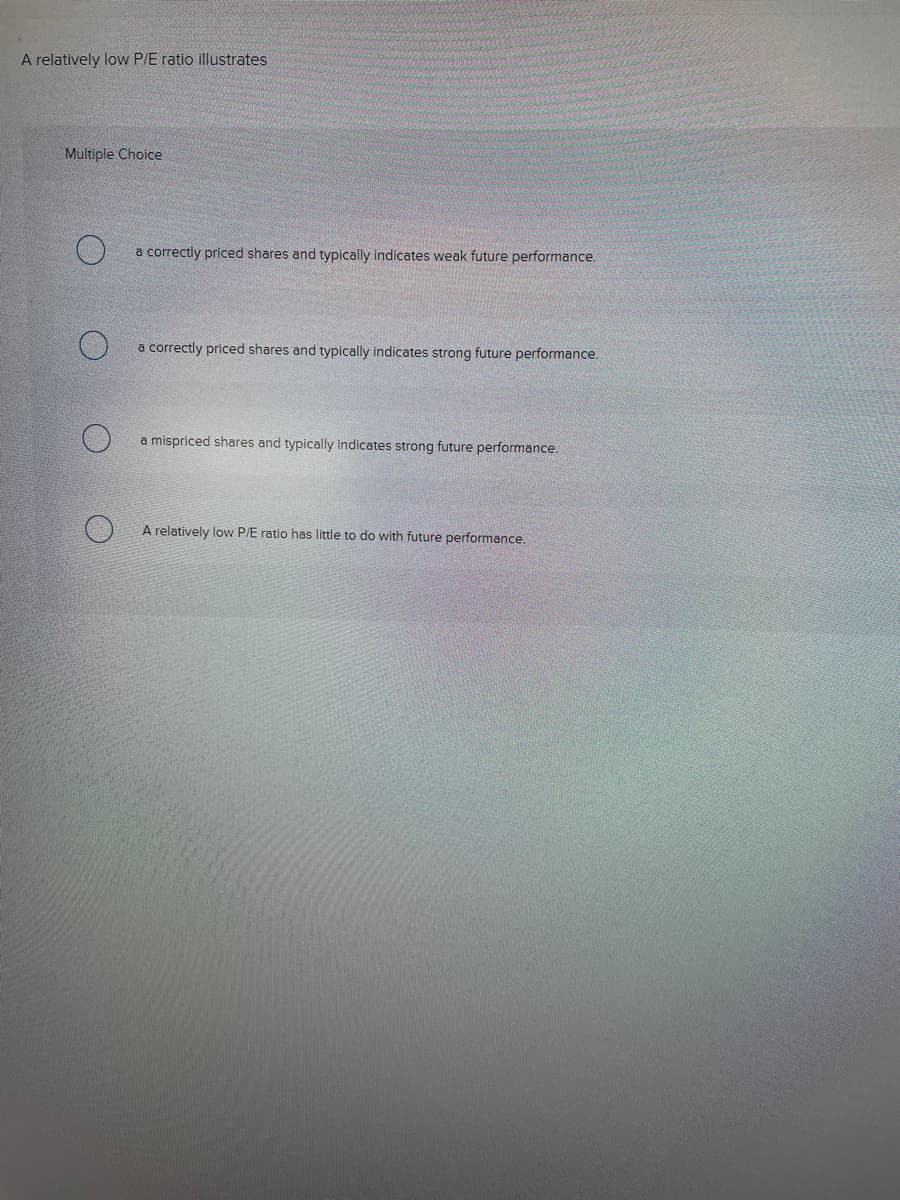

- Which of the following statements is most accurate in analyzing a stock? If the expected return exceeds itsrequired return__________________a. The stock should be sold.b. The stock is good to buy.c. The management is probably not trying to maximize the price per share.d. Dividends are not likely to be declarede. The stock is experiencing supernormal growthAn analyst is trying to determine the intrinsic value of a certain share. Which of the following is true with regards to the methods of stock valuation? a. Discounting techniques does not involve forecasting future dividends b. Free cash flow is important in discounted dividend model c. Aside from the intrinsic value, the market value of the firm can also be determined by free cash flow model d. Non-constant growth stock is valuated in the same way as preferred stockOne concern when screening for stocks with low price-to-earnings ratios is that companies with low P/Es may be fi nancially weak. What criterion might an analyst include toavoid inadvertently selecting weak companies?A . Net income less than zeroB . Debt-to-total assets ratio below a certain cutoff pointC . Current-year sales growth lower than prior-year sales growth

- Which of the following statements is false regarding treasury shares? [A] purchasing treasury shares would decreasethe total shareholders’ equity [B] the resulting gain in selling treasury shares is presented as share premium fromtreasury shares [C] treasury shares will not receive cash dividends [D] the retirement of treasury shares will decreasethe total shareholders’ equity.Why is the cost of retained earnings cheaper than the cost of issuing new common stock? Group of answer choices Issuing new common stock may send a negative signal to the capital markets, which may depress the stock price. When a company issues new common stock they also have to pay flotation costs to the underwriter. Either NeitherThe bird-in-the-hand argument espousing the importance of dividends or dividend relevance suggests that investors view a current (certain) dividend as less risky than future (uncertain) dividends or capital gains; nevertheless, proponents of this theory argue that this will have no significant impact on share price. Is this true or false

- Which of the following statement(s) is(are) TRUE? (i) The valuation price of a stock primarily depends on expected future dividends to its shareholders and its required rate of return. (ii) An investor who intends to sell a stock after holding it for a short period will forgo all future dividends, thus will be willing to pay for a lower price for the stock compared to another investor who prefers to hold the share for a longer period. (iii) The valuation share price is positively related to the share's required rate of return.Which of the following statements regarding P/E multiple is NOT correct? Group of answer choices A stock with a low P/E multiple indicates that the stock is undervalued. A firm's risk does not affect its P/E multiple. Two statements are NOT correct. A firm’s high P/E multiple may be attributed to a temporary decrease in its EPS. A firm’s growth potential affects its P/E multiple.which of the following statements is true? Select one: Investors sell a stock when required return is less than expected return and buy a stock when required return above expected return None of the answers are correct Investors buy a stock when it is under-valued and sell it when it is over-valued Investors sell a stock when it is under-valued and buy it when it is over-valued.

- Investments in smaller company stock compared to investments in larger company stock are generally: A) more volatile because they are less liquid, have less stock issued and have less diversified sources of income. B) more volatile because they are less liquid, have less stock issued and have more diversified sources of income. C) less volatile because they are less liquid, have less stock issued and have less diversified sources of income. D) less volatile because they are less liquid, have less stock issued and have more diversified sources of income.The small firm effect refers to the observed tendency for stock prices to behave in a manner that is contrary to normal expectations. Describe this effect and discuss whether it represents sufficient information to conclude that the stock market does not operate efficiently. In formulating your response, consider: (a) what it means for the stock market to be inefficient, and (b) what role the measurement of risk plays in your conclusions about each effect.WHICH STATEMENT IS FALSE?A. If the net income of prior period is overstated because of the change in accounting policy, the effect is deducted from the beginning retained earnings.B. Equity is also the net assets.C. Prior period errors are shown as adjustment of the ending balance of retained earnings. If the net income of the prior period is overstated, the amount of the error uis deducted from retained earnings.D. In the conversion of preference chares into ordinary shares, if the total par or stated value of the ordinary shares is more than the original issue of the preference shares, the difference is charged to retained earnings.