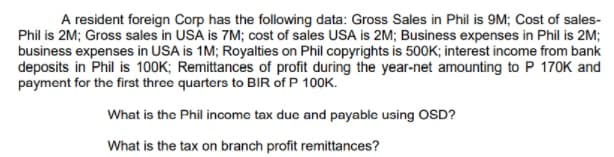

A resident foreign Corp has the following data: Gross Sales in Phil is 9M; Cost of sales- Phil is 2M; Gross sales in USA is 7M; cost of sales USA is 2M; Business expenses in Phil is 2M; business expenses in USA is 1M; Royalties on Phil copyrights is 500K; interest income from bank deposits in Phil is 100K; Remittances of profit during the year-net amounting to P 170K and payment for the first three quarters to BIR of P 100K. What is the Phil income tax due and payable using OSD? What is the tax on branch profit remittances?

A resident foreign Corp has the following data: Gross Sales in Phil is 9M; Cost of sales- Phil is 2M; Gross sales in USA is 7M; cost of sales USA is 2M; Business expenses in Phil is 2M; business expenses in USA is 1M; Royalties on Phil copyrights is 500K; interest income from bank deposits in Phil is 100K; Remittances of profit during the year-net amounting to P 170K and payment for the first three quarters to BIR of P 100K. What is the Phil income tax due and payable using OSD? What is the tax on branch profit remittances?

Chapter12: Tax Credits And Payments

Section: Chapter Questions

Problem 29P

Related questions

Question

Give answer within 30 min .....I will give you up vote immediately.... it's very urgent.

Transcribed Image Text:A resident foreign Corp has the following data: Gross Sales in Phil is 9M; Cost of sales-

Phil is 2M; Gross sales in USA is 7M; cost of sales USA is 2M; Business expenses in Phil is 2M;

business expenses in USA is 1M; Royalties on Phil copyrights is 500K; interest income from bank

deposits in Phil is 100K; Remittances of profit during the year-net amounting to P 170K and

payment for the first three quarters to BIR of P 100K.

What is the Phil income tax due and payable using OSD?

What is the tax on branch profit remittances?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you