A retail company must file a monthly sales tax report listing the sales for the month and the amount of sales tax collected. Write a program that asks for the month, the year, and the total amount collected at the cash register (that is, sales plus sales tax). Assume the state sales tax is 4 percent and the county sales tax is 2 percent. If the total amount collected is known and the total sales tax is 6 percent, the amount of product sales may be calculated as: S T 1.06 S is the product sales and T is the total income (product sales plus sales tax). The program should display a report similar to

A retail company must file a monthly sales tax report listing the sales for the month and the amount of sales tax collected. Write a program that asks for the month, the year, and the total amount collected at the cash register (that is, sales plus sales tax). Assume the state sales tax is 4 percent and the county sales tax is 2 percent. If the total amount collected is known and the total sales tax is 6 percent, the amount of product sales may be calculated as: S T 1.06 S is the product sales and T is the total income (product sales plus sales tax). The program should display a report similar to

C++ Programming: From Problem Analysis to Program Design

8th Edition

ISBN:9781337102087

Author:D. S. Malik

Publisher:D. S. Malik

Chapter4: Control Structures I (selection)

Section: Chapter Questions

Problem 20PE: The cost of renting a room at a hotel is, say $100.00 per night. For special occasions, such as a...

Related questions

Question

100%

Sales tax in mouth c++

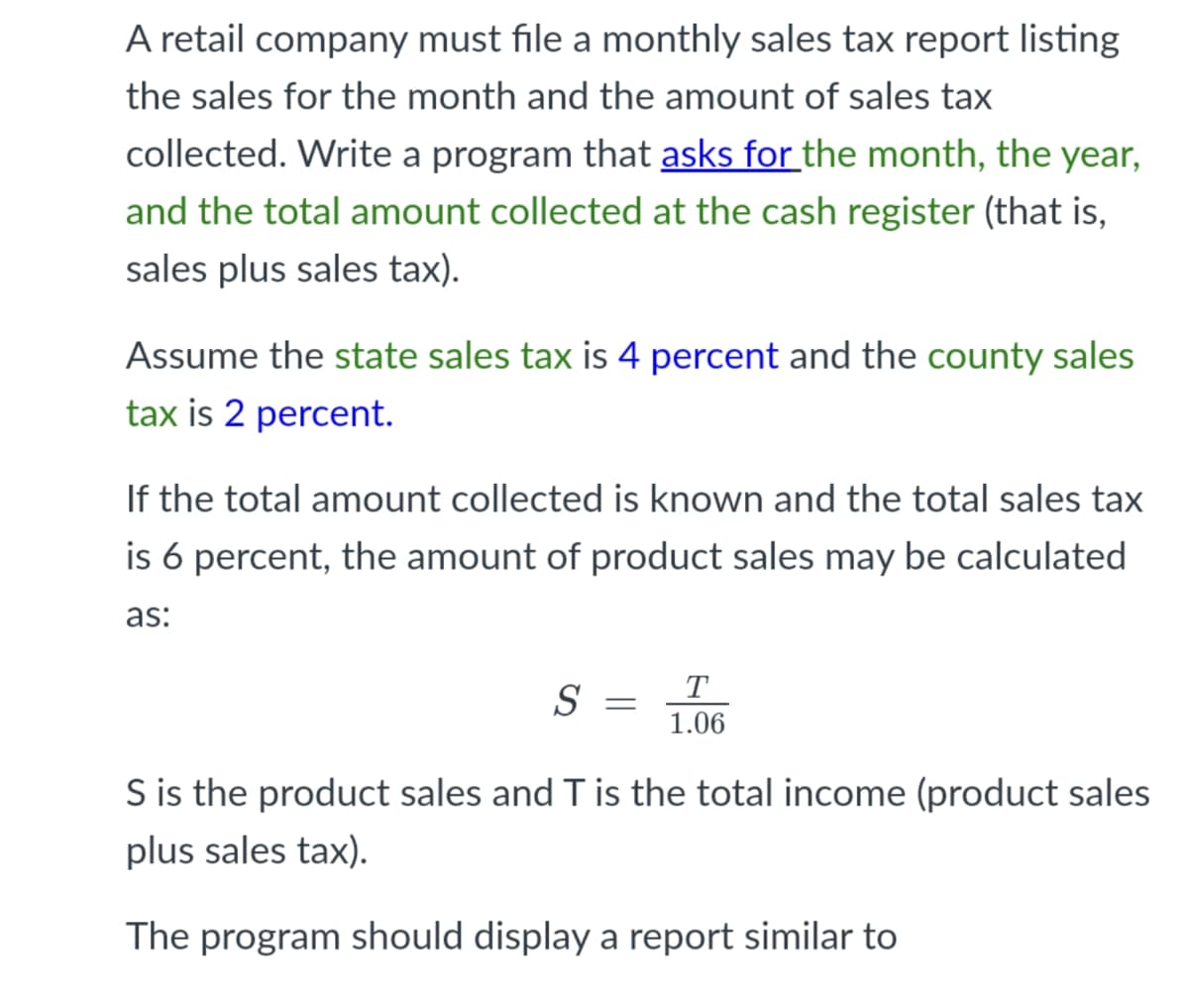

Transcribed Image Text:A retail company must file a monthly sales tax report listing

the sales for the month and the amount of sales tax

collected. Write a program that asks for the month, the year,

and the total amount collected at the cash register (that is,

sales plus sales tax).

Assume the state sales tax is 4 percent and the county sales

tax is 2 percent.

If the total amount collected is known and the total sales tax

is 6 percent, the amount of product sales may be calculated

as:

T

S

1.06

S is the product sales and T is the total income (product sales

plus sales tax).

The program should display a report similar to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, computer-science and related others by exploring similar questions and additional content below.Recommended textbooks for you

C++ Programming: From Problem Analysis to Program…

Computer Science

ISBN:

9781337102087

Author:

D. S. Malik

Publisher:

Cengage Learning

C++ Programming: From Problem Analysis to Program…

Computer Science

ISBN:

9781337102087

Author:

D. S. Malik

Publisher:

Cengage Learning