A sale is made for $7,600; terms are 3/10, n/30. Give the required entries to record the sale and the collection entry, assuming that it is during the discount period. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet 1 2 Record the sale using the gross method of recording sales discounts. Note: Enter debits before credits. Transaction a. General Journal Debit Credit 7

A sale is made for $7,600; terms are 3/10, n/30. Give the required entries to record the sale and the collection entry, assuming that it is during the discount period. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet 1 2 Record the sale using the gross method of recording sales discounts. Note: Enter debits before credits. Transaction a. General Journal Debit Credit 7

Chapter7: Accounting Information Systems

Section: Chapter Questions

Problem 17MC: Sold goods for $650, credit terms net 30 days. Which journal would the company use to record this...

Related questions

Question

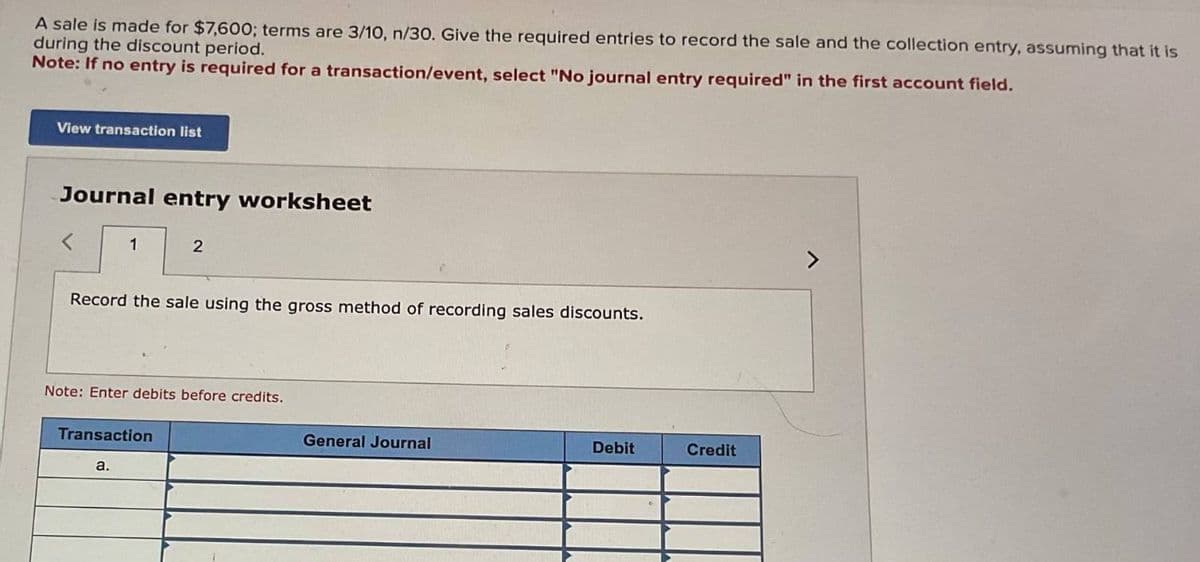

Transcribed Image Text:A sale is made for $7,600; terms are 3/10, n/30. Give the required entries to record the sale and the collection entry, assuming that it is

during the discount period.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction list

Journal entry worksheet

1

2

Record the sale using the gross method of recording sales discounts.

Note: Enter debits before credits.

Transaction

a.

General Journal

Debit

Credit

7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning