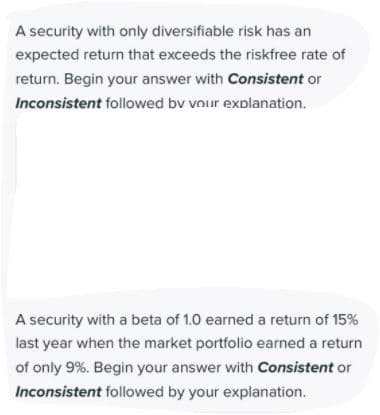

A security with only diversifiable risk has an expected return that exceeds the riskfree rate of return. Begin your answer with Consistent or Inconsistent followed bv vour explanation. A security with a beta of 1.0 earned a return of 15% last year when the market portfolio earned a return of only 9%. Begin your answer with Consistent or Inconsistent followed by your explanation.

Q: Assume that using the Security Market Line(SML) the required rate of return(RA)on stock A is found…

A: As per the security market line following is the Rate of return for stock A and stock B…

Q: During the coming year, the market risk premium (rm− rf), is expected to remain the same, while the…

A: The question is based on the concept of Financial analysis

Q: beta and expected return

A: : Beta refers to the measurement of stock movement in relation to the overall market. A beta greater…

Q: s NOT correlated with the S&P500. Asset B pays on average 8%, also has standard deviation equal to…

A:

Q: Tullow’s recent strategic moves have resulted in its beta going from 1.8 to 1.5. If the risk-free…

A: Beta coefficient refers to the degree of total volatility that security has with respect to the…

Q: Assume that using the Security Market Line(SML) the required rate of return(RA)on stock A is found…

A: Required rate of return on stock A is RARequired rate of return on stock B is RBRisk free rate is…

Q: You observe the following: ABC Inc. has 1.8 Beta and .2 Expected return XYZ Inc has 1.6 Beta and .19…

A: The required rate of return for a firm depends on the risk free rate, beta and market premium. Beta…

Q: A financial advisor is offering you a product with an expected return of 8% and a return standard…

A: A portfolio is a set or group of investments that include the collections of stocks, commodities,…

Q: Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is…

A: “Hey, since there are multiple questions posted, we will answer first question. If you want any…

Q: Stock A has an expected return of 7%, a standard deviation of expected returns of 35%, acorrelation…

A: Investments in securities result in risk. No investment guarantees profit. Analyzing risk before…

Q: Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is…

A: Capital Asset Pricing Model (CAPM): CAPM is the method of calculating the expected return on…

Q: The risk free rate is 4% and the expected rate of return on the market portfolio is 10%. A.…

A: Risk-free rate = 4% Expected rate of return on market = 10% The required rate of return on security…

Q: the Security Market Line (SML) the required rate of return (RA) on stock A is found to be half of…

A: The question is based on the concept of capital asset pricing model (CAPM) ,security market line and…

Q: A portfolio returned 11% last year, 2% better than the market return of 9%. the portfolio’s return…

A: Sharpe ratio = (Mean portfolio return − Risk-free rate)/Standard deviation of portfolio return

Q: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has…

A: according to sml equation: expected return=rf+beta×rm-rfwhere,rf= risk free raterm= market return

Q: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has…

A: Hai there! Thanks for the question. Question has multiple sub parts. As per company guidelines…

Q: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has…

A: 4. SML equation : expected return =rf+beta×rm-rfwhere,rf= risk free raterm= market return

Q: Consider a T-bill with a rate of return of 5 percent and the following risky securities. From which…

A: Risk Seekers: Risk seekers willing to pay for taking risk for getting more profits.…

Q: A portfolio has a beta of 1.2 and an actual return of 14.1 percent. The risk-free rate is 3.5…

A: Given: Beta = 1.2 Actual return = 14.1% Risk free rate = 3.5% Market risk premium = 7.4%

Q: Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is…

A: Solution: As per the security market line following is the Rate of return for stock A and stock B…

Q: State whether each of the following is inconsistent with the CAPM. A security with only…

A: Answer: The decision on the investment can be taken based on the CAPM. The return that is required…

Q: Suppose that the S&P 500, with a beta of 1.0, has an expected return of 13% and T-bills provide a…

A: Data given: Two types of assets: i) S&P 500 with expected return = 13% with a beta of 1.0 ii)…

Q: K.J. Lee, CFA, an analyst with Water's Edge Securities, estimates the market risk premium is 6.80%…

A: A model that represents the relationship of the required return and beta of a particular asset is…

Q: An analyst has modeled the stock of a company using a FamaFrench three-factor model and has…

A: Computation of predicted Return and unexplained Return is shown below: Hence, predicted return is…

Q: Determine the weights of a portfolio with a standard deviation of 7% created by combining T-Bill and…

A: Expected Return on Portfolio: It is estimated by adding the individual security returns that are…

Q: If the market portfolio has a required return of 0.12 and a standard deviation of 0.40, and the…

A: Security market line (SML): The security market line (SML) is the graphic depiction of the Capital…

Q: Assume that using the Security Market Line the required rate of return (RA) on stock A is found to…

A: As per the above consideration The ratio of expected return on A and expected return on B is

Q: An analyst has modeled the stock of Crisp Trucking using a two-factor APTmodel. The risk-free rate…

A: Factor 1: Risk premium r1p =Expected return of factor 1 - Risk free rate Risk premium r1p = (12% -…

Q: The following expected return and the standard deviation of current returns are known: Security…

A:

Q: The following expected return and the standard deviation of current returns are known: Security…

A: Portfolio standard deviation is the standard deviation of all the different investments in the…

Q: If the market portfolio has a required return of 0.12 and a standard deviation of 0.40, and the…

A: SML is an abbreviation used for security market line. It represent the market equilibrium and its…

Q: The risk-free rate of return is currently 0.03, whereas the market risk premium is 0.04. If the beta…

A: Following details are given in the question: Risk free rate of return = 0.03 = 3% Market Risk…

Q: What is a beta coefficient, and how are betas used in risk analysis? Do the expected returns appear…

A: Estimated rate of return is the rate of return which an investor expects to generate from the…

Q: According to CAPM, the expected rate of return of a portfolio with a beta of 1.0 and an alpha of 0…

A: CAPM is useful model to calculate theoretically/ expected rate of return It considers risk free rate…

Q: Security A has an expected return of 7%, a standard deviation of returns of 35%, a correlation…

A: To know the riskiness between the two projects, Coefficient of variation gives good results. Higher…

Q: Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to pay returns…

A: The question is based on the concept of capital asset pricing model (CAPM) , the model used to…

Q: Assume that using the Security Market Line(SML) the required rate of return(RA)on stock A is found…

A: Calculation of ratio of beta of A to beta of B: Answer: The ratio of beta A to beta B is 0.4286

Q: E(FAssume that using the Security Market Line (SML) the required rate of return (RA) on stock A is…

A: There are various models which shows the relation of return (benefit) and risk. SML is one of them,…

Q: We know that two stocks A and B are correctly priced by the CAPM model. For A, the expected return…

A: Given information : Expected return for stock A = 12% Beta for stock A = 1.5 Expected return for…

Q: During the year just ended, Anna Schultz's portfolio, which has a beta of 0.97, earned a return of…

A: Treynor's Ratio = (Average rate of portfolio-risk free rate)/Beta of the portfolio

Q: A security with a beta of 1.0 earned a return of 15% last year when the market portfolio earned a…

A: Beta is the measure of systematic risk which explain the movement of price of the asset with respect…

Q: Assume that the expected rates of return and the beta coefficients of the alternatives supplied by…

A: Beta coefficient is a relative risk measure. It measures and indicates risk of a particular security…

Q: Assume that using the Security Market Line(SML) the required rate of return(RA)on stock A is found…

A: Calculation of ratio of beta of A to beta of B: Answer: The ratio of beta A to beta B is 0.4286

Q: The following expected return and the standard deviation of current returns are known: Security…

A: The standard deviation is a measure of the consistency of returns of an investment. The standard…

Q: Which of the following statements is CORRECT? 1. a. Tests have shown that the betas of…

A: Portfolio Beta vs Individual Beta: When it comes to financial instruments, beta is described as "a…

Q: The risk-free rate is 7% and the expected rate of return on the market portfolio is 12%. a.…

A: Possible return from the investment and risk involved in it, both are related to each. There are…

Q: When the return on the market portfolio goes up by 5%, the return on Stock A goes up on average by…

A: A portfolio is defined as a group or a collection of various financial assets or commodities that…

Q: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has…

A: Security market line (SML) is a graphical representation of how the approach of the capital asset…

Q: A security has a beta of 1.20. Is this security more or less risky than the market? Explain. Assess…

A: The beta of a stock is the degree of responsiveness to movements in price with changes in the stock…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Security A has an expected rate of return of 6%, a standard deviation of returns of 30%, a correlation coefficient with the market of −0.25, and a beta coefficient of −0.5. Security B has an expected return of 11%, a standard deviation of returns of 10%, a correlation with the market of 0.75, and a beta coefficient of 0.5. Which security is more risky? Why?APT An analyst has modeled the stock of Crisp Trucking using a two-factor APT model. The risk-free rate is 6%, the expected return on the first factor (r1) is 12%, and the expected return on the second factor (r2) is 8%. If bi1 = 0.7 and bi2 = 0.9, what is Crisp’s required return?The risk-free rate is 3 percent, the expected return on the PSEi is 13 percent, and its standard deviation is 23 percent. XYZ co, has a standard deviation of 50 percent and a correlation of 65 with the market. Calculate XYZ beta and expected return then explain the role of a security’s beta in the calculation of expected returns

- Security A has an expected rate of return of 6%, a standard deviation ofreturns of 30%, a correlation coefficient with the market of 20.25, and abeta coefficient of 20.5. Security B has an expected return of 11%, a standard deviation of returns of 10%, a correlation with the market of 0.75, anda beta coefficient of 0.5. Which security is more risky? Why?State whether each of the following is inconsistent with the CAPM. A security with only diversifiable risk has an expected return that exceeds the risk-free interest rate. A security with a beta of 1 had a return last year of 15% when the market had a return of 9% Small stocks with a beta of 1.5 tend to have higher returns on average than large stocks with a beta of 1.5.Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is foundto be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the requiredreturn on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (A) to beta of B(B). d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to payreturns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standarddeviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also hasstandard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whetherasset A and B are overvalued or undervalued, and explain why. (Hint: Beta of asset i (??) =???????, where ??,?? are standard deviations of asset i and marketportfolio, ??? is the correlation between asset i and the market portfolio)Question 2. Foreign exchange marketsStatoil, the national…

- Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is foundto be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the requiredreturn on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (A) to beta of B(B). d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to payreturns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standarddeviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also hasstandard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whetherasset A and B are overvalued or undervalued, and explain why. (Hint: Beta of asset i (??) = ???????, where ??,?? are standard deviations of asset i and marketportfolio, ??? is the correlation between asset i and the market portfolio)Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has a beta, of 1.10. (could be done on word document or excel). Draw the security market line (SML) Use the CAPM to calculate the required return, on asset A. Assume that as a result of recent economic events, inflationary expectations have declined by 3%, lowering RF and RM to 5% and 9%, respectively. Draw the new SML on the axes in part a, and calculate and show the new required return for asset A. Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 2%, to be14%. Ignoring the shift in part c, draw the new SML on the same set of axes that you used before, and calculate and show the new required return for asset A. From the previous changes, what conclusions can be drawn about the impact of (1) decreased inflationary expectations and (2) increased risk aversion on the required returns of risky assets?…Suppose that during the coming year, the risk free rate, rRF, is expected to remain the same, while the market risk premium (rM − rRF), is expected to fall. Given this forecast, which of the following statements is CORRECT? a. The required return on all stocks will remain unchanged. b. The required return will fall for all stocks, but it will fall more for stocks with higher betas. c. The required return for all stocks will fall by the same amount. d. The required return will fall for all stocks, but it will fall less for stocks with higher betas. e. The required return will increase for stocks with a beta less than 1.0 and will decrease for stocks with a beta greater than 1.0.

- Assume that using the Security Market Line(SML) the required rate of return(RA)on stock A is found to be halfof the required return (RB) on stock B. The risk-free rate (Rf) is one-fourthof the required return on A. Return on market portfolio is denoted by RM. Find the ratioof betaof A(A) tobeta of B(B). Thank you for your help.Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has a beta, of 1.10. (could be done on word document or excel). a) Draw the security market line (SML) b) Use the CAPM to calculate the required return, on asset A. c) Assume that as a result of recent economic events, inflationary expectations have declined by 3%, lowering RF and RM to 5% and 9%, respectively. Draw the new SML on the axes in part a, and calculate and show the new required return for asset A. d) Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 2%, to be14%. Ignoring the shift in part c, draw the new SML on the same set of axes that you used before, and calculate and show the new required return for asset A. e) From the previous changes, what conclusions can be drawn about the impact of (1) decreased inflationary expectations and (2) increased risk aversion on the required returns of risky assets?Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has a beta, of 1.10. (could be done on word document or excel). Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 2%, to be14%. Ignoring the shift in part c, draw the new SML on the same set of axes that you used before, and calculate and show the new required return for asset A. From the previous changes, what conclusions can be drawn about the impact of (1) decreased inflationary expectations and (2) increased risk aversion on the required returns of risky assets?