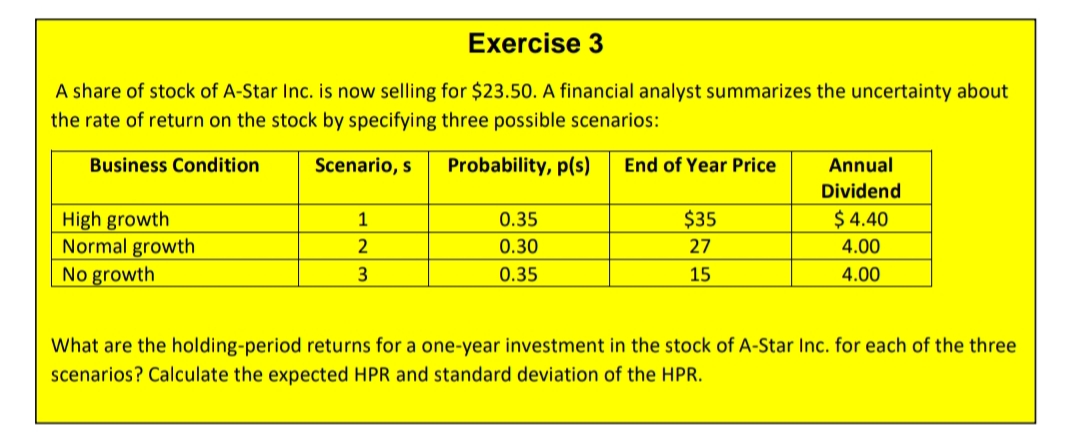

A share of stock of A-Star Inc. is now selling for $23.50. A financial analyst summarizes the uncertainty about the rate of return on the stock by specifying three possible scenarios: Business Condition Scenario, s Probability, p(s) End of Year Price Annual Dividend High growth Normal growth No growth 1 0.35 $35 $ 4.40 0.30 27 4.00 0.35 15 4.00 What are the holding-period returns for a one-year investment in the stock of A-Star Inc. for each of the three scenarios? Calculate the expected HPR and standard deviation of the HPR.

A share of stock of A-Star Inc. is now selling for $23.50. A financial analyst summarizes the uncertainty about the rate of return on the stock by specifying three possible scenarios: Business Condition Scenario, s Probability, p(s) End of Year Price Annual Dividend High growth Normal growth No growth 1 0.35 $35 $ 4.40 0.30 27 4.00 0.35 15 4.00 What are the holding-period returns for a one-year investment in the stock of A-Star Inc. for each of the three scenarios? Calculate the expected HPR and standard deviation of the HPR.

Chapter12: The Cost Of Capital

Section: Chapter Questions

Problem 5P

Related questions

Question

Transcribed Image Text:Exercise 3

A share of stock of A-Star Inc. is now selling for $23.50. A financial analyst summarizes the uncertainty about

the rate of return on the stock by specifying three possible scenarios:

Business Condition

Scenario, s

Probability, p(s)

End of Year Price

Annual

Dividend

High growth

Normal growth

No growth

1

0.35

$35

$ 4.40

2

0.30

27

4.00

0.35

15

4.00

What are the holding-period returns for a one-year investment in the stock of A-Star Inc. for each of the three

scenarios? Calculate the expected HPR and standard deviation of the HPR.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning