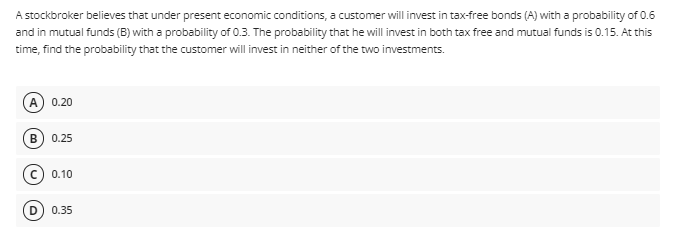

A stockbroker believes that under present economic conditions, a customer will invest in tax-free bonds (A) with a probability of 0.6 and in mutual funds (B) with a probability of 0.3. The probability that he will invest in both tax free and mutual funds is 0.15. At this time, find the probability that the customer will invest in neither of the two investments. A) 0.20 B) 0.25 (c) 0.10 0.35

A stockbroker believes that under present economic conditions, a customer will invest in tax-free bonds (A) with a probability of 0.6 and in mutual funds (B) with a probability of 0.3. The probability that he will invest in both tax free and mutual funds is 0.15. At this time, find the probability that the customer will invest in neither of the two investments. A) 0.20 B) 0.25 (c) 0.10 0.35

Holt Mcdougal Larson Pre-algebra: Student Edition 2012

1st Edition

ISBN:9780547587776

Author:HOLT MCDOUGAL

Publisher:HOLT MCDOUGAL

Chapter11: Data Analysis And Probability

Section: Chapter Questions

Problem 15CR

Related questions

Question

Transcribed Image Text:A stockbroker believes that under present economic conditions, a customer will invest in tax-free bonds (A) with a probability of 0.6

and in mutual funds (B) with a probability of 0.3. The probability that he will invest in both tax free and mutual funds is 0.15. At this

time, find the probability that the customer will invest in neither of the two investments.

A

0.20

0.25

0.10

0.35

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL