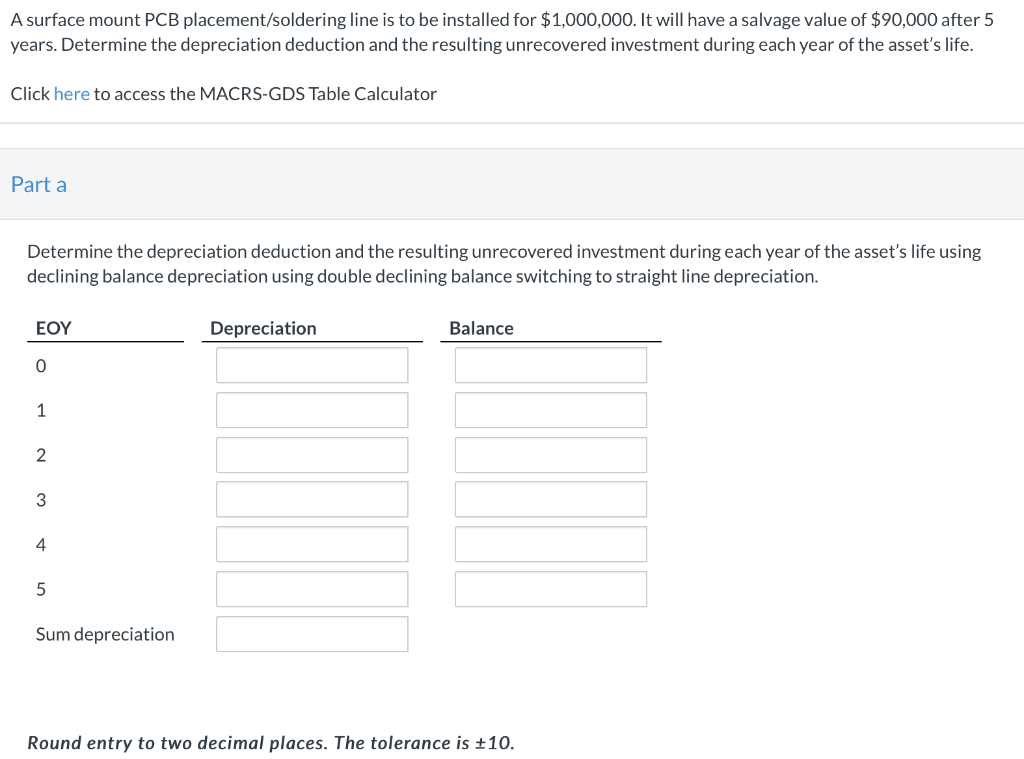

A surface mount PCB placement/soldering line is to be installed for $1,000,000. It will have a salvage value of $90,000 after 5 years. Determine the depreciation deduction and the resulting unrecovered investment during each year of the asset's life.

A surface mount PCB placement/soldering line is to be installed for $1,000,000. It will have a salvage value of $90,000 after 5 years. Determine the depreciation deduction and the resulting unrecovered investment during each year of the asset's life.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter18: Accounting For Long-term Assets

Section: Chapter Questions

Problem 3CE: A machine costing 350,000 has a salvage value of 15,000 and an estimated life of three years....

Related questions

Question

Transcribed Image Text:A surface mount PCB placement/soldering line is to be installed for $1,000,000. It will have a salvage value of $90,000 after 5

years. Determine the depreciation deduction and the resulting unrecovered investment during each year of the asset's life.

Click here to access the MACRS-GDS Table Calculator

Part a

Determine the depreciation deduction and the resulting unrecovered investment during each year of the asset's life using

declining balance depreciation using double declining balance switching to straight line depreciation.

EOY

Depreciation

Balance

1

3

4

Sum depreciation

Round entry to two decimal places. The tolerance is ±10.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning