A taxpayer can only qualify for a deduction for normal tax purposes (ignoring prohibited deductions) if the underlying expenditure or a loss:

A taxpayer can only qualify for a deduction for normal tax purposes (ignoring prohibited deductions) if the underlying expenditure or a loss:

Chapter1: Understanding And Working With The Federal Tax Law

Section: Chapter Questions

Problem 12DQ

Related questions

Question

Transcribed Image Text:+II

01

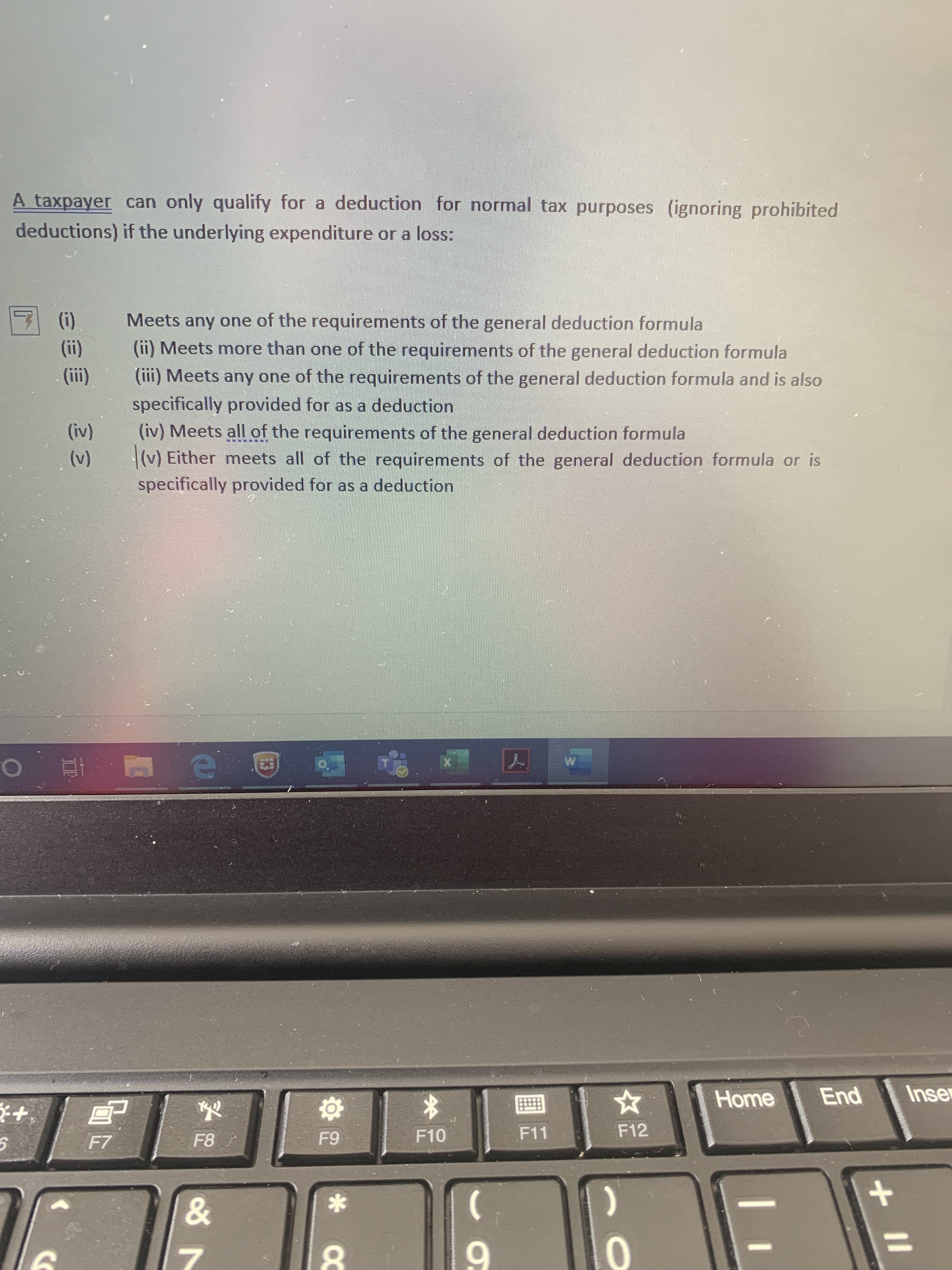

A taxpayer can only qualify for a deduction for normal tax purposes (ignoring prohibited

deductions) if the underlying expenditure or a loss:

Meets any one of the requirements of the general deduction formula

(!)

(!)

(ii) Meets more than one of the requirements of the general deduction formula

Meets any one of the requirements of the general deduction formula and is also

(!)

specifically provided for as a deduction

(iv) Meets all of the requirements of the general deduction formula

(^)

(v) Either meets all of the requirements of the general deduction formula or is

specifically provided for as a deduction

e

Home

Inser

F7

F8

F10

F11

F12

7.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT