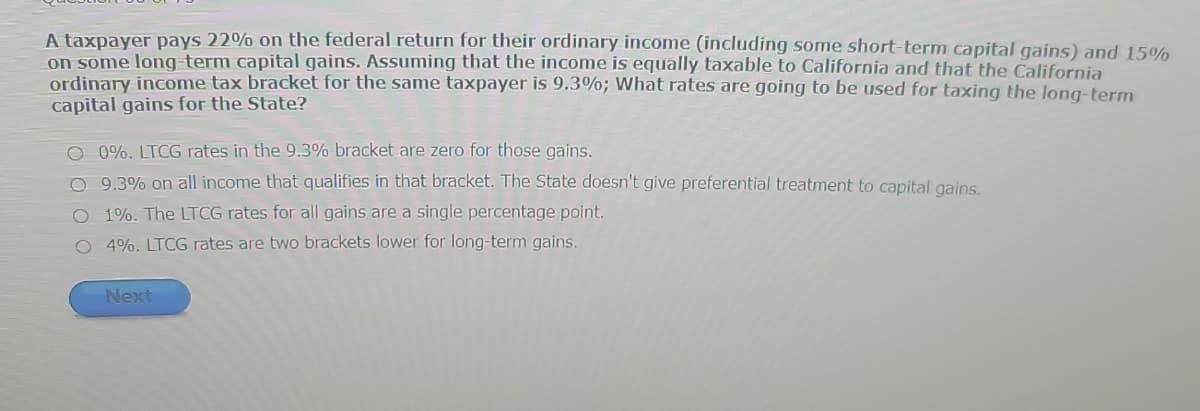

A taxpayer pays 22% on the federal return for their ordinary income (including some short-term capital gains) and 15% on some long term capital gains. Assuming that the income is equally taxable to California and that the California ordinary income tax bracket for the same taxpayer is 9.3%; What rates are going to be used for taxing the long-term capital gains for the State? O 0%. LTCG rates in the 9.3% bracket are zero for those gains. O 9.3% on all income that qualifies in that bracket. The State doesn't give preferential treatment to capital gains O 1%. The LTCG rates for all gains are a single percentage point. O 4%. LTCG rates are two brackets lower for long-term gains. Next

A taxpayer pays 22% on the federal return for their ordinary income (including some short-term capital gains) and 15% on some long term capital gains. Assuming that the income is equally taxable to California and that the California ordinary income tax bracket for the same taxpayer is 9.3%; What rates are going to be used for taxing the long-term capital gains for the State? O 0%. LTCG rates in the 9.3% bracket are zero for those gains. O 9.3% on all income that qualifies in that bracket. The State doesn't give preferential treatment to capital gains O 1%. The LTCG rates for all gains are a single percentage point. O 4%. LTCG rates are two brackets lower for long-term gains. Next

Chapter23: Exempt Entities

Section: Chapter Questions

Problem 3DQ

Related questions

Question

Transcribed Image Text:A taxpayer pays 22% on the federal return for their ordinary income (including some short-term capital gains) and 15%

on some long term capital gains. Assuming that the income is equally taxable to California and that the California

ordinary income tax bracket for the same taxpayer is 9.3%; What rates are going to be used for taxing the long-term

capital gains for the State?

O 0%. LTCG rates in the 9.3% bracket are zero for those gains.

O 9.3% on all income that qualifies in that bracket. The State doesn't give preferential treatment to capital gains.

O 1%. The LTCG rates for all gains are a single percentage point.

O 4%. LTCG rates are two brackets lower for long-term gains.

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT