A "three-against-nine" FRA has an agreement rate of 4.77 percent. You believe six-month CME Term SOFR in three months will be 5.135 percent. You decide to take a speculative position in an FRA with a $1,000,000 notional value. There are 183 days in the FRA period. Determine whether you should buy or sell the FRA and what your expected profit will be if your forecast is correct about the six-month CME Term SOFR rate. Note: Round your intermediate calculations to 6 decimal places. Round your answer to 2 decimal places. Assume 360 days in a year. for an expected profit of

A "three-against-nine" FRA has an agreement rate of 4.77 percent. You believe six-month CME Term SOFR in three months will be 5.135 percent. You decide to take a speculative position in an FRA with a $1,000,000 notional value. There are 183 days in the FRA period. Determine whether you should buy or sell the FRA and what your expected profit will be if your forecast is correct about the six-month CME Term SOFR rate. Note: Round your intermediate calculations to 6 decimal places. Round your answer to 2 decimal places. Assume 360 days in a year. for an expected profit of

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter11: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 2DQ: A company could sell a building for 250,000 or lease it for 2,500 per month. What would need to be...

Related questions

Question

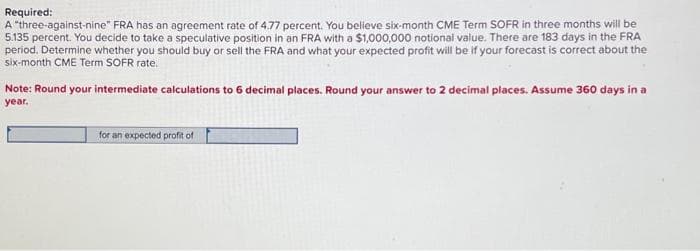

Transcribed Image Text:Required:

A "three-against-nine" FRA has an agreement rate of 4.77 percent. You believe six-month CME Term SOFR in three months will be

5.135 percent. You decide to take a speculative position in an FRA with a $1,000,000 notional value. There are 183 days in the FRA

period. Determine whether you should buy or sell the FRA and what your expected profit will be if your forecast is correct about the

six-month CME Term SOFR rate.

Note: Round your intermediate calculations to 6 decimal places. Round your answer to 2 decimal places. Assume 360 days in a

year.

for an expected profit of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub