A university spent $1.3 million to install solar panels atop a parking garage. These panels will have a capacity of 300 kilowatts (kW) and have a life expectancy of 20 years. Suppose that the discount rate is 30%, that electricity can be purchased at $0.10 per kilowatt-hour (kWh), and that the marginal cost of electricity production using the solar panels is zero. Hint: It may be easier to think of the present value of operating the solar panels for 1 hour per year first. Approximately how many hours per year will the solar panels need to operate to enable this project to break even? 16,990.05 6,534.64 O 13,069.27

A university spent $1.3 million to install solar panels atop a parking garage. These panels will have a capacity of 300 kilowatts (kW) and have a life expectancy of 20 years. Suppose that the discount rate is 30%, that electricity can be purchased at $0.10 per kilowatt-hour (kWh), and that the marginal cost of electricity production using the solar panels is zero. Hint: It may be easier to think of the present value of operating the solar panels for 1 hour per year first. Approximately how many hours per year will the solar panels need to operate to enable this project to break even? 16,990.05 6,534.64 O 13,069.27

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 13PROB

Related questions

Question

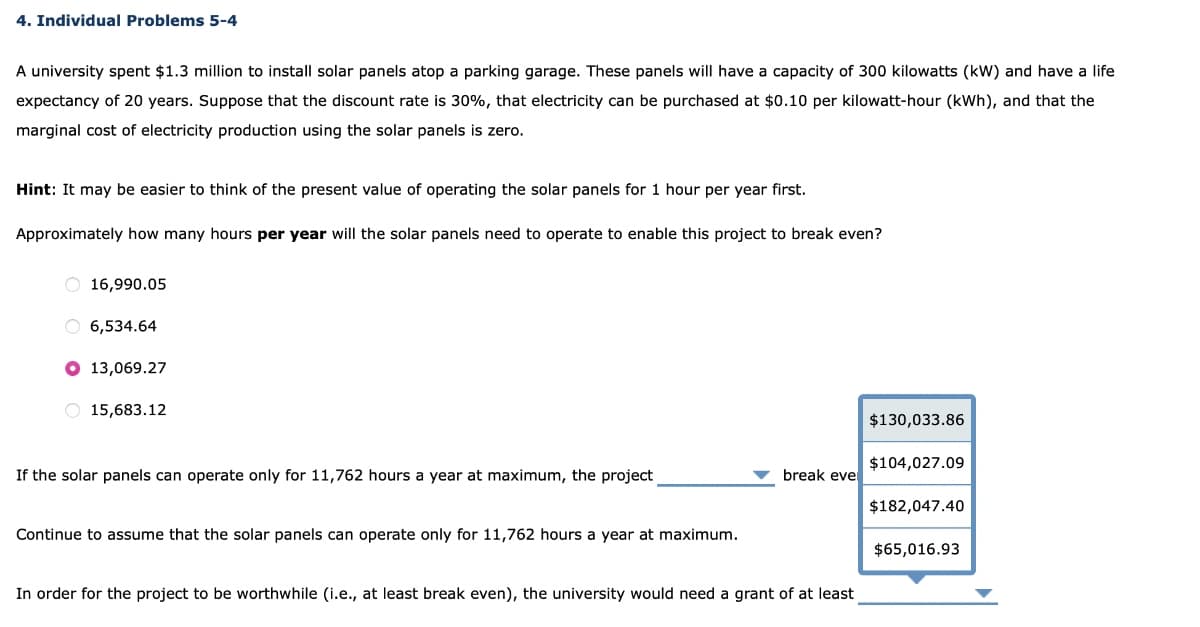

Transcribed Image Text:4. Individual Problems 5-4

A university spent $1.3 million to install solar panels atop a parking garage. These panels will have a capacity of 300 kilowatts (kW) and have a life

expectancy of 20 years. Suppose that the discount rate is 30%, that electricity can be purchased at $0.10 per kilowatt-hour (kWh), and that the

marginal cost of electricity production using the solar panels is zero.

Hint: It may be easier to think of the present value of operating the solar panels for 1 hour per year first.

Approximately how many hours per year will the solar panels need to operate to enable this project to break even?

O 16,990.05

O 6,534.64

O 13,069.27

O 15,683.12

$130,033.86

$104,027.09

If the solar panels can operate only for 11,762 hours a year at maximum, the project

break eve

$182,047.40

Continue to assume that the solar panels can operate only for 11,762 hours a year at maximum.

$65,016.93

In order for the project to be worthwhile (i.e., at least break even), the university would need a grant of at least

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you