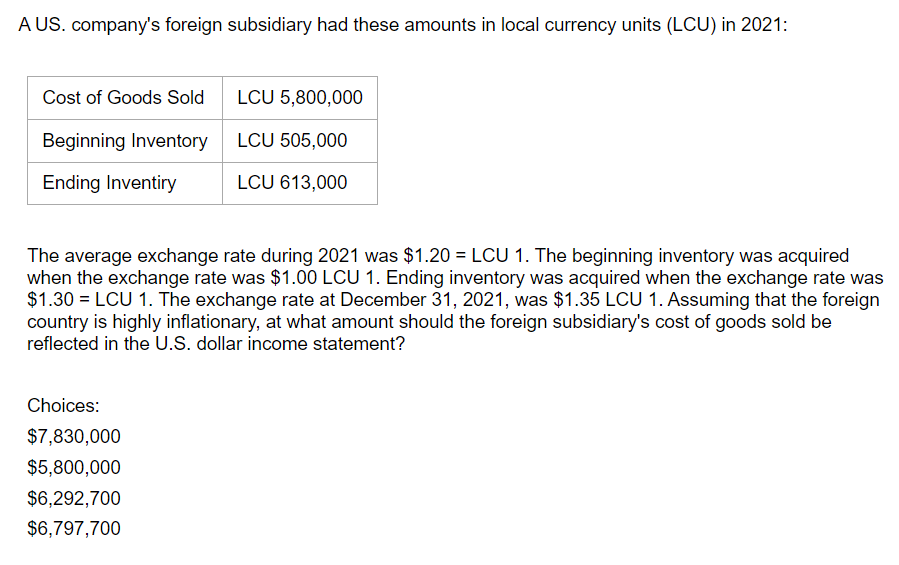

A US. company's foreign subsidiary had these amounts in local currency units (LCU) in 2021: Cost of Goods Sold LCU 5,800,000 Beginning Inventory LCU 505,000 Ending Inventiry LCU 613,000 The average exchange rate during 2021 was $1.20 = LCU 1. The beginning inventory was acquired when the exchange rate was $1.00 LCU 1. Ending inventory was acquired when the exchange rate was $1.30=LCU 1. The exchange rate at December 31, 2021, was $1.35 LCU 1. Assuming that the foreign country is highly inflationary, at what amount should the foreign subsidiary's cost of goods sold be reflected in the U.S. dollar income statement? Choices: $7,830,000 $5,800,000 $6,292,700 $6,797,700

A US. company's foreign subsidiary had these amounts in local currency units (LCU) in 2021: Cost of Goods Sold LCU 5,800,000 Beginning Inventory LCU 505,000 Ending Inventiry LCU 613,000 The average exchange rate during 2021 was $1.20 = LCU 1. The beginning inventory was acquired when the exchange rate was $1.00 LCU 1. Ending inventory was acquired when the exchange rate was $1.30=LCU 1. The exchange rate at December 31, 2021, was $1.35 LCU 1. Assuming that the foreign country is highly inflationary, at what amount should the foreign subsidiary's cost of goods sold be reflected in the U.S. dollar income statement? Choices: $7,830,000 $5,800,000 $6,292,700 $6,797,700

Chapter10: Measuring Exposure To Exchange Rate Fluctuations

Section: Chapter Questions

Problem 22QA

Question

A3

Transcribed Image Text:A US. company's foreign subsidiary had these amounts in local currency units (LCU) in 2021:

Cost of Goods Sold

LCU 5,800,000

Beginning Inventory LCU 505,000

Ending Inventiry

LCU 613,000

The average exchange rate during 2021 was $1.20 = LCU 1. The beginning inventory was acquired

when the exchange rate was $1.00 LCU 1. Ending inventory was acquired when the exchange rate was

$1.30=LCU 1. The exchange rate at December 31, 2021, was $1.35 LCU 1. Assuming that the foreign

country is highly inflationary, at what amount should the foreign subsidiary's cost of goods sold be

reflected in the U.S. dollar income statement?

Choices:

$7,830,000

$5,800,000

$6,292,700

$6,797,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning