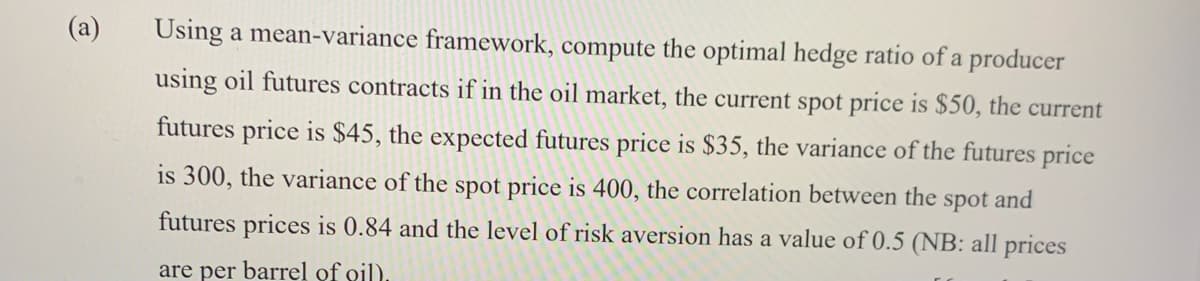

(a) Using a mean-variance framework, compute the optimal hedge ratio of a producer using oil futures contracts if in the oil market, the current spot price is $50, the current futures price is $45, the expected futures price is $35, the variance of the futures price is 300, the variance of the spot price is 400, the correlation between the spot and futures prices is 0.84 and the level of risk aversion has a value of 0.5 (NB: all prices are nor

Q: Consider a new machine at a packaging plant that has a first cost of $100000, operating and…

A: The equivalent annual cost is the cost of owning, operating, and maintaining an asset over its…

Q: Asset allocation is performed to A) reduce the load that intermediaries charge maximize the earning…

A: Asset Allocation means the process of allocating money across different financial assets (such as…

Q: A stock has a beta of 1.88. The risk free rate is 1.775% and the market risk premium is 5%. What is…

A: Risk free rate = 1.775% Beta = 1.88 Market return = 5%

Q: You are advising company ABC on its merger and acquisition case. The buyer company offers ABC two…

A: Given, Two options, Option 1 $100 million Option 2 is $50 now and $50 two additional payments for…

Q: A stock price is currently $80. It is known that at the end of four months it will be either $75 or…

A: Options are derivatives, whose values are derived from the value of an underlying asset. There are…

Q: Finance Calculate the price of an FRA (Forward Rate Agreement) that starts in 30 days and ends in 60…

A: Forward rate agreement It involves two parties. One pays fixed interest rate in exchange of the…

Q: Question 4 “During the 2008 Financial Crisis, the nominal interest rates of all major…

A: The nominal interest rate is the rate of interest before inflation is calculated. The advertised or…

Q: (b) Calculate the working capital cycle for both years. Year ended 31st December 2019 2018 Inventory…

A: Working capital cycle - It is defined as the time taken by a firm to convert its current…

Q: What monthly payment will she be required to make if the car is financed over a period of 24 months?…

A: Loan Monthly Payments: These are payments made by the borrower to the lender for the purpose of…

Q: 8. Suppose a certain bond sold a volume of 2, 375, 000. If the bonds sold for $824.99, calculate the…

A: Given, Meaning of bond, Its an instrument of debt which is floated by the company so that the…

Q: uppose a project has an initial outflow of $600000. If the cash flows projected for years 1-6 are…

A: IRR and NPV are investment appraisal tools. NPV gives idea about the net increase in wealth of the…

Q: I was thinking about the topic B. What would be the answer : b. Ignoring tax, depreciation, and…

A: Payback period is a capital budgeting technique which helps the company in knowing that in…

Q: Q)Suppose that in 2018 the price index was 120 and Ifikile purchased R35 000 worth of bonds. One…

A: Concept. Real after tax interest . It is actual benefit of investment after considering into account…

Q: Compute the following financial ratios for this year: 1. Times interest earned ratio. 2.…

A: In finance we use several financial ratios. These ratios helps us to determine the financial health…

Q: Do you think that the provisions of the new contract will increase morale and decrease turnover? Why…

A: Contract refers to an agreement enforceable by law. It is legal agreement held between two or more…

Q: A $14,000 loan at 6% interest rate is paid over 4 years. Draw up the loan repayment table if the…

A: Mortgage/ Borrowings: Borrowings are the loan which is taken by the individual to meet its…

Q: Suppose a French bottle of champagne costs 20.5 euros. Instructions: Enter your responses rounded to…

A: The cost of one currency expressed in another currency is called exchange rate. Currencies are…

Q: On August 10, a credit card account had a balance of $320. A purchase of $51 was made on August 15,…

A: Here, Credit Card Balance is $320 Purchase on Aug 15 is $51 Payment on Aug 15 is $78 Charged on Aug…

Q: 4/ Julieta and Eric are purchasing a home. They wish to save money for 15 years and purchase a house…

A: Solution: Annuity means an equal amount is deposited each period. The accumulated value of these…

Q: Calculate the present value of this infinite future payment of $100

A: Time value of money (TVM) refers to the method used to measure the amount of money at different…

Q: Jessica has identified a stock pattern showing a head-and-shoulders bottom formation and its price…

A: Head and shoulder bottom formation shows that after a long period of increase the prices are going…

Q: Tareq is about to make his dream of a house of his own come true. For years he has been saving for…

A: As you have asked a multiple sub part question, we will answer the first three sub parts for you. To…

Q: $10,000 zero coupon bonds is redeemed at par in 4 years. The average annual discount rate is 7%.…

A: Par value of the bond = $10,000 Discount rate (r) = 0.07 Maturity period (p) = 4 Years Maturity…

Q: Discuss the differences between a market order, limit order, and stop order.

A: Solution: Stock market is the place where securities are traded in market. There are different types…

Q: his dream of a house of his own come true. For years he has been saving for this moment and now,…

A: Loans are paid by equal monthly payment that carry the payment of interest and payment of principal…

Q: A stock is currently selling for $92.45 and is expected to sell for $109.07 in 1 year. If the…

A: The overall return on an asset or investment portfolio over the time it has been kept is known as…

Q: Suppose you are going to receive $13,500 per year for five years. The interest rate is 8.4% a. What…

A: PV of Ordinary Annuity = 13500*a<5> = 13500*(1-(1+i)^-5)/i = 13500*(1-1.084^-5)/0.084 =…

Q: what would be the HPR?

A: Holding period return (HPR) is the return which is earned by the company by holding a security for a…

Q: lowing are examples of retirement plans EXC O 401(k) O 403(b) O Traditional IRA O Roth IRAS O…

A: There are many types of retirement plans depending on amount of deposit ,period of deposit and…

Q: Question 2 a) Explain the different dividend payment patterns that can be adopted in an…

A: a) A dividend is a portion of a company's profits distributed to its shareholders as a return on…

Q: Which derivative does not reduce financial risk? a. options b. swaps c. futures d.forwards e.…

A: Financial derivative is referred as the financial instrument, which can link to the particular…

Q: 2. Juliet is a risk-averse investor. Romeo is a less risk-averse investor than Juliet. Therefore. •…

A: Bartleby honor code states that when multiple questions are asked, the expert is required to solve…

Q: company usually has an average balance in its bank account equal to $60,000. The The company makes a…

A: The company here is required to hold more money in the bank. The usual balance is $60,000 and the…

Q: Imagine you are the project manager at an investment firm and given the task of preparing a report…

A: (Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: “Investors engage in forward exchange transactions to hedge against foreign currency risk. EXPLAIN…

A: A futures contract is a customized contract between two parties to buy or sell an asset at a price…

Q: What is the expected rate of return for the Philippine Stock Index Portfolio? STOCK MARKET VALUE…

A: Expected Return: The expected return is the minimum required rate of return which an investor…

Q: Calculate Sandy’s monthly payment

A: Loan Payment: These are payments made by the lender to the borrower for amortizing the loan amount.…

Q: For a major plant expansion project, a company wants to have $63 million 5 years from now If the…

A: Solution: Money is invested somewhere to earn interest on it. The amount initially deposited in…

Q: Current Price $100 Expected Price in 1 year Expected Dividend T-year T Bond yield $107.98 Beta 2.0…

A: Holding period return is referred to the total return received from holding an asset or portfolio of…

Q: Ihrough 15: The financial manager of Apple Co. is evaluating Banana Co. as a possible acquisition.…

A: Market value of a company Market value of a company is calculated as shown below. Market value of a…

Q: you deposited ₱5,000 from the savings of your daily allowance in a time deposit account with your…

A: Solution:- When an amount is invested somewhere, it earns interest on it. The amount invested is…

Q: price-to-earnings ratio

A: Price to earnings ratio refers to the ratio who is valuing a company which measured the current…

Q: 6. David is opening an Aerial Adventure Park. He has three mutually exclusive design alternatives:…

A: Future worth is a compounding technique of the time value of money. It is used to calculate the…

Q: Elearning Company would like to develop its technology process by purchasing a production equipment…

A: Initial Investment is HUF 115 million Life of Equipment is 4 years Cash Flow in year 1 is HUF 32…

Q: Use the following information: Stock A B Good state 12% 17% Bad state 0% -1% Assume there is 60%…

A: Given, Stock A and Stock B. Investment in Stock A is 9% and investment is Stock B is 1-9%

Q: Bicycle Company had the following operating results for 2021-2022. In addition, the company paid…

A: The cash a firm earns after accounting for cash expenses to sustain operations and maintain capital…

Q: Use the following information: Stock A B Good state 10% 14% Bad state 2% -2% Assume there is 60%…

A: The probabilities of expected standard deviation for various scenarios can be used to compute the…

Q: best 20 US penny stock for 2022?

A: Penny stock - Share of a small public company that trade at a low price is referred to as penny…

Q: A standard “fixed for floating” interest rate swap contract is effectively a series of call…

A: Interest rate swaps are the derivative contracts where two parties exchange cashflows each other on…

Q: how was the trading of uwmc company in march 2022?

A: UMWC holdings stands for United Wholesale Mortgage, located in Pontiac, Michigan, is a national…

Step by step

Solved in 2 steps

- Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is foundto be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the requiredreturn on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (A) to beta of B(B). d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to payreturns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standarddeviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also hasstandard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whetherasset A and B are overvalued or undervalued, and explain why. (Hint: Beta of asset i (??) =???????, where ??,?? are standard deviations of asset i and marketportfolio, ??? is the correlation between asset i and the market portfolio)Question 2. Foreign exchange marketsStatoil, the national…Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is foundto be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the requiredreturn on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (A) to beta of B(B). d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to payreturns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standarddeviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also hasstandard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whetherasset A and B are overvalued or undervalued, and explain why. (Hint: Beta of asset i (??) = ???????, where ??,?? are standard deviations of asset i and marketportfolio, ??? is the correlation between asset i and the market portfolio)The data on the expected return of 2 stocks (M and C) along with the economic conditions and their probabilities is attached below Questions : Calculate the expected return for asset M and asset C. Calculate the standard deviation for asset M and asset C. c) If asset M is a market portfolio, while the beta (β) for asset C is 1.25 and the risk-free asset is 6%. What is the required rate of return for asset C according to the CAPM method ?. .

- The expected return on the Market Portfolio M is E(RM)=15%, the standard deviation is sM=25% and the risk-free rate is Rf=5%. a. Suppose that stock X has standard deviation sX=30%, and correlation with the market portfolio rXM=0.5. Compute bX and E(RX) (the beta and the expected return of stock X) according to the Market Model (ie: alpha equals zero under the Market Model). b. Suppose that stock Y has standard deviation sy=15%, and correlation with the market portfolio rYM=-0.1. Compute bY and E(RY) (the beta and the expected return of stock Y) according to the Market Model (ie: alpha equals zero under the Market Model). c. Compute the beta of a portfolio composed 65% of stock X and 35% of stock Y.Using the following information determine the expected rate of return for a risky asset using CAPM, consider the following example stocks assuming that you have already computed their betas Stocks Beta A 0.70 B 1.00 C 1.15 D 1.40 E -0.30 Assume that you expect the economy RFR to be 6% (0.06) The expected return on the market portfolio (E(Rm)) to be 8% (0.08) A market risk premium of (0.04). Question: What would be the SML required rate of return for the following stocks. A, B,C,D and EUsing the following information determine the expected rate of return for a risky asset using CAPM, consider the following example stocks assuming that you have already computed their betas Stocks Beta A 0.70 B 1.00 C 1.15 D 1.40 E -0.30 Also assume that you expect the economy RFR to be 6% (0.06) and the expected return on the market portfolio (E(Rm)) to be 8% (0.08) which implies a market risk premium of (0.04). What would be the SML required rate of return for the following stocks: A, B, C, D and E.

- Assume that two securities, A and B, constitute the market portfolio, their proportions and variances are 0.39, 160, and 0.61, 340, respectively. The covariance of the two securities is 190. Estimate the systematic risk (beta) of the two securities. Note that the covariance of security-i with the market portfolio is simply the weighted average of the covariances of security-i with all the securities included in the market portfolio – the lesson you learned in the context of the bordered covariance matrix. Answer step by step.Do all part.Answer must be correct.Suppose the standard deviation of monthly changes in the price of a commodity is 0.4. The standard deviation of monthly changes in futures price for a contract on commodity B (similar to commodity A) is 0.5. The correlation between the futures and commodity price is 0.88. What is the hedge ratio and the optimal number of contracts if the commodity trader wants to hedge 10000 bushels and one contract is on 100bushels? Hedge ratio should be rounded off to three decimal places and optima number of contracts should be in whole numbers.Consider an economy where Capital Asset Pricing Model holds. In this economy, stocks A and B have the following characteristics: • Stock A has and expected return of 22% and a beta of 2. • Stock B has an expected return of 15% and a beta of 0.8. The standard deviation of the market portfolio’s return is 18%. (a) Assuming that stocks A and B are correctly priced according to the CAPM, compute the risk-free rate and the market risk premium. (b) Draw the security market line, showing the positions of stocks A and B, as well as the risk-free rate and the market portfolio on the plot. You are not required to draw the security market line to scale. (c) Consider stock C that has an expected return of 30%, a beta of 2.3, and a standard deviation of returns of 20%. According to the CAPM, calculated in part (a) above, is stock C overpriced, underpriced, or correctly priced? What would you recommend to investors? (d) Briefly explain the definition of market portfolio in a CAPM economy

- Given that the formula for CAPM is Expected return= risk free rate + Beta*(Return on market - risk free rate), Security A has a beta of 1.16 and an expected return of .1137 and Security B has a beta of .92 and expected return of .0984. If these securities are assumed to be correctly priced, what is their risk free rate? Based on CAPM, what is the return on the market?The CAPM states that the expected (required) return on an asset is : E(Ri)=Rf+βi[E(RM)−Rf] where the term in square brackets is the risk-premium earned by the market portfolio. Therefore, the beta of the market portfolio (βM) must be equal to __________ . A) zero B) 0.5 C) 1.0 D) an unknown estimateConsider two types of assets: market portfolio (M) and stock A. The expected return is 8% and standard deviation of the market portfolio is 15%. The risk-free rate is 2%. The standard deviation of market portfolio returns is 15%. The standard deviation of stock A is 30%, and the beta coefficient is 1. Draw the capital market line and show the position of stock A.