A VAT registered person engages in both VAT and VAT exempt business. During the year total sales amounted to P500,000, exclusive of the VAT. Sale of the VAT exempt business amounts toP200,000. During the quarter, the bu

A VAT registered person engages in both VAT and VAT exempt business. During the year total sales amounted to P500,000, exclusive of the VAT. Sale of the VAT exempt business amounts toP200,000. During the quarter, the bu

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 7C: On January 1, 2019, Mopps Corp. agrees to provide Conklin Company 3 years of cleaning and janitorial...

Related questions

Question

A VAT registered person engages in both VAT and VAT exempt business. During the year total sales amounted to P500,000, exclusive of the VAT. Sale of the VAT exempt business amounts toP200,000. During the quarter, the business incurred the following: Input VAT arising from repairs amounting P6,000. On the other hand, input on supplies, for common use amounted P1,200. The creditable input tax is

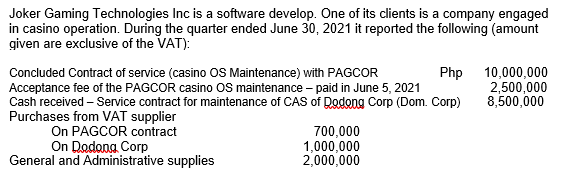

Transcribed Image Text:Joker Gaming Technologies Inc is a software develop. One of its clients is a company engaged

in casino operation. During the quarter ended June 30, 2021 it reported the following (amount

given are exclusive of the VAT):

Php

10,000,000

2,500,000

8,500,000

Concluded Contract of service (casino OS Maintenance) with PAGCOR

Acceptance fee of the PAGCOR casino OS maintenance – paid in June 5, 2021

Cash received – Service contract for maintenance of CAS of Dodong Corp (Dom. Corp)

Purchases from VAT supplier

On PAGCOR contract

On Dodona Corp

General and Administrative supplies

700,000

1,000,000

2,000,000

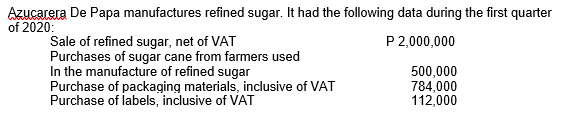

Transcribed Image Text:Azucarera De Papa manufactures refined sugar. It had the following data during the first quarter

of 2020:

P 2,000,000

Sale of refined sugar, net of VAT

Purchases of sugar cane from farmers used

In the manufacture of refined sugar

Purchase of packaging materials, inclusive of VAT

Purchase of labels, inclusive of VAT

500,000

784,000

112,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT