(a) What is the correct entry to make? (b) Referring to J.R. Hansen, SCt, 59-2 USTC 19533, 360 US446, 79 SCt 1270, when is the amount held back taxable to the dealership?

(a) What is the correct entry to make? (b) Referring to J.R. Hansen, SCt, 59-2 USTC 19533, 360 US446, 79 SCt 1270, when is the amount held back taxable to the dealership?

Chapter2: Income Tax Concepts

Section: Chapter Questions

Problem 18P

Related questions

Question

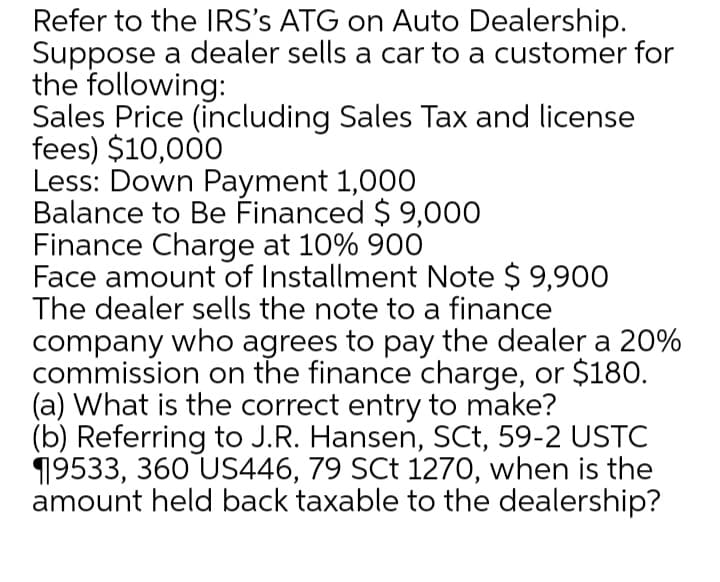

Transcribed Image Text:Refer to the IRS's ATG on Auto Dealership.

Suppose a dealer sells a car to a customer for

the following:

Sales Price (including Sales Tax and license

fees) $10,000

Less: Down Payment 1,000

Balance to Be Financed $ 9,000

Finance Charge at 10% 900

Face amount of Installment Note $ 9,900

The dealer sells the note to a finance

company who agrees to pay the dealer a 20%

commission on the finance charge, or $180.

(a) What is the correct entry to make?

(b) Referring to J.R. Hansen, SCt, 59-2 USTC

19533, 360 US446, 79 SCt 1270, when is the

amount held back taxable to the dealership?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT