(a) What is the probability that a new customer has an accident over the first year of his contract? (b) A new customer has an accident during the first year of his contract. What is the probability that he belongs to the group likely to have an accident?

(a) What is the probability that a new customer has an accident over the first year of his contract? (b) A new customer has an accident during the first year of his contract. What is the probability that he belongs to the group likely to have an accident?

Chapter8: Sequences, Series,and Probability

Section8.7: Probability

Problem 50E: Flexible Work Hours In a recent survey, people were asked whether they would prefer to work flexible...

Related questions

Question

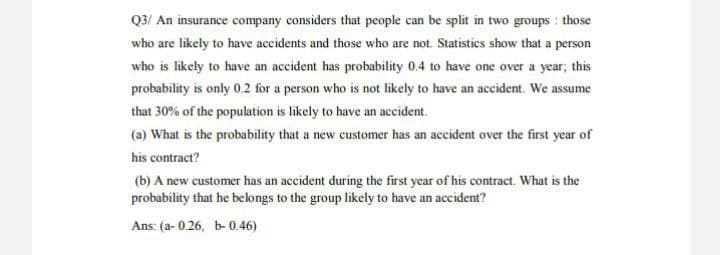

Transcribed Image Text:Q3/ An insurance company considers that people can be split in two groups : those

who are likely to have accidents and those who are not. Statisties show that a person

who is likely to have an accident has probability 0.4 to have one over a year; this

probability is only 0.2 for a person who is not likely to have an accident. We assume

that 30% of the population is likely to have an accident.

(a) What is the probability that a new customer has an accident over the first year of

his contract?

(b) A new customer has an accident during the first year of his contract. What is the

probability that he belongs to the group likely to have an accident?

Ans: (a- 0.26, b- 0.46)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning