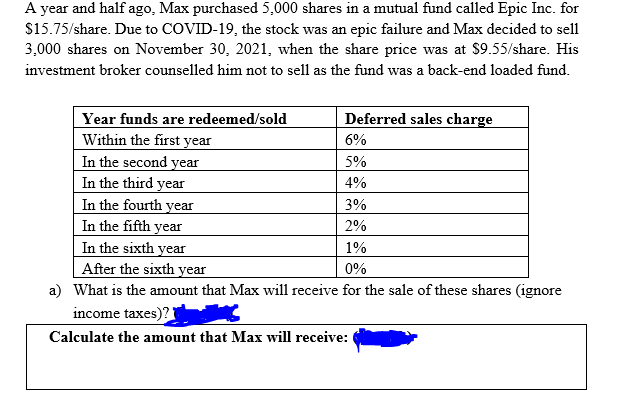

A year and half ago, Max purchased 5,000 shares in a mutual fund called Epic Inc. for $15.75/share. Due to COVID-19, the stock was an epic failure and Max decided to sell 3,000 shares on November 30, 2021, when the share price was at $9.55/share. His investment broker counselled him not to sell as the fund was a back-end loaded fund. Year funds are redeemed/sold Within the first year In the second year In the third year In the fourth year In the fifth year In the sixth year After the sixth year Deferred sales charge 6% 5% 4% 3% 2% 1% 0% a) What is the amount that Max will receive for the sale of these shares (ignore income taxes)? Calculate the amount that Max will receive:

A year and half ago, Max purchased 5,000 shares in a mutual fund called Epic Inc. for $15.75/share. Due to COVID-19, the stock was an epic failure and Max decided to sell 3,000 shares on November 30, 2021, when the share price was at $9.55/share. His investment broker counselled him not to sell as the fund was a back-end loaded fund. Year funds are redeemed/sold Within the first year In the second year In the third year In the fourth year In the fifth year In the sixth year After the sixth year Deferred sales charge 6% 5% 4% 3% 2% 1% 0% a) What is the amount that Max will receive for the sale of these shares (ignore income taxes)? Calculate the amount that Max will receive:

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 50P

Related questions

Question

Transcribed Image Text:A year and half ago, Max purchased 5,000 shares in a mutual fund called Epic Inc. for

$15.75/share. Due to COVID-19, the stock was an epic failure and Max decided to sell

3,000 shares on November 30, 2021, when the share price was at $9.55/share. His

investment broker counselled him not to sell as the fund was a back-end loaded fund.

Year funds are redeemed/sold

Within the first year

In the second year

In the third year

In the fourth year

In the fifth year

In the sixth year

After the sixth year

Deferred sales charge

6%

5%

4%

3%

2%

1%

0%

a) What is the amount that Max will receive for the sale of these shares (ignore

income taxes)?

Calculate the amount that Max will receive:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT