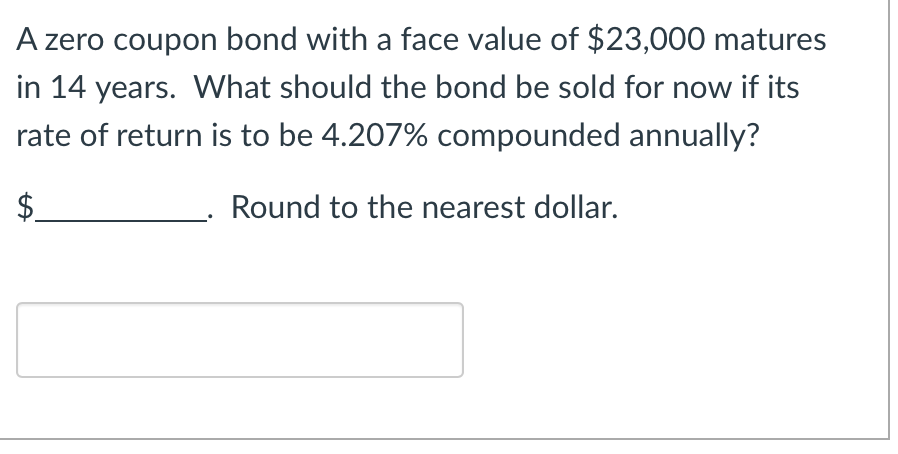

A zero coupon bond with a face value of $23,000 matures in 14 years. What should the bond be sold for now if its rate of return is to be 4.207% compounded annually? Round to the nearest dollar. tA

A zero coupon bond with a face value of $23,000 matures in 14 years. What should the bond be sold for now if its rate of return is to be 4.207% compounded annually? Round to the nearest dollar. tA

Algebra and Trigonometry (MindTap Course List)

4th Edition

ISBN:9781305071742

Author:James Stewart, Lothar Redlin, Saleem Watson

Publisher:James Stewart, Lothar Redlin, Saleem Watson

Chapter13: Sequences And Series

Section13.CR: Chapter Review

Problem 66E

Related questions

Question

f10

Transcribed Image Text:A zero coupon bond with a face value of $23,000 matures

in 14 years. What should the bond be sold for now if its

rate of return is to be 4.207% compounded annually?

$

Round to the nearest dollar.

LA

Transcribed Image Text:Zero Coupon Bond

A zero coupon bond is a bond that is sold now at a

discount and will pay its face value when it matures. No

interest payments are made.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage