a. Calculate the change in retur Security A's change in return w Data table Security A (Click on the icon here in order to copy its contents of the data table below into a spreadsheet.) BC с Print Beta 1.63 0.62 -0.24 10.001 Done - X iod.

a. Calculate the change in retur Security A's change in return w Data table Security A (Click on the icon here in order to copy its contents of the data table below into a spreadsheet.) BC с Print Beta 1.63 0.62 -0.24 10.001 Done - X iod.

Pkg Acc Infor Systems MS VISIO CD

10th Edition

ISBN:9781133935940

Author:Ulric J. Gelinas

Publisher:Ulric J. Gelinas

Chapter11: The Billing/accounts Receivable/cash

receipts (b/ar/cr) Process

Section: Chapter Questions

Problem 3DQ

Related questions

Question

Transcribed Image Text:a. Calculate the change in retur

Security A's change in return w

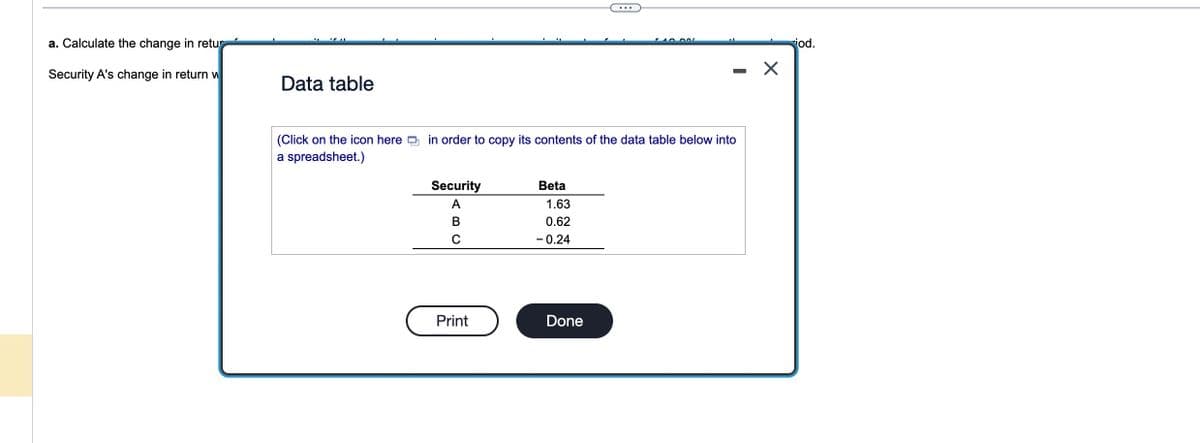

Data table

(Click on the icon here in order to copy its contents of the data table below into

a spreadsheet.)

Security

A

BC

Print

Beta

1.63

0.62

-0.24

---n

Done

X

iod.

Transcribed Image Text:↑

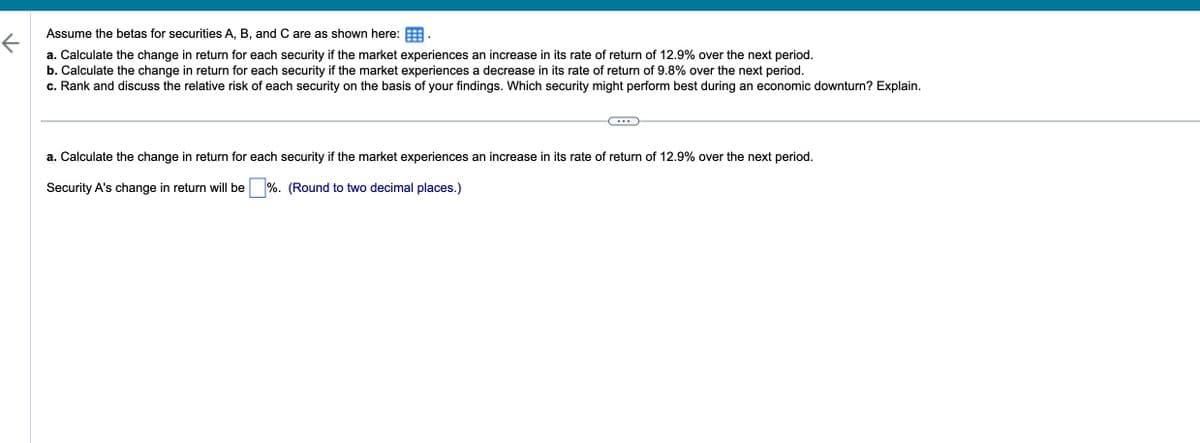

Assume the betas for securities A, B, and C are as shown here: BB.

a. Calculate the change in return for each security if the market experiences an increase in its rate of return of 12.9% over the next period.

b. Calculate the change in return for each security if the market experiences a decrease in its rate of return of 9.8% over the next period.

c. Rank and discuss the relative risk of each security on the basis of your findings. Which security might perform best during an economic downturn? Explain.

...

a. Calculate the change in return for each security if the market experiences an increase in its rate of return of 12.9% over the next period.

Security A's change in return will be %. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Recommended textbooks for you

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning