A. Complete each table by filling in the blanks. 0-30 days 31-90 days Over 90 days past due past due past due Accounts receivable amount $55,000 $34,000 $20,000 Percent uncollectible 8% 15% 30% Total per category Total uncollectible 0-60 days 61-120 days Over 120 days past due past due past due Accounts receivable amount $84,000 $13,000 $6,000 Percent uncollectible 8% 15% 30% Total per category 24 Total uncollectible B. Determine the difference between total uncollectible. C. How does the new total uncollectible amount affect net income and net accounts receivable? а. Bad debt expense is lower, net income is higher, and net receivables are higher. b. Bad debt expense is lower, net income is higher, and net receivables are lower. c. Bad debt expense is higher, net income is lower, and net receivables are higher. d. Bad debt expense is higher, net income is lower, and net receivables are lower.

A. Complete each table by filling in the blanks. 0-30 days 31-90 days Over 90 days past due past due past due Accounts receivable amount $55,000 $34,000 $20,000 Percent uncollectible 8% 15% 30% Total per category Total uncollectible 0-60 days 61-120 days Over 120 days past due past due past due Accounts receivable amount $84,000 $13,000 $6,000 Percent uncollectible 8% 15% 30% Total per category 24 Total uncollectible B. Determine the difference between total uncollectible. C. How does the new total uncollectible amount affect net income and net accounts receivable? а. Bad debt expense is lower, net income is higher, and net receivables are higher. b. Bad debt expense is lower, net income is higher, and net receivables are lower. c. Bad debt expense is higher, net income is lower, and net receivables are higher. d. Bad debt expense is higher, net income is lower, and net receivables are lower.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 11EA: Mirror Mart uses the balance sheet aging method to account for uncollectible debt on receivables....

Related questions

Question

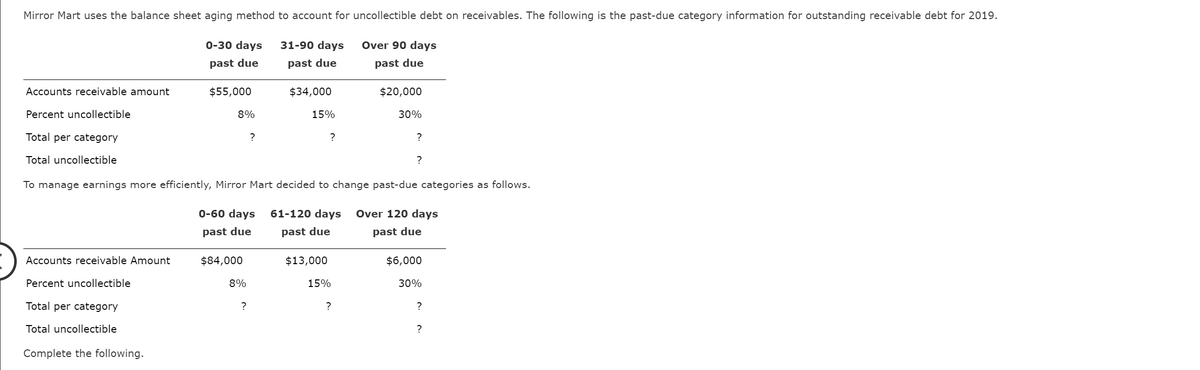

Transcribed Image Text:Mirror Mart uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019.

0-30 days

31-90 days

Over 90 days

past due

past due

past due

Accounts receivable amount

$55,000

$34,000

$20,000

Percent uncollectible

8%

15%

30%

Total per category

?

?

?

Total uncollectible

?

To manage earnings more efficiently, Mirror Mart decided to change past-due categories as follows.

0-60 days

61-120 days

Over 120 days

past due

past due

past due

Accounts receivable Amount

$84,000

$13,000

$6,000

Percent uncollectible

8%

15%

30%

Total per category

?

?

?

Total uncollectible

?

Complete the following.

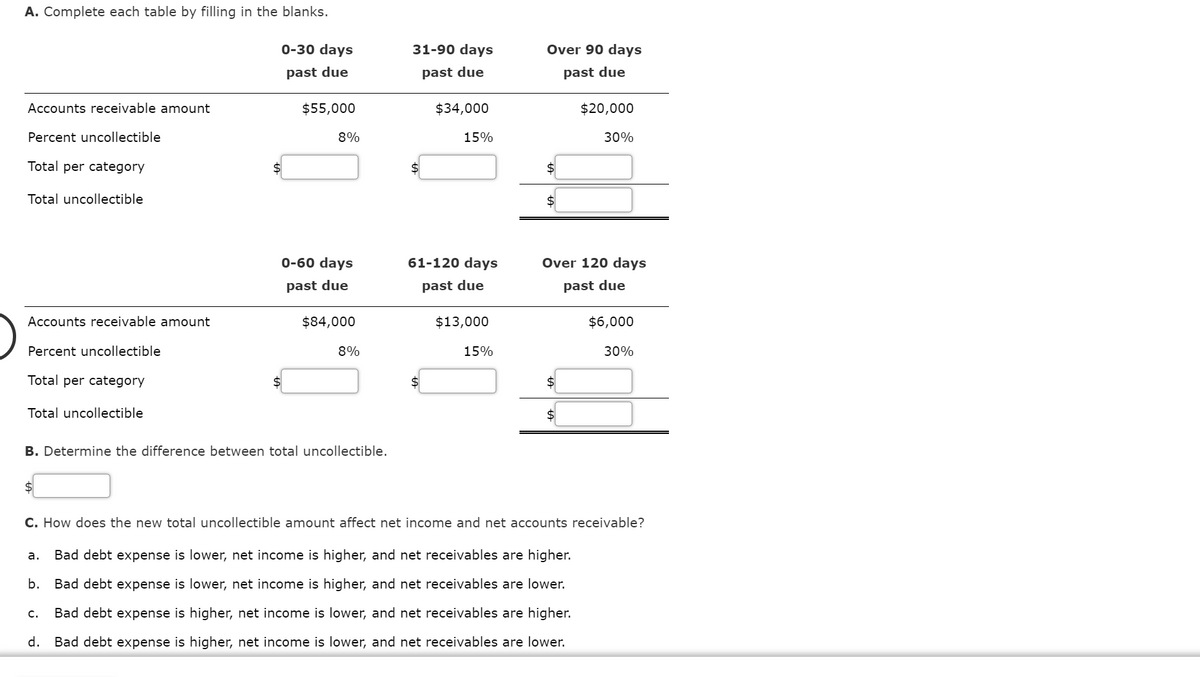

Transcribed Image Text:A. Complete each table by filling in the blanks.

0-30 days

31-90 days

Over 90 days

past due

past due

past due

Accounts receivable amount

$55,000

$34,000

$20,000

Percent uncollectible

8%

15%

30%

Total per category

$

Total uncollectible

$

0-60 days

61-120 days

Over 120 days

past due

past due

past due

Accounts receivable amount

$84,000

$13,000

$6,000

Percent uncollectible

8%

15%

30%

Total per category

$

Total uncollectible

$

B. Determine the difference between total uncollectible.

2$

C. How does the new total uncollectible amount affect net income and net accounts receivable?

а.

Bad debt expense is lower, net income is higher, and net receivables are higher.

b.

Bad debt expense is lower, net income is higher, and net receivables are lower.

c.

Bad debt expense is higher, net income is lower, and net receivables are higher.

d.

Bad debt expense is higher, net income is lower, and net receivables are lower.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning