a. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the straight-line depreciation method (half-year convention). b. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the 200 percent declining-balance method (half-year convention) with a switch to straight-line when it will maximize depreciation expense. c. Which of these two depreciation methods (straight-line or double-declining-balance) results in the highest net income for financial reporting purposes during the first two years of the equipment's use?

a. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the straight-line depreciation method (half-year convention). b. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the 200 percent declining-balance method (half-year convention) with a switch to straight-line when it will maximize depreciation expense. c. Which of these two depreciation methods (straight-line or double-declining-balance) results in the highest net income for financial reporting purposes during the first two years of the equipment's use?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 8MC: On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was...

Related questions

Question

what is the

Transcribed Image Text:Help

Sa

2

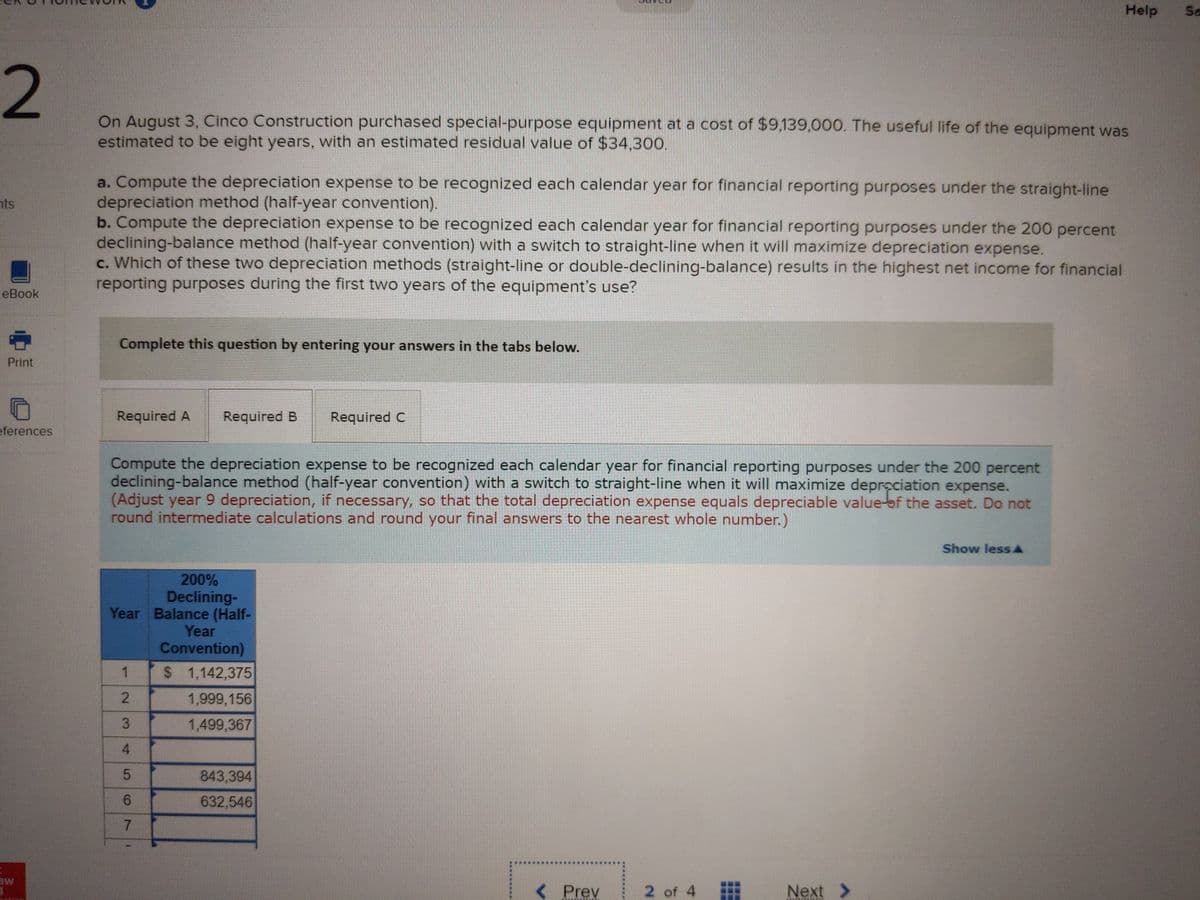

On August 3, Cinco Construction purchased special-purpose equipment at a cost of $9,139,000. The useful life of the equipment was

estimated to be eight years, with an estimated residual value of $34,300.

a. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the straight-line

depreciation method (half-year convention).

b. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the 200 percent

declining-balance method (half-year convention) with a switch to straight-line when it will maximize depreciation expense.

c. Which of these two depreciation methods (straight-line or double-declining-balance) results in the highest net income for financial

reporting purposes during the first two years of the equipment's use?

nts

еВook

Complete this question by entering your answers in the tabs below.

Print

Required A

Required B

Required C

eferences

Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the 200 percent

declining-balance method (half-year convention) with a switch to straight-line when it will maximize deprociation expense.

(Adjust year 9 depreciation, if necessary, so that the total depreciation expense equals depreciable value-bf the asset. Do not

round intermediate calculations and round your final answers to the nearest whole number.)

Show less A

200%

Declining-

Year Balance (Half-

Year

Convention)

1

$ 1,142,375

1,999,156

1,499,367

843,394

6.

632,546

aw

< Prev

2 of 4

Next >

23

4.

5

7,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning