a. Compute the total income tax that would be paid assuming Cherry is an S corporation. Ignore payroll taxes Begin by calculating taxable income for Gina under this scenario. S corporation income Salaries 74,000 82,000 156,000 Adjusted gross income Minus: Qualified business income deduction Itemized deductions Taxable income 0 31,500 124,500 Now enter the income tax that would be paid by Gina and the corporation under this scenario, and compute the total income tax. (Use the 2022 tax rate schedules for all tax calculations. Enter a "0" if no tax is due. Do not round any intermediary calculations. Round your final tax liability to the nearest whole dollar.) Income tax paid by Gina Corporation Amount of tax 18,624 0 Total income tax 18,624

a. Compute the total income tax that would be paid assuming Cherry is an S corporation. Ignore payroll taxes Begin by calculating taxable income for Gina under this scenario. S corporation income Salaries 74,000 82,000 156,000 Adjusted gross income Minus: Qualified business income deduction Itemized deductions Taxable income 0 31,500 124,500 Now enter the income tax that would be paid by Gina and the corporation under this scenario, and compute the total income tax. (Use the 2022 tax rate schedules for all tax calculations. Enter a "0" if no tax is due. Do not round any intermediary calculations. Round your final tax liability to the nearest whole dollar.) Income tax paid by Gina Corporation Amount of tax 18,624 0 Total income tax 18,624

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 30P

Related questions

Question

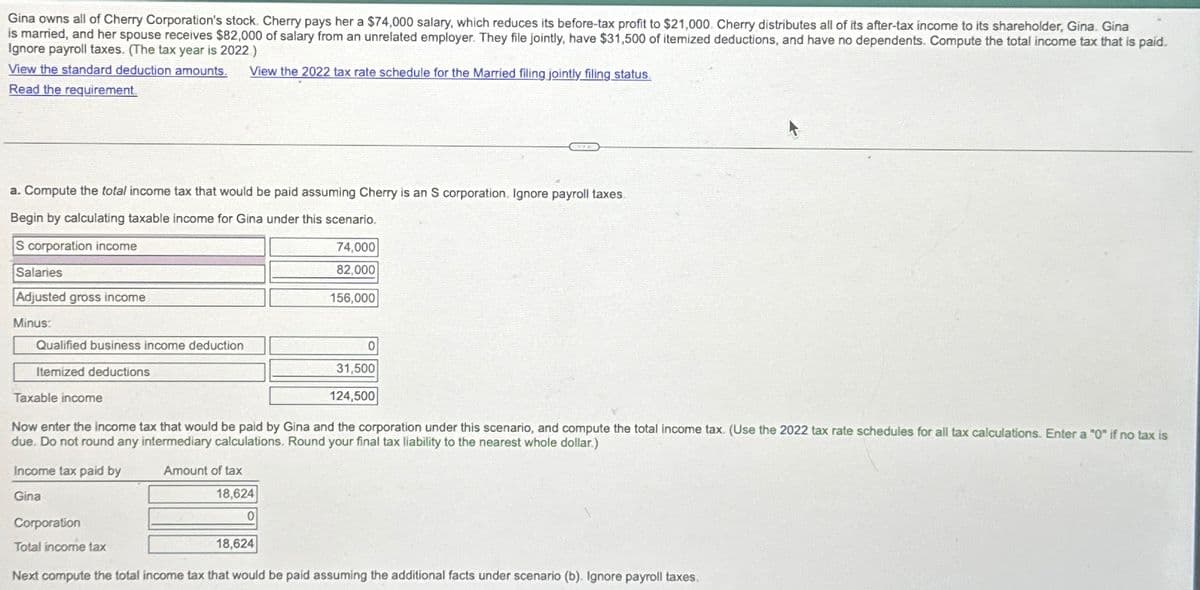

Transcribed Image Text:Gina owns all of Cherry Corporation's stock. Cherry pays her a $74,000 salary, which reduces its before-tax profit to $21,000. Cherry distributes all of its after-tax income to its shareholder, Gina. Gina

is married, and her spouse receives $82,000 of salary from an unrelated employer. They file jointly, have $31,500 of itemized deductions, and have no dependents. Compute the total income tax that is paid.

Ignore payroll taxes. (The tax year is 2022)

View the standard deduction amounts. View the 2022 tax rate schedule for the Married filing jointly filing status.

Read the requirement.

a. Compute the total income tax that would be paid assuming Cherry is an S corporation. Ignore payroll taxes.

Begin by calculating taxable income for Gina under this scenario.

S corporation income

Salaries

Adjusted gross income

Minus:

74,000

82,000

156,000

Qualified business income deduction

Itemized deductions

Taxable income

0

31,500

124,500

Now enter the income tax that would be paid by Gina and the corporation under this scenario, and compute the total income tax. (Use the 2022 tax rate schedules for all tax calculations. Enter a "0" if no tax is

due. Do not round any intermediary calculations. Round your final tax liability to the nearest whole dollar.)

Income tax paid by

Gina

Corporation

Total income tax

Amount of tax

18,624

0

18,624

Next compute the total income tax that would be paid assuming the additional facts under scenario (b). Ignore payroll taxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you