a. Consider a portfolio, made up by selling short $10,000 of Contravent stocks and buying $10,000 of Sensor and $5000 of Cosmo. How sensitive will this portfolio be to each of the three factors? b. What is the expected return of your portfolio in (a) if the expected return on the S&P 500 index is 15%, the expected return on the SMB factor is 4%, the expected return on the HML factor is 2% and the risk free rate is 0.5% c. What is the systematic volatility (standard deviation of returns) of your portfolio in (a) given that the volatility of the S&P 500 index is 16%, the volatility of the SMB factor is 20% and the volatility of HML factor is 10%?

a. Consider a portfolio, made up by selling short $10,000 of Contravent stocks and buying $10,000 of Sensor and $5000 of Cosmo. How sensitive will this portfolio be to each of the three factors? b. What is the expected return of your portfolio in (a) if the expected return on the S&P 500 index is 15%, the expected return on the SMB factor is 4%, the expected return on the HML factor is 2% and the risk free rate is 0.5% c. What is the systematic volatility (standard deviation of returns) of your portfolio in (a) given that the volatility of the S&P 500 index is 16%, the volatility of the SMB factor is 20% and the volatility of HML factor is 10%?

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 8DQ: Beta pf CPB company Beta of the MSI Company is 0.19. The beta of TIF Company is 1.76. Repeat the...

Related questions

Question

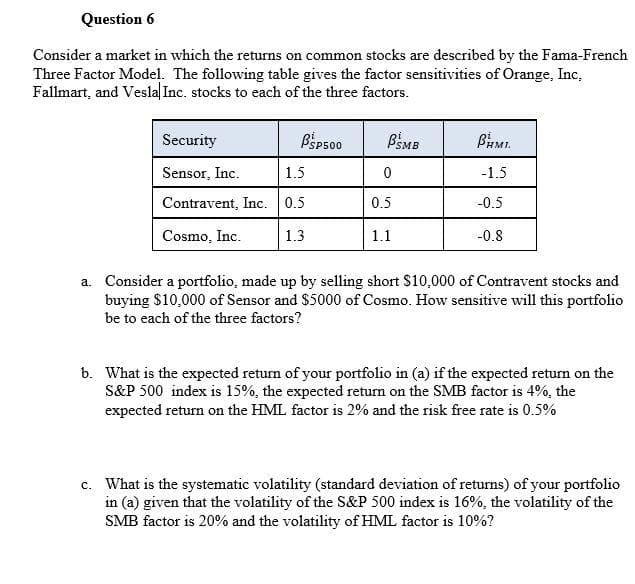

Transcribed Image Text:Question 6

Consider a market in which the returns on common stocks are described by the Fama-French

Three Factor Model. The following table gives the factor sensitivities of Orange, Inc,

Fallmart, and Vesla| Inc. stocks to each of the three factors.

Security

BSp500

BSMB

Sensor, Inc.

1.5

-1.5

Contravent, Inc. 0.5

0.5

-0.5

Cosmo, Inc.

1.3

1.1

-0.8

a. Consider a portfolio, made up by selling short $10,000 of Contravent stocks and

buying $10,000 of Sensor and $5000 of Cosmo. How sensitive will this portfolio

be to each of the three factors?

b. What is the expected return of your portfolio in (a) if the expected return on the

S&P 500 index is 15%, the expected return on the SMB factor is 4%, the

expected return on the HML factor is 2% and the risk free rate is 0.5%

c. What is the systematic volatility (standard deviation of returns) of your portfolio

in (a) given that the volatility of the S&P 500 index is 16%, the volatility of the

SMB factor is 20% and the volatility of HML factor is 10%?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning