a. $40,000

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 11P: REPLACEMENT ANALYSIS St. Johns River Shipyards is considering the replacement of an 8-year-old...

Related questions

Question

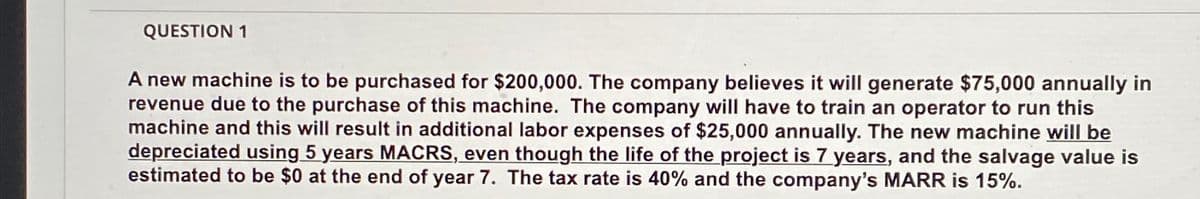

Transcribed Image Text:QUESTION 1

A new machine is to be purchased for $200,000. The company believes it will generate $75,000 annually in

revenue due to the purchase of this machine. The company will have to train an operator to run this

machine and this will result in additional labor expenses of $25,000 annually. The new machine will be

depreciated using 5 years MACRS, even though the life of the project is 7 years, and the salvage value is

estimated to be $0 at the end of year 7. The tax rate is 40% and the company's MARR is 15%.

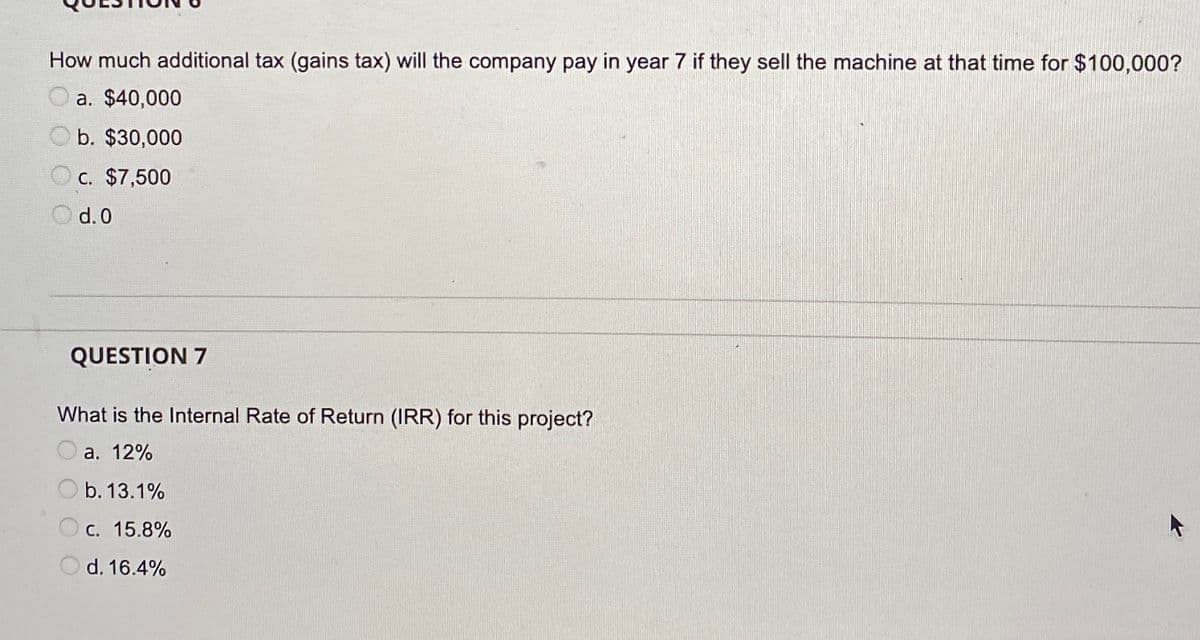

Transcribed Image Text:How much additional tax (gains tax) will the company pay in year 7 if they sell the machine at that time for $100,000?

a. $40,000

b. $30,000

O c. $7,500

O d.0

QUESTION 7

What is the Internal Rate of Return (IRR) for this project?

а. 12%

b. 13.1%

С. 15.8%

d. 16.4%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning