a. Income tax payable currently. b. Deferred tax asset-ending balance. c. Deferred tax asset-change. d. Deferred tax liability-ending balance. e. Deferred tax liability-change. f. Income tax expense. $ $ $ $ $ S 1 2 Situation 29.0 $ 6.0 4.0 $ (2.0) 0.0 $ 12.0 0.0 $ 4.0 33.0 $ 66.0 62.0 $ 0.0 ام م م م م kk 3 65.0 22.0 MN $ $ 5.0 $ 6.0 $ 4 $ 4.0 $ $ 89.0 9.0 5.0 15.0 15.0 66.0 $ 109.0

a. Income tax payable currently. b. Deferred tax asset-ending balance. c. Deferred tax asset-change. d. Deferred tax liability-ending balance. e. Deferred tax liability-change. f. Income tax expense. $ $ $ $ $ S 1 2 Situation 29.0 $ 6.0 4.0 $ (2.0) 0.0 $ 12.0 0.0 $ 4.0 33.0 $ 66.0 62.0 $ 0.0 ام م م م م kk 3 65.0 22.0 MN $ $ 5.0 $ 6.0 $ 4 $ 4.0 $ $ 89.0 9.0 5.0 15.0 15.0 66.0 $ 109.0

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 28CE

Related questions

Question

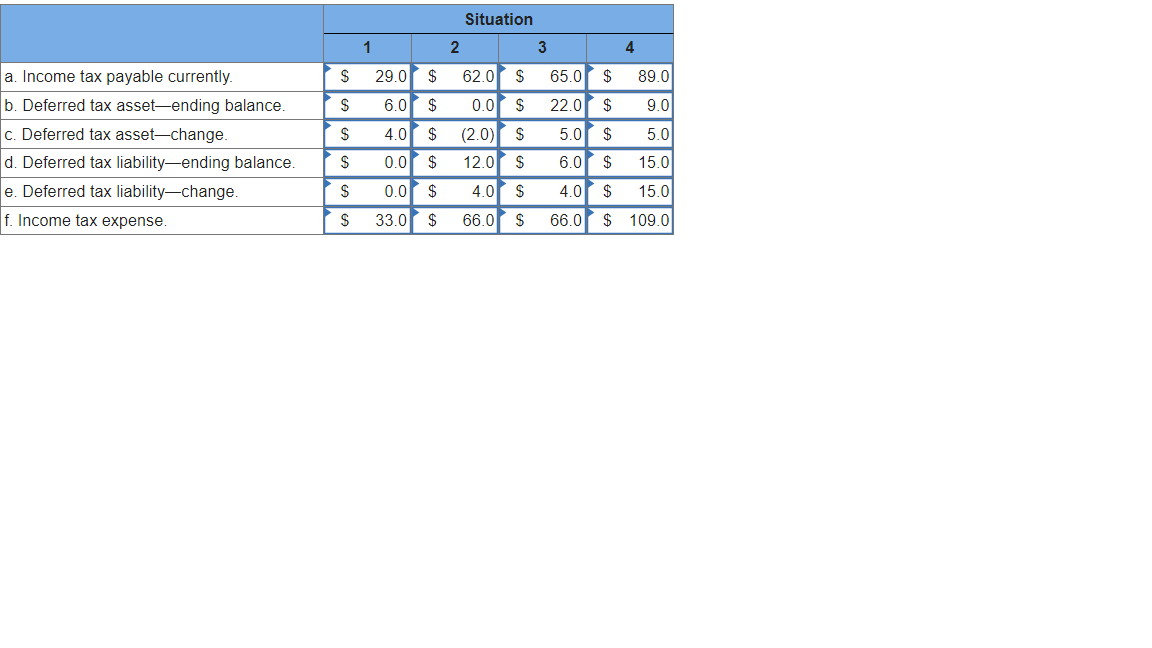

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences:

| ($ in thousands) | ||||

|---|---|---|---|---|

| Situation | ||||

| 1 | 2 | 3 | 4 | |

| Taxable income | $ 116 | $ 248 | $ 260 | $ 356 |

| Future deductible amounts | 16 | 20 | 20 | |

| Future taxable amounts | 16 | 16 | 60 | |

| Balance(s) at beginning of the year: | ||||

| 2 | 17 | 4 | ||

| 8 | 2 |

The enacted tax rate is 25%.

Required:

For each situation, determine the following:

Note: Enter your answers in thousands rounded to one decimal place (i.e. 1,200 should be entered as 1.2). Negative amounts should be indicated by a minus sign. Leave no cell blank, enter "0" wherever applicable.

Transcribed Image Text:a. Income tax payable currently.

b. Deferred tax asset-ending balance.

c. Deferred tax asset-change.

d. Deferred tax liability-ending balance.

e. Deferred tax liability-change.

f. Income tax expense.

$

$

$

$

$

S

1

2

Situation

29.0 $

6.0

4.0 $ (2.0)

0.0

$

12.0

0.0 $

4.0

33.0 $ 66.0

62.0

$ 0.0

ام م م م م

kk

3

65.0

22.0

MN

$

$

5.0 $

6.0 $

4

$ 4.0 $

$

89.0

9.0

5.0

15.0

15.0

66.0 $ 109.0

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT