a. Into which type of account are employer's payroll contributions entered? i. Asset ii. iii. iv. Expense Revenue Retained Earnings

a. Into which type of account are employer's payroll contributions entered? i. Asset ii. iii. iv. Expense Revenue Retained Earnings

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter9: Operating Activities

Section: Chapter Questions

Problem 11QE

Related questions

Question

Transcribed Image Text:a.

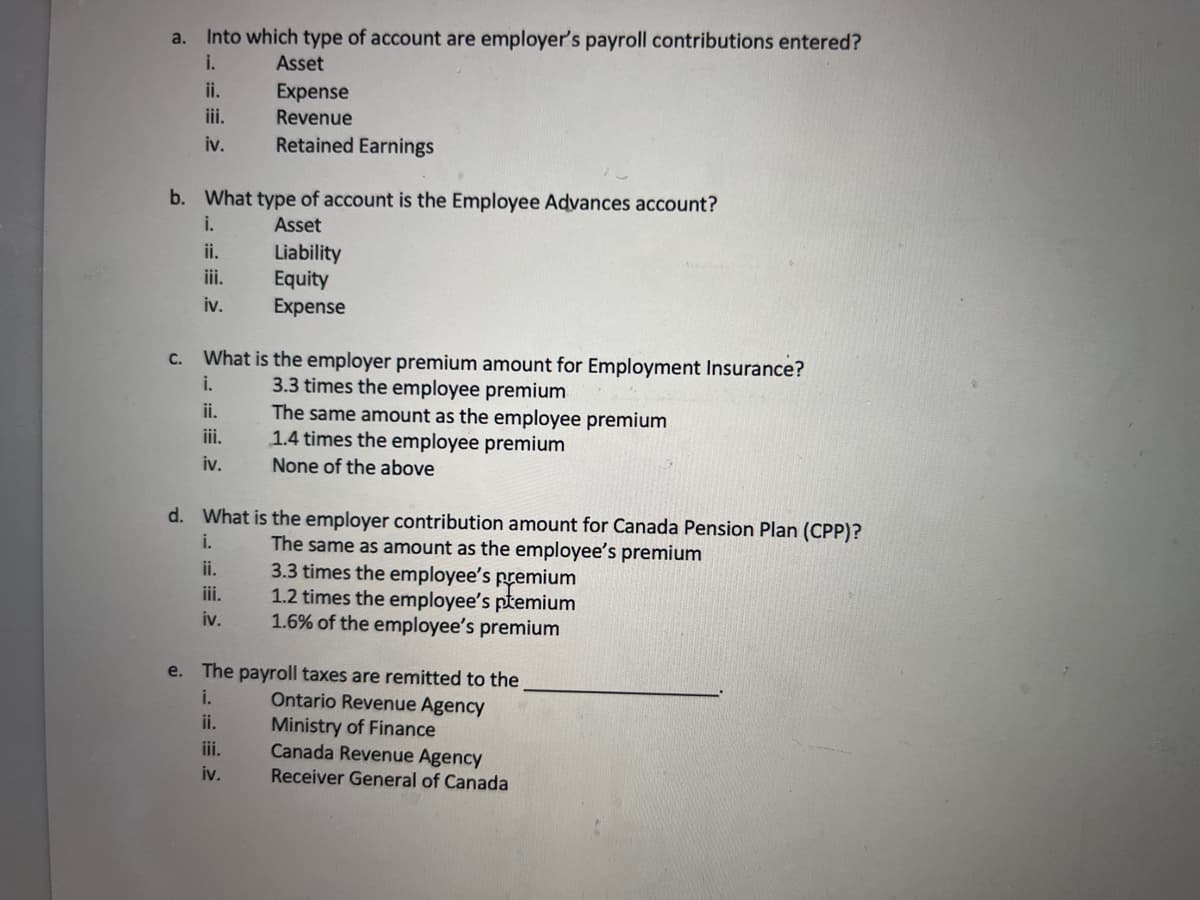

Into which type of account are employer's payroll contributions entered?

i.

Asset

Expense

Revenue

Retained Earnings

ii.

iii.

iv.

b. What type of account is the Employee Advances account?

i.

Asset

ii.

iii.

iv.

c. What is the employer premium amount for Employment Insurance?

i.

3.3 times the employee premium

ii.

iii.

iv.

Liability

Equity

Expense

ii.

iii.

iv.

d. What is the employer contribution amount for Canada Pension Plan (CPP)?

The same as amount as the employee's premium

i.

The same amount as the employee premium

1.4 times the employee premium

None of the above

iii.

iv.

3.3 times the employee's premium

1.2 times the employee's premium

1.6% of the employee's premium

e. The payroll taxes are remitted to the

i.

ii.

Ontario Revenue Agency

Ministry of Finance

Canada Revenue Agency

Receiver General of Canada

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College