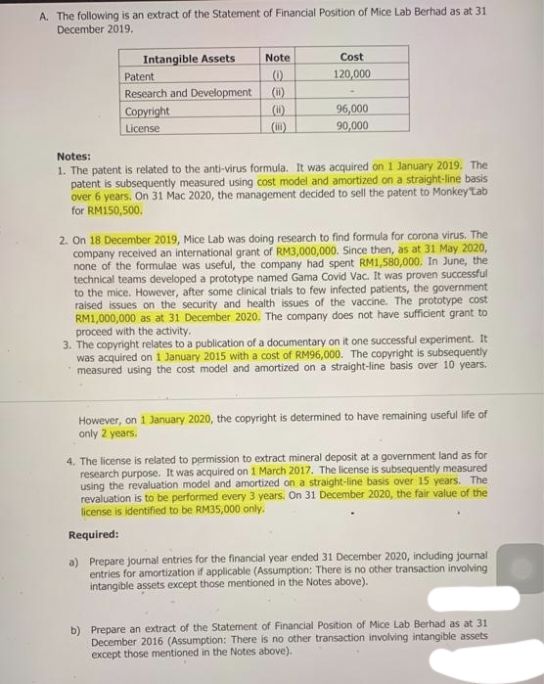

A. The following is an extract of the Statement of Financial Position of Mice Lab Berhad as at 31 December 2019. Intangible Assets Note Cost 120,000 (0) (W) Patent Research and Development () (I) Copyright 96,000 90,000 License Notes: 1. The patent is related to the anti-virus formula. It was acquired on 1 January 2019. The patent is subsequently measured using cost model and amortized on a straight-line basis over 6 years. On 31 Mac 2020, the management decided to sell the patent to Monkey tab for RM150,500. 2. On 18 December 2019, Mice Lab was doing research to find formula for corona virus. The company received an international grant of RM3,000,000. Since then, as at 31 May 2020, none of the formulae was useful, the company had spent RM1,580,000. In June, the technical teams developed a prototype named Gama Covid Vac. It was proven successful to the mice. However, after some clinical trials to few infected patients, the government raised issues on the security and health issues of the vaccine. The prototype cost RM1,000,000 as at 31 December 2020. The company does not have sufficient grant to proceed with the activity. 3. The copyright relates to a publication of a documentary on it one successful experiment. It was acquired on 1 January 2015 with a cost of RM96,000. The copyright is subsequently measured using the cost model and amortized on a straight-line basis over 10 years. However, on 1 January 2020, the copyright is determined to have remaining useful life of only 2 years. 4. The license is related to permission to extract mineral deposit at a government land as for research purpose. It was acquired on 1 March 2017. The license is subsequently measured using the revaluation model and amortized on a straight-line basis over 15 years. The revaluation is to be performed every 3 years. On 31 December 2020, the fair value of the license is identified to be RM35,000 only. Required: a) Prepare journal entries for the financial year ended 31 December 2020, including journal entries for amortization if applicable (Assumption: There is no other transaction involving intangible assets except those mentioned in the Notes above). b) Prepare an extract of the Statement of Financial Position of Mice Lab Berhad as at 31 December 2016 (Assumption: There is no other transaction involving intangible assets except those mentioned in the Notes above).

A. The following is an extract of the Statement of Financial Position of Mice Lab Berhad as at 31 December 2019. Intangible Assets Note Cost 120,000 (0) (W) Patent Research and Development () (I) Copyright 96,000 90,000 License Notes: 1. The patent is related to the anti-virus formula. It was acquired on 1 January 2019. The patent is subsequently measured using cost model and amortized on a straight-line basis over 6 years. On 31 Mac 2020, the management decided to sell the patent to Monkey tab for RM150,500. 2. On 18 December 2019, Mice Lab was doing research to find formula for corona virus. The company received an international grant of RM3,000,000. Since then, as at 31 May 2020, none of the formulae was useful, the company had spent RM1,580,000. In June, the technical teams developed a prototype named Gama Covid Vac. It was proven successful to the mice. However, after some clinical trials to few infected patients, the government raised issues on the security and health issues of the vaccine. The prototype cost RM1,000,000 as at 31 December 2020. The company does not have sufficient grant to proceed with the activity. 3. The copyright relates to a publication of a documentary on it one successful experiment. It was acquired on 1 January 2015 with a cost of RM96,000. The copyright is subsequently measured using the cost model and amortized on a straight-line basis over 10 years. However, on 1 January 2020, the copyright is determined to have remaining useful life of only 2 years. 4. The license is related to permission to extract mineral deposit at a government land as for research purpose. It was acquired on 1 March 2017. The license is subsequently measured using the revaluation model and amortized on a straight-line basis over 15 years. The revaluation is to be performed every 3 years. On 31 December 2020, the fair value of the license is identified to be RM35,000 only. Required: a) Prepare journal entries for the financial year ended 31 December 2020, including journal entries for amortization if applicable (Assumption: There is no other transaction involving intangible assets except those mentioned in the Notes above). b) Prepare an extract of the Statement of Financial Position of Mice Lab Berhad as at 31 December 2016 (Assumption: There is no other transaction involving intangible assets except those mentioned in the Notes above).

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 3P

Related questions

Question

Please help me

Transcribed Image Text:A. The following is an extract of the Statement of Financial Position of Mice Lab Berhad as at 31

December 2019.

Intangible Assets

Note

Cost

Patent

120,000

Research and Development (i)

Сoрyright

License

(i)

()

96,000

90,000

Notes:

1. The patent is related to the anti-virus formula. It was acquired on 1 January 2019. The

patent is subsequently measured using cost model and amortized on a straight-line basis

over 6 years. On 31 Mac 2020, the management decided to sell the patent to Monkey tab

for RM150,500.

2. On 18 December 2019, Mice Lab was doing research to find formula for corona virus. The

company received an international grant of RM3,000,000. Since then, as at 31 May 2020,

none of the formulae was useful, the company had spent RM1,580,000. In June, the

technical teams developed a prototype named Gama Covid Vac. It was proven successful

to the mice. However, after some clinical trials to few infected patients, the government

raised issues on the security and health issues of the vaccine. The prototype cost

RM1,000,000 as at 31 December 2020. The company does not have sufficient grant to

proceed with the activity.

3. The copyright relates to a publication of a documentary on it one successful experiment. It

was acquired on 1 January 2015 with a cost of RM96,000. The copyright is subsequently

measured using the cost model and amortized on a straight-line basis over 10 years.

However, on 1 January 2020, the copyright is determined to have remaining useful life of

only 2 years.

4. The license is related to permission to extract mineral deposit at a government land as for

research purpose. It was acquired on 1 March 2017. The license is subsequently measured

using the revaluation model and amortized on a straight-line basis over 15 years. The

revaluation is to be performed every 3 years. On 31 December 2020, the fair value of the

license is identified to be RM35,000 only.

Required:

a) Prepare journal entries for the financial year ended 31 December 2020, induding journal

entries for amortization if applicable (Assumption: There is no other transaction involving

intangible assets except those mentioned in the Notes above).

b) Prepare an extract of the Statement of Financial Position of Mice Lab Berhad as at 31

December 2016 (Assumption: There is no other transaction involving intangible assets

except those mentioned in the Notes above).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning