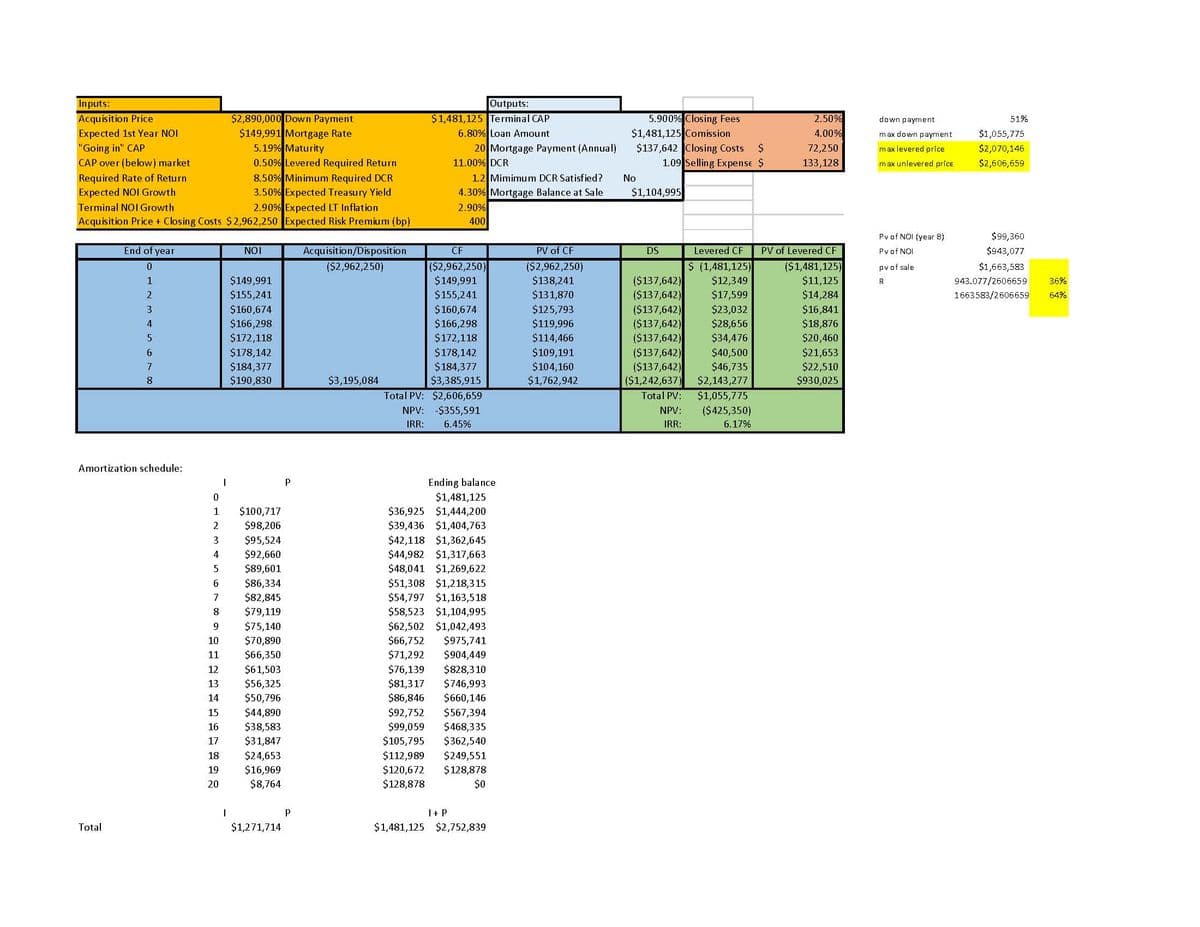

a. Using the information on the Excel sheet provided, Please thoroughly explain the steps on how to determine the expected levered-before-tax-annual rate of return on your capital. b. please determine the portion of the return that is expected from the annual cashflows and the portion that is expected as a result of property price appreciation.

a. Using the information on the Excel sheet provided, Please thoroughly explain the steps on how to determine the expected levered-before-tax-annual rate of return on your capital. b. please determine the portion of the return that is expected from the annual cashflows and the portion that is expected as a result of property price appreciation.

Chapter15: Harvesting The Business Venture Investment

Section: Chapter Questions

Problem 5EP

Related questions

Question

a. Using the information on the Excel sheet provided, Please thoroughly explain the steps on how to determine the expected levered-before-tax-annual

b. please determine the portion of the return that is expected from the annual cashflows and the portion that is expected as a result of property price appreciation.

Transcribed Image Text:Inputs:

Acquisition Price

Expected 1st Year NOI

"Going in" CAP

$2,890,000 Down Payment

$149,991 Mortgage Rate

5.19% Maturity

CAP over (below) market

0.50% Levered Required Return

Required Rate of Return

8.50% Minimum Required DCR

Expected NOI Growth

3.50% Expected Treasury Yield

Terminal NOI Growth

2.90% Expected LT Inflation.

Acquisition Price + Closing Costs $2,962,250 Expected Risk Premium (bp)

End of year

0

1

2

3

4

5

6

7

8

Amortization schedule:

Total

I

NOI

0

1

$100,717

2 $98,206

3

$95,524

4

$92,660

5 $89,601

6

7

8

19

20

$149,991

$155,241

$160,674

$166,298

$172,118

$178,142

$184,377

$190,830

9 $75,140

10

$70,890

11 $66,350

I

$86,334

$82,845

$79,119

12 $61,503

$56,325

13

14 $50,796

15

$44,890

16

$38,583

17 $31,847

18 $24,653

$16,969

$8,764

$1,271,714

P

P

Acquisition/Disposition

($2,962,250)

$3,195,084

Outputs:

$1,481,125 Terminal CAP

6.80% Loan Amount

20 Mortgage Payment (Annual)

11.00% DCR

1.2 Mimimum DCR Satisfied?

4.30% Mortgage Balance at Sale

2.90%

400

CF

($2,962,250)

$149,991

$155,241

$160,674

$166,298

$172,118

$178,142

$184,377

$3,385,915

Total PV: $2,606,659

NPV: -$355,591

IRR: 6.45%

Ending balance

$1,481,125

$36,925 $1,444,200

$39,436 $1,404,763

$42,118 $1,362,645

$44,982 $1,317,663

$48,041 $1,269,622

$51,308 $1,218,315

$54,797 $1,163,518

$58,523 $1,104,995

$62,502 $1,042,493

$66,752 $975,741

$71,292 $904,449

$76,139

$828,310

$81,317

$746,993

$86,846 $660,146

$567,394

$92,752

$99,059 $468,335

$105,795 $362,540

$112,989 $249,551

$120,672 $128,878

$128,878

$0

I + P

$1,481,125 $2,752,839

PV of CF

($2,962,250)

$138,241

$131,870

$125,793

$119,996

$114,466

$109,191

$104,160

$1,762,942

5.900% Closing Fees

$1,481,125 Comission

$137,642 Closing Costs $

1.09 Selling Expense $

No

$1,104,995

DS

($137,642)

($137,642)

Levered CF

$ (1,481,125)

$12,349

$17,599

$23,032

$28,656

$34,476

$40,500

$46,735

($137,642)

($137,642)

($137,642)

($137,642)

($137,642)

($1,242,637) $2,143,277

Total PV: $1,055,775

($425,350)

6.17%

NPV:

IRR:

2.50%

4.00%

72,250

133,128

PV of Levered CF

($1,481,125)

$11,125

$14,284

$16,841

$18,876

$20,460

$21,653

$22,510

$930,025

down payment

max down payment

max levered price

max unlevered price

Pv of NOI (year 8)

Pv of NOI

pv of sale

R

51%

$1,055,775

$2,070,146

$2,606,659

$99,360

$943,077

$1,663,583

943.077/2606659

1663583/2606659

36%

64%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning