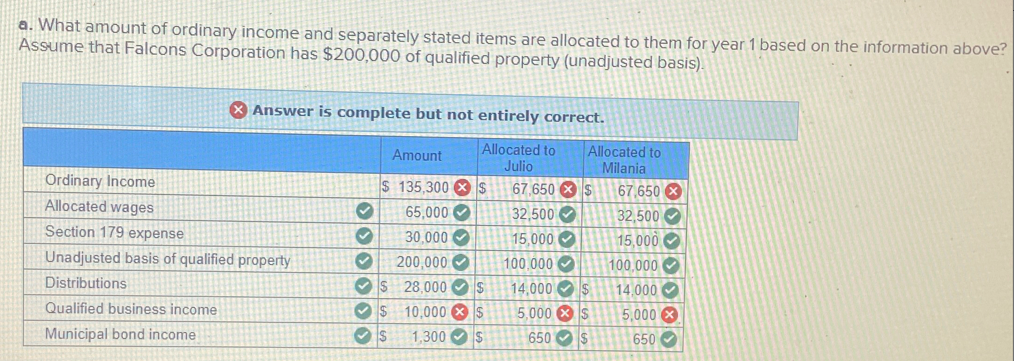

a. What amount of ordinary income and separately stated items are allocated to them for year 1 based on the information above? Assume that Falcons Corporation has $200,000 of qualified property (unadjusted basis). Answer is complete but not entirely correct. Ordinary Income Allocated wages Section 179 expense Unadjusted basis of qualified property Distributions Qualified business income Municipal bond income Amount Allocated to Julio Allocated to Milania $ 135,300 $ 67,650 $ 67,650 x 65,000 32,500 32,500 30,000 15,000 15,000 200,000 100,000 100,000 $ 28,000 $ 14,000 $ 14.000 $ 10,000 $ 5,000 $ 5,000 x $ 1,300 $ 650 $ 650

a. What amount of ordinary income and separately stated items are allocated to them for year 1 based on the information above? Assume that Falcons Corporation has $200,000 of qualified property (unadjusted basis). Answer is complete but not entirely correct. Ordinary Income Allocated wages Section 179 expense Unadjusted basis of qualified property Distributions Qualified business income Municipal bond income Amount Allocated to Julio Allocated to Milania $ 135,300 $ 67,650 $ 67,650 x 65,000 32,500 32,500 30,000 15,000 15,000 200,000 100,000 100,000 $ 28,000 $ 14,000 $ 14.000 $ 10,000 $ 5,000 $ 5,000 x $ 1,300 $ 650 $ 650

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter16: Multijurisdictional Taxation

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

Transcribed Image Text:a. What amount of ordinary income and separately stated items are allocated to them for year 1 based on the information above?

Assume that Falcons Corporation has $200,000 of qualified property (unadjusted basis).

Answer is complete but not entirely correct.

Ordinary Income

Allocated wages

Section 179 expense

Unadjusted basis of qualified property

Distributions

Qualified business income

Municipal bond income

Amount

Allocated to

Julio

Allocated to

Milania

$ 135,300 $

67,650 $

67,650 x

65,000

32,500

32,500

30,000

15,000

15,000

200,000

100,000

100,000

$ 28,000 $

14,000 $

14.000

$ 10,000

$

5,000 $

5,000 x

$

1,300

$

650

$

650

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you