a. What is the return for SBUX over the period without including its dividends? With the dividends? b. What is the return for GOOGL over the period? c. If you have 50% of your portfolio in SBUX and 50% in GOOGL, what was the return on your portfolio excluding dividends?

a. What is the return for SBUX over the period without including its dividends? With the dividends? b. What is the return for GOOGL over the period? c. If you have 50% of your portfolio in SBUX and 50% in GOOGL, what was the return on your portfolio excluding dividends?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter2: Risk And Return: Part I

Section: Chapter Questions

Problem 4P: An analyst has modeled the stock of a company using the Fama-French three-factor model. The market...

Related questions

Question

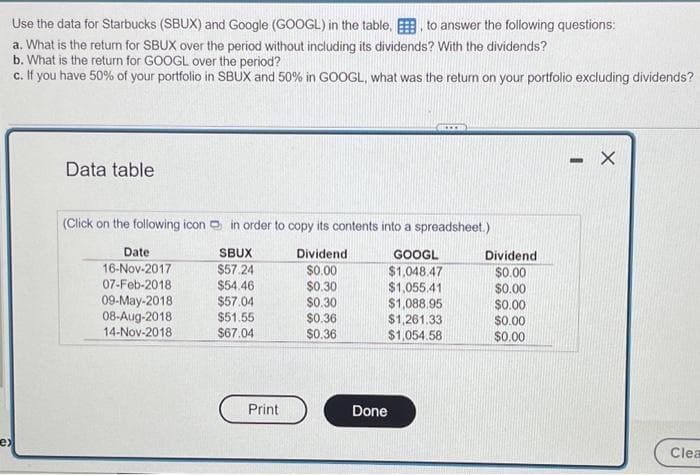

Transcribed Image Text:Use the data for Starbucks (SBUX) and Google (GOOGL) in the table, to answer the following questions:

a. What is the return for SBUX over the period without including its dividends? With the dividends?

b. What is the return for GOOGL over the period?

c. If you have 50% of your portfolio in SBUX and 50% in GOOGL, what was the return on your portfolio excluding dividends?

ex

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

SBUX

Dividend

GOOGL

$57.24

$0.00

$1,048.47

$54.46

$0.30

$1,055.41

$57.04

$0.30

$51.55

$0.36

$67.04

$0.36

Date

16-Nov-2017

07-Feb-2018

09-May-2018

08-Aug-2018

14-Nov-2018

Print

$1,088.95

$1,261.33

$1,054.58

Done

Dividend

$0.00

$0.00

$0.00

$0.00

$0.00

- X

Clea

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning