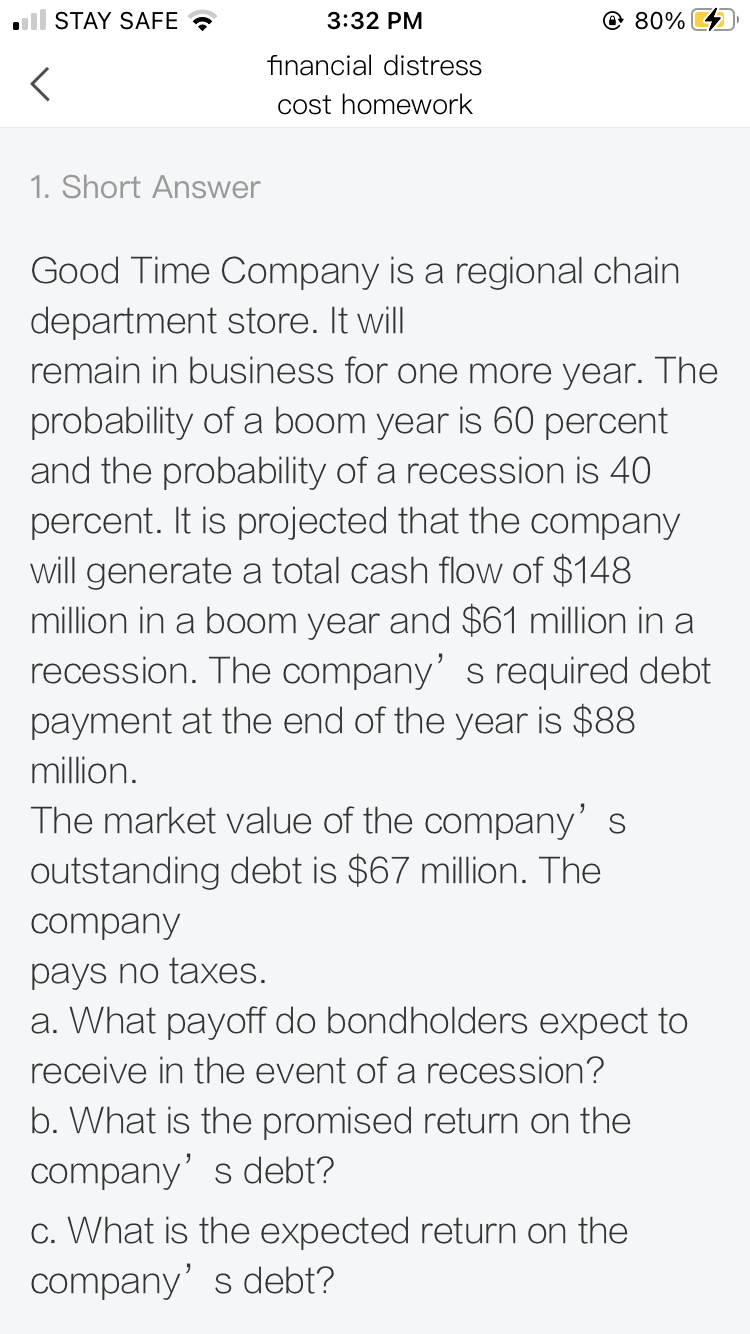

a. What payoff do bondholders expect to receive in the event of a recession? b. What is the promised return on the company' s debt? c. What is the expected return on the company' s debt?

Q: Which of the following is false? A) Interest expense reported in the income statement equals the…

A: Solution Concept Interest expense using effective interest method = market rate of interest…

Q: How does a firm's use of short-term debt as opposed to long-term debt subject the firm to a greater…

A: The given statement is that short-term debt leads to illiquidity as opposed to long-term debt. The…

Q: What are the total return, the current yield, and the capital gains yield for the discount bond?…

A: Total return of a discount bond is the difference between Maturity value and the issue price of the…

Q: Suppose company Z is already in financial distress and the equity holders are very close to default.…

A: The debt value and equity value of the company has increase or decrease as per the risk and the…

Q: Which of the following is true regarding a company assuming more debt? Select one: a. Assuming…

A: WHEN A COMPANY BORROWS MONEY TO BE PAID IN FUTURE WITH INTEREST IT IS KNOWN AS DEBT . MORE OF DEBT…

Q: In general, as a company increases the amount of short-term financing relative to long-term…

A: Explanation : An increase in the proportion of short-term financing will not affect a company’s…

Q: Question 1 Indicate whether each of the following actions will increase or decrease a bond’s yield…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: Is the debt level that maximizes a firm’s expected EPS the same as the debt level that maximizesits…

A: Capital structure refers to the securities or debt included in the total capital of the firm.…

Q: Tell whether the following statements describe the characteristics of stocks or bonds. e. Issues of…

A: Stocks are the shares held by owners of the companies. They represent part ownership in the…

Q: When borrowers tend to pay back the loans to bankers earlier, the bank is facing a. Repricing…

A: Repricing risk is associated with the the rate of changes in the interest rate charged. It occurs…

Q: Which of the following events would make it more likely that a company would choose to call its…

A: Callable Bonds: A callable bond, additionally recognized as a redeemable bond, is a bond that the…

Q: how do banks improve their net profit margin to increase Return on Equity?

A: Return on Equity (ROE) measures the company’s net income to the value of its total shareholders’…

Q: Which of the following statements is false? A. Banks have high levels of liquidity assets and…

A: Duration of bond measures the sensitivity of prices of bonds with change in interest rate in the…

Q: Would the yield spread on a corporate bond over a Treasury bond with the same maturitytend to become…

A: Answer: Yield spread is nothing but the disparity between the returns levels of two financial…

Q: The future earnings are likely to withstand an economic downturn,is situation of? A. defensive…

A: defensive companies and stock : Are the companies whose sales remain stable during both economic…

Q: it better to finance a company thru debt or thru equity? Why? What are the downside and upside to…

A: A business can raise funds predominantly either by Issuing Equity, or Borrowings Loans, Issuing…

Q: How is the market interest rate in the short-term and long-term financial market affected under the…

A: Introduction : In simple words, the pure expectation theory refers to the market finance theory…

Q: Which of the following would increase the likelihood that a company would increase its debt ratio,…

A: Cetris Perbius Means Other things remaining constant, if the company is considering to increase the…

Q: Why might it make sense for a mature, slow-growth company to have a high debt ratio

A: Mature, Slow-growth Company: These are companies established in the industry, having a strong…

Q: Identify the following as either an advantage (A) or a disadvantage (D) of bond financing for a…

A: Bond financing refers To the borrowing for the long term that is used by the state and local…

Q: Which of the following statements is correct?(a) The quickest way to determine whether the firmhas…

A: a) Time interest earned ratio is a ratio that is calculated that shows an indication about the…

Q: easier to calculate directly, the expected rate of return on the assets of a firm or the expected…

A: The return on assets states how profitable the assets of company are in generating the revenue. To…

Q: Why does the WACC decrease as a firm begins to take on debt and then increase after a certain point?

A: WACC: It is also known as Weighted Average Cost of Capital. It is the mixture of weighted cost of…

Q: What are pros and cons of raising money with debt? What is an alternative and why might some…

A: When a corporation generates funds by issuing debt instruments, this is known as debt financing.…

Q: Explain why corporate bonds’ default and liquidity premiums are likely to increasewith their…

A: solution: corporate bonds yield higher more than treasury bills due to their additional default and…

Q: Do bondholders fare better when the yeild to maturity increases or when it decreases? Why?

A: A bondholder refers to an investor or any owner of debt securities which large corporations or the…

Q: If a firm went from zero debt to successively higher levels of debt, why would you expect its stock…

A: Debt- It refers to the amount of money that is to be repaid by the borrower to the lender which is…

Q: Which of the following is a disadvantage of long-term debt as a means of company financing? Group…

A: Funds are very important and necessary for smooth running of a business organization. A business has…

Q: An economy is making a rapid recovery from steep recession, and businesses foresee a need for large…

A: The question is based on the concept of demand curve and need of investment. The price of product…

Q: What effect will disinflation following a highly inflationary period have on the reported income of…

A: Disinflation is the reduction or lowering of the pace of inflation. In other words, in situation of…

Q: Identify the following as either an advantage (A) or a disadvantage (D) of bond financing for a…

A:

Q: The time value of money is used in calculating bond prices because: Group of answer choices A - The…

A: The time value of money is helpful in calculating the present value of future payments. So the…

Q: Which of the following trends can be unfavorable from the viewpoint of a bondholder? a. The issuing…

A: Bonds refer to the borrowing security that is issued by the company to raise finds from the market…

Q: Identify the following as either an advantage (A) or a disadvantage (D) of bond financing for a…

A: Definition: Long-term debt: Long-term debt refers to the obligations of a firm that are due and has…

Q: What are the risk implications/shortcomings of financial institutions in increasing their financial…

A: Financial leverage is defined as the use of the debt for acquiring an additional assets. Usage of…

Q: The price-earnings ratio of a company tells how the company determines the price of common stock…

A: "Since you have posted multiple questions, we have solved the first question for you. To get it…

Q: What is WACC? Why do firms compute it? What happens to WACC when the debt level of a firm changes?

A: WACC is the weighted average cost of capital. It is the average cost of raising capital both equity…

Q: Which of the following events would make it more likely that a company would choose to call its…

A: Callable Bonds are the bonds that are issued with a privilege of redeeming early before expiry. A…

Q: Why do analysts need to consider different factors when evaluating a company’s ability to repay…

A: Short-term debt or current liabilities refers to the company's financial obligations to the…

Q: does the WACC decrease as a com

A: Introduction : In simple words, Weighted average cost of capital or WACC is the sum of the cost of…

Q: (1) Why do analysts need to consider different factorswhen evaluating a company’s ability to repay…

A: Disclaimer: “Since you have asked multiple question, we will solve the first question for you. If…

Q: Assume that inflation is expected to rise soon. How could this affect future bond prices? Would you…

A: Inflation affects bond’s interest rate and interest rate in turns affect the bond prices. There is…

Trending now

This is a popular solution!

Step by step

Solved in 8 steps

- Relaxing Collection Efforts The Boyd Corporation has annual credit sales of 1.6 million. Current expenses for the collection department are 35,000, bad-debt losses are 1.5%, and the days sales outstanding is 30 days. The firm is considering easing its collection efforts such that collection expenses will be reduced to 22,000 per year. The change is expected to increase bad-debt losses to 2.5% and to increase the days sales outstanding to 45 days. In addition, sales are expected to increase to 1,625,000 per year. Should the firm relax collection efforts if the opportunity cost of funds is 16%, the variable cost ratio is 75%, and taxes are 40%?Fast pls solve this question correctly in 5 min pls I will give u like for sure Surbh Assume the firm has a constant dividend payout ratio and a projected sales increase of 10 percent. All costs, assets, and current liabilities vary directly with sales. The firm is currently at full production. What is the external financing need? Currently, the firm’s sales =$5,700, net income is $520, total assets=8890, dividends=156, A/P =990, LTD= 3730, and common stock=2980, and retained earnings =1200. $146.00 $251.20 $379.60 $421.60 $550.30H3. please show proper step by step calculation Good Time Company is a regional chain department store. It will remain in business for one more year. The probability of a boom year is 60 percent and the probability of a recession is 40 percent. It is projected that the company will generate a total cash flow of $193 million in a boom year and $84 million in a recession. The company's required debt payment at the end of the year is $118 million. The market value of the company’s outstanding debt is $91 million. The company pays no taxes. a. What payoff do bondholders expect to receive in the event of a recession? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) b. What is the promised return on the company's debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the expected return on the…

- Which one is correct answer please confirm? QUESTION 39 Getrag expects its sales to increase 20% next year from its current level of $4.7 million. Getrag has current assets of $660,000, net fixed assets of $1.5 million, and current liabilities of $462,000. All assets are expected to grow proportionately with sales. If Getrag has a net profit margin of 10%, what additional financing will be needed to support the increase in sales? Getrag does not pay dividends. a. $339,600 b. No financing needed, surplus of $224,400 c. No financing needed, surplus of $524,400 d. $283,200which one is correct please confirm? QUESTION 35 CU Tech expects sales next year will be $4.8 million, a 25% increase over current sales. CU has total assets of $2.24 million, and all assets will increase proportionately with sales. CU has $1.49 million in current liabilities and a current ratio of 1.60 to 1. What total financing will CU need to support the expected sales increase? a. $234,400 b. No financing needed, surplus of $139,700 c. $48,800 d. $187,500Wal-Mart plans to open a new store near Campus. Wal-Mart is going to finance via bond market and stock market. Total capital required is 10 million dollars. 3 million dollars are going to be financed via stock market. Wal-Mart’s beta is 0.70. Three month Treasury Bill rate is 2% (risk free rate) and the S&P500 index return is 8% (market return). How much is the cost of equity to Wal-Mart stockholders? 2% 5% 2% 1%

- which one is correct please suggest? QUESTION 39 Getrag expects its sales to increase 20% next year from its current level of $4.7 million. Getrag has current assets of $660,000, net fixed assets of $1.5 million, and current liabilities of $462,000. All assets are expected to grow proportionately with sales. If Getrag has a net profit margin of 10%, what additional financing will be needed to support the increase in sales? Getrag does not pay dividends. a. $339,600 b. No financing needed, surplus of $224,400 c. No financing needed, surplus of $524,400 d. $283,200Only need answers for parts d) and e). Please include calculations. XYZ company has the following expected cash flows for three scenarios that could occur: Recession Expected Expansion (prob. = .2) (prob. = .5) (prob. =.3) EBIT $10,000 $20,000 $30,000 MV Assets ______ (a) Complete the table above if the company is 100% equity financed, it pays taxes at 30%, the non-levered return on equity is expected to be 12%, the constant growth rate (g) is 5%, and overall firm value is calculated based on the expected after-tax cash flows (b) If the company wants to recapitalize (debt for equity swap) to save on taxes, what is the most debt the company can add (at a 6% rate) so that it will never go bankrupt under the above scenarios? (Assume the company goes bankrupt if EBIT < Interest owed) (c) Calculate the WACC for the unlevered case and for the…Consider a firm with a 2010 revenue of S60 million and cost of goods sold of $25 million lf the balance shert amount show $4million of inventory and $1.5 million ofproperty, plant & equipment how many weeks of suppiy does the fim bolat(2 weeksinoneyear)(use 2 decimals)Select oneO a.8.33O b.6.25Oc 13.75O d. 400Oe 12.50

- What amount of cash must be invested today in order to have $60,000 at the end of one year assuming the rate of return is 9%? (Do not round your PV factors.)A. $54,600.00B. $45,454.56 C. $55,045.88 D. $54,000.00Q1: Aztec Products wishes to evaluate its cash conversion cycle (CCC). Research by one of the firm’s financial analysts indicates that on average the firm holds items in inventory for 65 days, pays its suppliers 35 days after purchase, and collects its receivables after 55 days. The firm’s annual sales (all on credit) are about $2.1 billion, its cost of goods sold represent about 67 percent of sales, and purchases represent about 40 percent of cost of goods sold. Assume a 365-day year. A) How many dollars of resources does Aztec have invested in (1) inventory, (2) accounts receivable, (3) accounts payable, and (4) the total CCC? B). If Aztec could shorten its cash conversion cycle by reducing its inventory holding period by 5 days, what effect would it have on its total resource investment found in part A?Q1: Aztec Products wishes to evaluate its cash conversion cycle (CCC). Research by one of the firm’s financial analysts indicates that on average the firm holds items in inventory for 65 days, pays its suppliers 35 days after purchase, and collects its receivables after 55 days. The firm’s annual sales (all on credit) are about $2.1 billion, its cost of goods sold represent about 67 percent of sales, and purchases represent about 40 percent of cost of goods sold. Assume a 365-day year. a) If Dean Muhammad Suppliers receive an invoice for purchases dated 12/12/2002 subject to credit terms of "2/10, net 30", what is the last possible day the discount can be taken? January 11 January 22 January 30 December 22