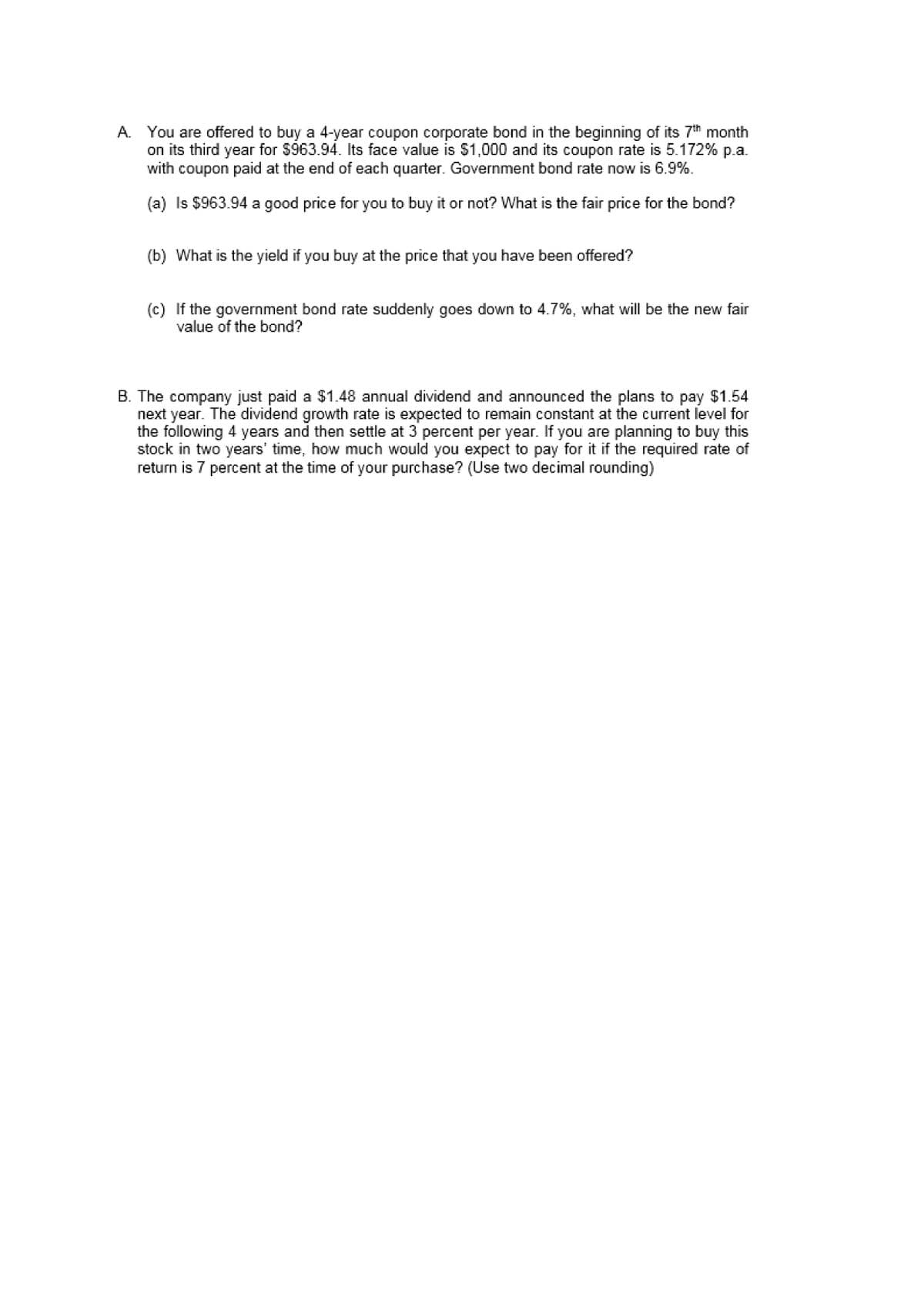

A. You are offered to buy a 4-year coupon corporate bond in the beginning of its 7th month on its third year for $963.94. Its face value is $1,000 and its coupon rate is 5.172% p.a. with coupon paid at the end of each quarter. Government bond rate now is 6.9%. (a) Is $963.94 a good price for you to buy it or not? What is the fair price for the bond? (b) What is the yield if you buy at the price that you have been offered? (c) If the government bond rate suddenly goes down to 4.7%, what will be the new fair value of the bond?

A. You are offered to buy a 4-year coupon corporate bond in the beginning of its 7th month on its third year for $963.94. Its face value is $1,000 and its coupon rate is 5.172% p.a. with coupon paid at the end of each quarter. Government bond rate now is 6.9%. (a) Is $963.94 a good price for you to buy it or not? What is the fair price for the bond? (b) What is the yield if you buy at the price that you have been offered? (c) If the government bond rate suddenly goes down to 4.7%, what will be the new fair value of the bond?

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 16P

Related questions

Question

Transcribed Image Text:A. You are offered to buy a 4-year coupon corporate bond in the beginning of its 7th month

on its third year for $963.94. Its face value is $1,000 and its coupon rate is 5.172% p.a.

with coupon paid at the end of each quarter. Government bond rate now is 6.9%.

(a) Is $963.94 a good price for you to buy it or not? What is the fair price for the bond?

(b) What is the yield if you buy at the price that you have been offered?

(c) If the government bond rate suddenly goes down to 4.7%, what will be the new fair

value of the bond?

B. The company just paid a $1.48 annual dividend and announced the plans to pay $1.54

next year. The dividend growth rate is expected to remain constant at the current level for

the following 4 years and then settle at 3 percent per year. If you are planning to buy this

stock in two years' time, how much would you expect to pay for it if the required rate of

return is 7 percent at the time of your purchase? (Use two decimal rounding)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning