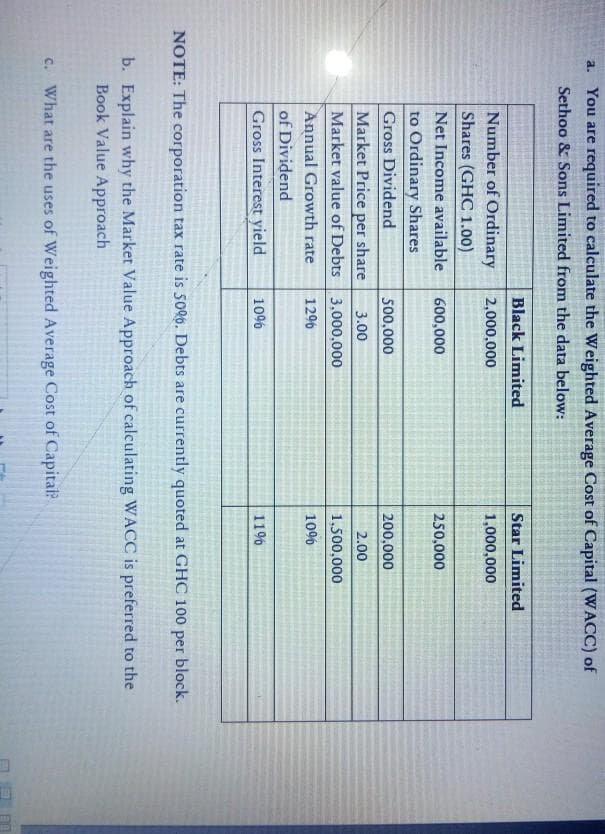

a. You are required to calculate the Weighted Average Cost of Capital (WACC) of Sethoo & Sons Limited from the data below: Black Limited Star Limited Number of Ordinary 2,000,000 1,000,000 Shares (GHC 1.00) Net Income available 600,000 250,000 to Ordinary Shares Gross Dividend 500,000 200,000 Market Price per share 3.00 2.00 Market value of Debts 3.000,000 1,500,000 Annual Growth rate 1296 1096 of Dividend Gross Interest yield 1096 1196 NOTE: The corporation tax rate is 50%6. Debts are currently quoted at GHC 100 per block. b. Explain why the Market Value Approach of calculating WACC is preferred to the Book Value Approach c. What are the uses of Weighted Average Cost of Capital?

a. You are required to calculate the Weighted Average Cost of Capital (WACC) of Sethoo & Sons Limited from the data below: Black Limited Star Limited Number of Ordinary 2,000,000 1,000,000 Shares (GHC 1.00) Net Income available 600,000 250,000 to Ordinary Shares Gross Dividend 500,000 200,000 Market Price per share 3.00 2.00 Market value of Debts 3.000,000 1,500,000 Annual Growth rate 1296 1096 of Dividend Gross Interest yield 1096 1196 NOTE: The corporation tax rate is 50%6. Debts are currently quoted at GHC 100 per block. b. Explain why the Market Value Approach of calculating WACC is preferred to the Book Value Approach c. What are the uses of Weighted Average Cost of Capital?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter15: Distributions To Shareholders: Dividends And Repurchases

Section: Chapter Questions

Problem 6MC: Suppose IWT has decided to distribute $50 million, which it presently is holding in liquid...

Related questions

Question

Transcribed Image Text:a. You are required to calculate the Weighted Average Cost of Capital (WACC) of

Sethoo & Sons Limited from the data below:

Black Limited

Star Limited

Number of Ordinary

Shares (GHC 1.00)

2,000,000

1,000,000

Net Income available

600,000

250,000

to Ordinary Shares

Gross Dividend

500,000

200,000

Market Price per share

Market value of Debts 3,000,000

Annual Growth rate

3.00

2.00

1,500,000

1296

10%

of Dividend

Gross Interest yield

10%

119%

NOTE: The corporation tax rate is 506. Debts are currently quoted at GHC 100 per block.

b. Explain why the Market Value Approach of calculating WACC is preferred to the

Book Value Approach

c. What are the uses of Weighted Average Cost of Capital?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning