A. Your employer is offering you stock options on the firm as part of your pay package. You know the following about this offer: $23 $28 | Current Stock Price Exercise Price | Maturity (yrs) Risk-free Rate | Stock Volatility 2.25% 23% What is the value of the option? Suppose the Fed reduces Treasury rates to 2.0%, what is the new price of the option? After the rate reduction, your company's share price rises to $25, what is the new price of the option?

A. Your employer is offering you stock options on the firm as part of your pay package. You know the following about this offer: $23 $28 | Current Stock Price Exercise Price | Maturity (yrs) Risk-free Rate | Stock Volatility 2.25% 23% What is the value of the option? Suppose the Fed reduces Treasury rates to 2.0%, what is the new price of the option? After the rate reduction, your company's share price rises to $25, what is the new price of the option?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter5: Financial Options

Section: Chapter Questions

Problem 4MC

Related questions

Question

I need Just Part A Solution

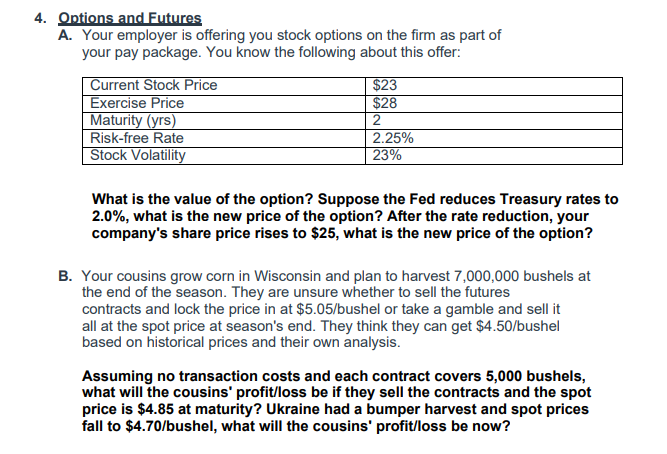

Transcribed Image Text:4. Options and Futures

A. Your employer is offering you stock options on the firm as part of

your pay package. You know the following about this offer:

Current Stock Price

Exercise Price

Maturity (yrs)

Risk-free Rate

Stock Volatility

$23

$28

2

2.25%

23%

What is the value of the option? Suppose the Fed reduces Treasury rates to

2.0%, what is the new price of the option? After the rate reduction, your

company's share price rises to $25, what is the new price of the option?

B. Your cousins grow corn in Wisconsin and plan to harvest 7,000,000 bushels at

the end of the season. They are unsure whether to sell the futures

contracts and lock the price in at $5.05/bushel or take a gamble and sell it

all at the spot price at season's end. They think they can get $4.50/bushel

based on historical prices and their own analysis.

Assuming no transaction costs and each contract covers 5,000 bushels,

what will the cousins' profit/loss be if they sell the contracts and the spot

price is $4.85 at maturity? Ukraine had a bumper harvest and spot prices

fall to $4.70/bushel, what will the cousins' profit/loss be now?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT