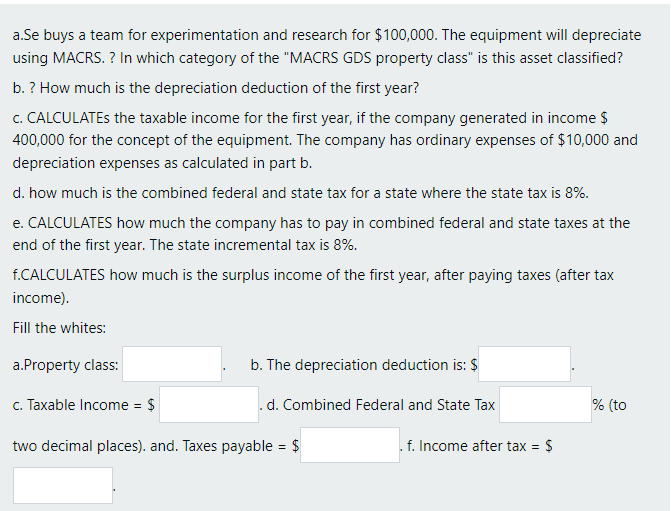

a.Se buys a team for experimentation and research for $100,000. The equipment will depreciate using MACRS. ? In which category of the "MACRS GDS property class" is this asset classified? b. ? How much is the depreciation deduction of the first year? c. CALCULATES the taxable income for the first year, if the company generated in income $ 400,000 for the concept of the equipment. The company has ordinary expenses of $10,000 and depreciation expenses as calculated in part b.

a.Se buys a team for experimentation and research for $100,000. The equipment will depreciate using MACRS. ? In which category of the "MACRS GDS property class" is this asset classified? b. ? How much is the depreciation deduction of the first year? c. CALCULATES the taxable income for the first year, if the company generated in income $ 400,000 for the concept of the equipment. The company has ordinary expenses of $10,000 and depreciation expenses as calculated in part b.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 5RE: Turnip Company purchased an asset at a cost of 10,000 with a 10-year life during the current year....

Related questions

Question

7

Transcribed Image Text:a.Se buys a team for experimentation and research for $100,000. The equipment will depreciate

using MACRS. ? In which category of the "MACRS GDS property class" is this asset classified?

b. ? How much is the depreciation deduction of the first year?

c. CALCULATES the taxable income for the first year, if the company generated in income $

400,000 for the concept of the equipment. The company has ordinary expenses of $10,000 and

depreciation expenses as calculated in part b.

d. how much is the combined federal and state tax for a state where the state tax is 8%.

e. CALCULATES how much the company has to pay in combined federal and state taxes at the

end of the first year. The state incremental tax is 8%.

f.CALCULATES how much is the surplus income of the first year, after paying taxes (after tax

income).

Fill the whites:

a.Property class:

b. The depreciation deduction is: $

c. Taxable Income = $

. d. Combined Federal and State Tax

% (to

two decimal places). and. Taxes payable = $

. f. Income after tax = $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College