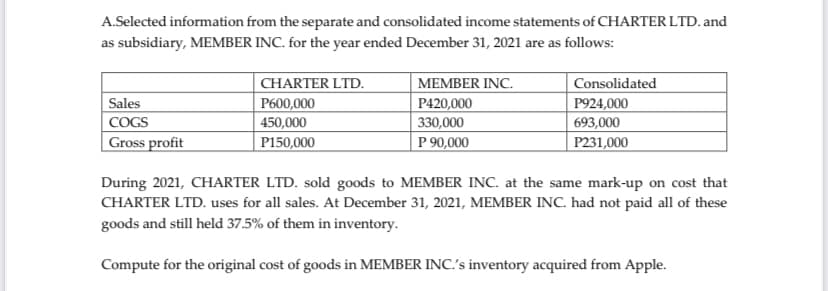

A.Selected information from the separate and consolidated income statements of CHARTER LTD. and as subsidiary, MEMBER INC. for the year ended December 31, 2021 are as follows: Sales COGS Gross profit CHARTER LTD. P600,000 450,000 P150,000 MEMBER INC. P420,000 330,000 P 90,000 |Consolidated P924,000 693,000 P231,000 During 2021, CHARTER LTD. sold goods to MEMBER INC. at the same mark-up on cost that CHARTER LTD. uses for all sales. At December 31, 2021, MEMBER INC. had not paid all of these goods and still held 37.5% of them in inventory. Compute for the original cost of goods in MEMBER INC.'s inventory acquired from Apple.

A.Selected information from the separate and consolidated income statements of CHARTER LTD. and as subsidiary, MEMBER INC. for the year ended December 31, 2021 are as follows: Sales COGS Gross profit CHARTER LTD. P600,000 450,000 P150,000 MEMBER INC. P420,000 330,000 P 90,000 |Consolidated P924,000 693,000 P231,000 During 2021, CHARTER LTD. sold goods to MEMBER INC. at the same mark-up on cost that CHARTER LTD. uses for all sales. At December 31, 2021, MEMBER INC. had not paid all of these goods and still held 37.5% of them in inventory. Compute for the original cost of goods in MEMBER INC.'s inventory acquired from Apple.

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 5P: Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of...

Related questions

Question

Transcribed Image Text:A.Selected information from the separate and consolidated income statements of CHARTER LTD. and

as subsidiary, MEMBER INC. for the year ended December 31, 2021 are as follows:

|CHARTER LTD.

P600,000

Consolidated

P924,000

693,000

MEMBER INC.

Sales

P420,000

330,000

P 90,000

COGS

450,000

| Gross profit

P150,000

P231,000

During 2021, CHARTER LTD. sold goods to MEMBER INC. at the same mark-up on cost that

CHARTER LTD. uses for all sales. At December 31, 2021, MEMBER INC. had not paid all of these

goods and still held 37.5% of them in inventory.

Compute for the original cost of goods in MEMBER INC.'s inventory acquired from Apple.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning