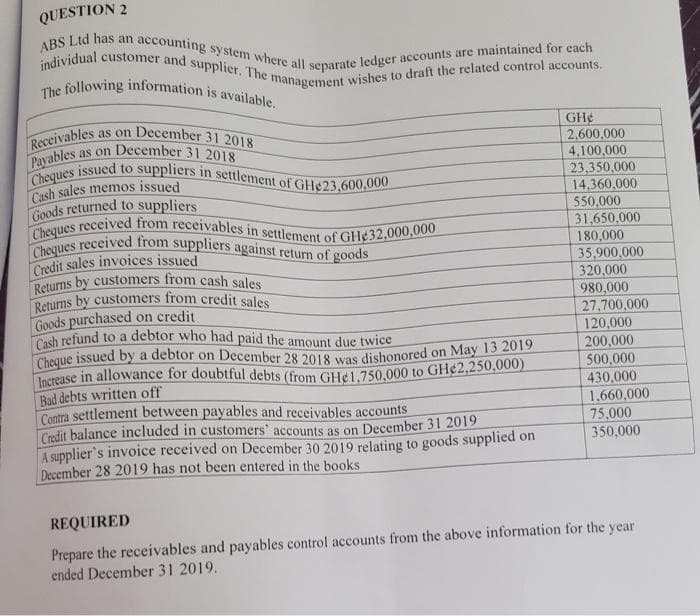

aaccounting system where all separate ledger accounts are maintained for each ABS Ltd has an individual customer and supplier. The management wishes to draft the related control accounts. The following information is available. Receivables Payables Cheques issued to suppliers in settlement of GH¢23,600,000 as on December 31 2018 as on December 31 2018 GH¢ 2,600,000 4.100,000 23,350,000 14,360,000 550,000 31,650,000 180,000 35,900,000 320,000 980,000 27,700,000 120,000 200,000 500,000 430,000 1,660,000 75,000 350,000 Cash sales memos issued Goods returned to suppliers Cheques received from receivables in settlement of GH¢32,000,000 Cheques received from suppliers against return of goods Credit sales invoices issued Returns by customers from cash sales Returns by customers from credit sales Goods purchased on credit Cash refund to a debtor who had paid the amount due twice Cheque issued by a debtor on December 28 2018 was dishonored on May 13 2019 Increase in allowance for doubtful debts (from GHé1.750,000 to GH¢2,250,000). Bad debts written off Contra settlement between payables and receivables accounts Crodit balance included in customers' accounts as on December 31 2019. A supplier's invoice received on December 30 2019 relating to goods supplied on December 28 2019 has not been entered in the books REQUIRED Prepare the receivables and payables control accounts from the above information for the year ended December 31 2019.

aaccounting system where all separate ledger accounts are maintained for each ABS Ltd has an individual customer and supplier. The management wishes to draft the related control accounts. The following information is available. Receivables Payables Cheques issued to suppliers in settlement of GH¢23,600,000 as on December 31 2018 as on December 31 2018 GH¢ 2,600,000 4.100,000 23,350,000 14,360,000 550,000 31,650,000 180,000 35,900,000 320,000 980,000 27,700,000 120,000 200,000 500,000 430,000 1,660,000 75,000 350,000 Cash sales memos issued Goods returned to suppliers Cheques received from receivables in settlement of GH¢32,000,000 Cheques received from suppliers against return of goods Credit sales invoices issued Returns by customers from cash sales Returns by customers from credit sales Goods purchased on credit Cash refund to a debtor who had paid the amount due twice Cheque issued by a debtor on December 28 2018 was dishonored on May 13 2019 Increase in allowance for doubtful debts (from GHé1.750,000 to GH¢2,250,000). Bad debts written off Contra settlement between payables and receivables accounts Crodit balance included in customers' accounts as on December 31 2019. A supplier's invoice received on December 30 2019 relating to goods supplied on December 28 2019 has not been entered in the books REQUIRED Prepare the receivables and payables control accounts from the above information for the year ended December 31 2019.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 6P

Related questions

Question

Transcribed Image Text:individual customer and supplier. The management wishes to draft the related control accounts.

Increase in allowance for doubtful debts (from GH¢1,750,000 to GH¢2,250,000)

The following information is available.

Receivables as on December 31 2018

Payables as on December 31 2018

accounting system where all separate ledger accounts are maintained for each

Returns by customers from cash sales

Returns by customers from credit sales

Cash refund to a debtor who had paid the amount due twice

Cheques received from suppliers against return of goods

Cheques received from receivables in settlement of GH¢32,000,000

Cheques issued to suppliers in settlement of GH¢23,600,000

QUESTION 2

ABS Ltd has an

GH¢

2,600,000

4.100,000

23,350,000

14,360,000

550,000

31,650,000

180,000

35,900,000

320,000

980,000

27.700,000

120,000

Cash sales memos issued

Goods returned to suppliers

Credit sales invoices issued

Goods purchased on credit

200,000

500,000

Bad debts written off

Contra settlement between payables and receivables accounts

Credit balance included in customers' accounts as on December 31 2019

A supplier's invoice received on December 30 2019 relating to goods supplied on

December 28 2019 has not been entered in the books

430,000

1,660,000

75,000

350,000

REQUIRED

Prepare the receivables and payables control accounts from the above information for the year

ended December 31 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning