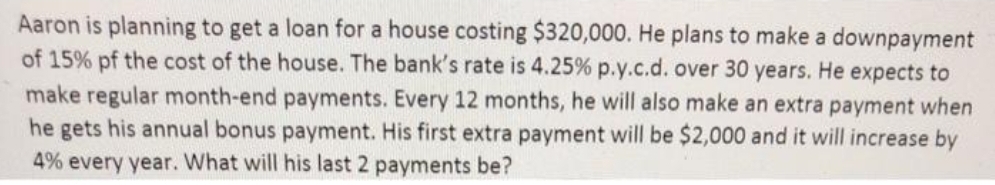

Aaron is planning to get a loan for a house costing $320,000. He plans to make a downpayment of 15% pf the cost of the house. The bank's rate is 4.25% p.y.c.d. over 30 years. He expects to make regular month-end payments. Every 12 months, he will also make an extra payment when he gets his annual bonus payment. His first extra payment will be $2,000 and it will increase by 4% every year. What will his last 2 payments be?

Aaron is planning to get a loan for a house costing $320,000. He plans to make a downpayment of 15% pf the cost of the house. The bank's rate is 4.25% p.y.c.d. over 30 years. He expects to make regular month-end payments. Every 12 months, he will also make an extra payment when he gets his annual bonus payment. His first extra payment will be $2,000 and it will increase by 4% every year. What will his last 2 payments be?

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 25PROB

Related questions

Question

Transcribed Image Text:Aaron is planning to get a loan for a house costing $320,000. He plans to make a downpayment

of 15% pf the cost of the house. The bank's rate is 4.25% p.y.c.d. over 30 years. He expects to

make regular month-end payments. Every 12 months, he will also make an extra payment when

he gets his annual bonus payment. His first extra payment will be $2,000 and it will increase by

4% every year. What will his last 2 payments be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT