AASB 102 Inventories specifies that the measurement rule for inventories is: higher of initial cost and realisable value. O higher of production costs and selling price. O lower of fair value and selling price. lower of cost and net realisable value.

AASB 102 Inventories specifies that the measurement rule for inventories is: higher of initial cost and realisable value. O higher of production costs and selling price. O lower of fair value and selling price. lower of cost and net realisable value.

Accounting Information Systems

11th Edition

ISBN:9781337552127

Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Chapter16: The General Ledger And Business Reporting (gl/br) Process

Section: Chapter Questions

Problem 4DQ

Related questions

Question

i need the answer quickly

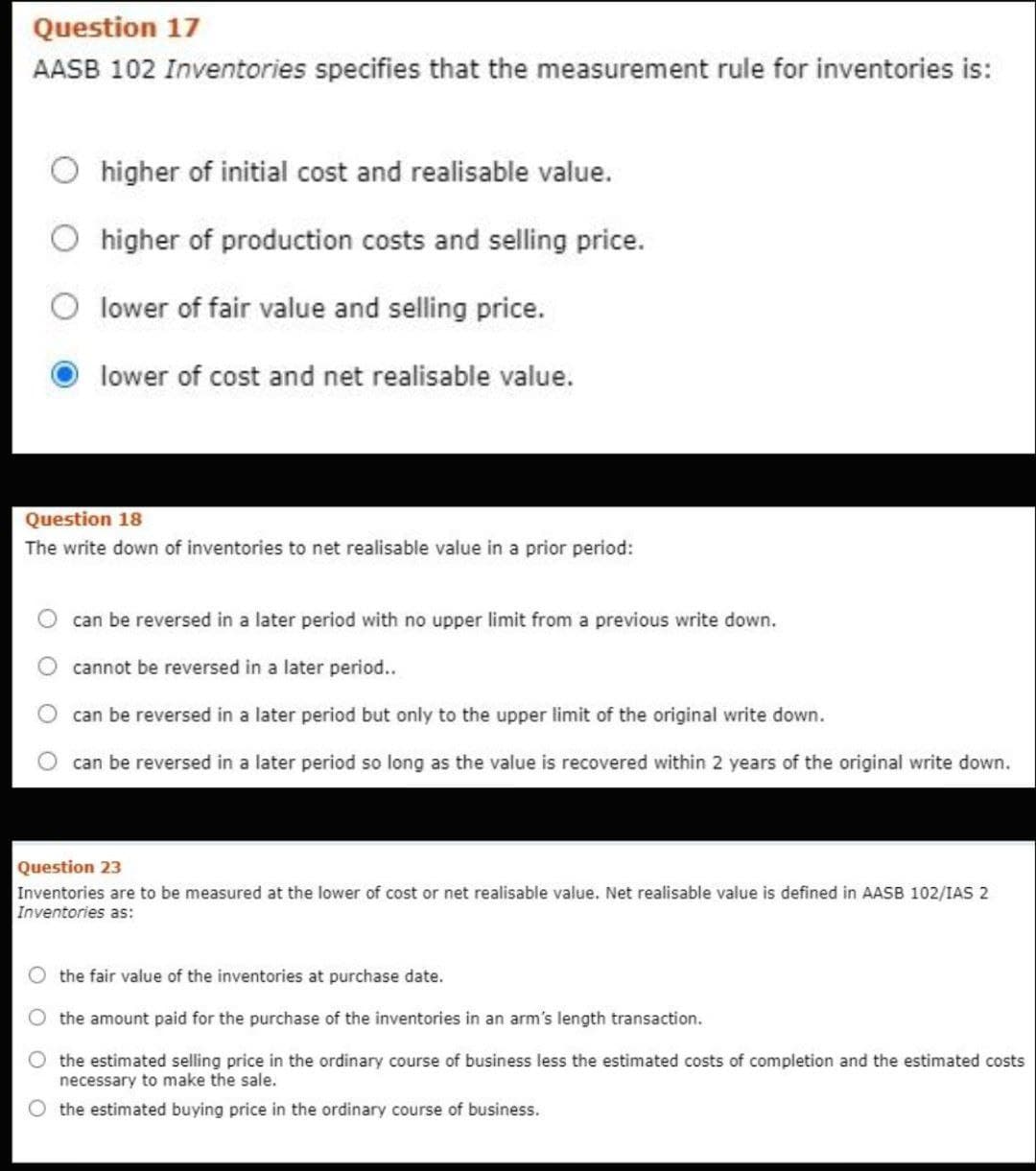

Transcribed Image Text:Question 17

AASB 102 Inventories specifies that the measurement rule for inventories is:

higher of initial cost and realisable value.

higher of production costs and selling price.

lower of fair value and selling price.

lower of cost and net realisable value.

Question 18

The write down of inventories to net realisable value in a prior period:

can be reversed in a later period with no upper limit from a previous write down.

cannot be reversed in a later period..

can be reversed in a later period but only to the upper limit of the original write down.

can be reversed in a later period so long as the value is recovered within 2 years of the original write down.

Question 23

Inventories are to be measured at the lower of cost or net realisable value. Net realisable value is defined in AASB 102/IAS 2

Inventories as:

the fair value of the inventories at purchase date.

the amount paid for the purchase of the inventories in an arm's length transaction.

the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs

necessary to make the sale.

O the estimated buying price in the ordinary course of business.

O O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning