According to money.CNN.com, with mortgage rates near 35-year lows, you may be able to cut your payments sharply by refinancing your loan. To qualify for the best rates, you need a credit score of 740 or higher and usually at least 20% equity. Even if you have to settle for a higher rate, a new loan may save you money. The main consideration is whether you will live in your home long enough to offset the refinance closing costs. Your current mortgage payment is $1,658.50 per month, with a balance of $219,800. Suppose you have a chance to refinance at a certain bank with a 30-year, 5.5% mortgage. The closing costs of the loan are application fee, $80; credit report, $165; title insurance, 0.4% of the amount financed; title search, $360; and attorney's fees, $560. You plan to live in your home for at least four more years. Use the Mortgage Refinancing Worksheet to see if it makes sense to refinance your mortgage. Using this table, what is your new monthly mortgage payment (in $) if you decide to refinance? (Round your answer to the nearest cent.)

According to money.CNN.com, with mortgage rates near 35-year lows, you may be able to cut your payments sharply by refinancing your loan. To qualify for the best rates, you need a credit score of 740 or higher and usually at least 20% equity. Even if you have to settle for a higher rate, a new loan may save you money. The main consideration is whether you will live in your home long enough to offset the refinance closing costs. Your current mortgage payment is $1,658.50 per month, with a balance of $219,800. Suppose you have a chance to refinance at a certain bank with a 30-year, 5.5% mortgage. The closing costs of the loan are application fee, $80; credit report, $165; title insurance, 0.4% of the amount financed; title search, $360; and attorney's fees, $560. You plan to live in your home for at least four more years. Use the Mortgage Refinancing Worksheet to see if it makes sense to refinance your mortgage. Using this table, what is your new monthly mortgage payment (in $) if you decide to refinance? (Round your answer to the nearest cent.)

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 16Q: Jain Enterprises honors a short-term note payable. Principal on the note is $425,000, with an annual...

Related questions

Question

According to money.CNN.com, with mortgage rates near 35-year lows, you may be able to cut your payments sharply by refinancing your loan. To qualify for the best rates, you need a credit score of 740 or higher and usually at least 20% equity.

Even if you have to settle for a higher rate, a new loan may save you money. The main consideration is whether you will live in your home long enough to offset the refinance closing costs.

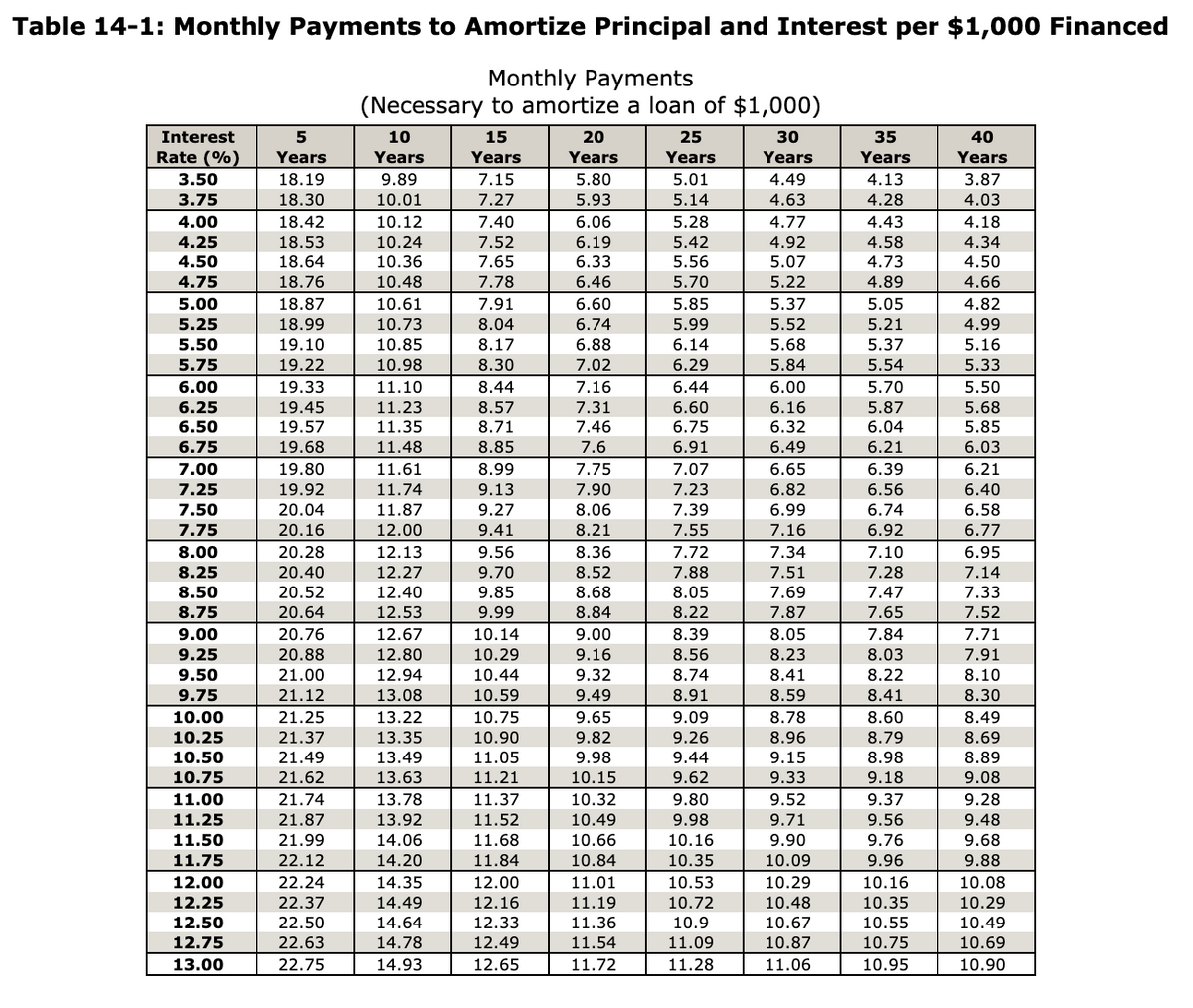

Your current mortgage payment is $1,658.50 per month, with a balance of $219,800. Suppose you have a chance to refinance at a certain bank with a 30-year, 5.5% mortgage. The closing costs of the loan are application fee, $80; credit report, $165; title insurance, 0.4% of the amount financed; title search, $360; and attorney's fees, $560.

You plan to live in your home for at least four more years. Use the Mortgage Refinancing Worksheet to see if it makes sense to refinance your mortgage.

Using this table, what is your new monthly mortgage payment (in $) if you decide to refinance? (Round your answer to the nearest cent.)

$

(c)

What is your monthly savings (in $) if you decide to refinance? (Round your answer to the nearest cent.)

$

(d)

Calculate the total refinance closing cost (in $). (Round your answer to the nearest cent.)

$

Transcribed Image Text:Table 14-1: Monthly Payments to Amortize Principal and Interest per $1,000 Financed

Monthly Payments

(Necessary to amortize a loan of $1,000)

Interest

5

10

15

20

25

30

35

40

Rate (%)

Years

Years

Years

Years

Years

Years

Years

Years

3.50

18.19

9.89

7.15

5.80

5.01

4.49

4.13

3.87

3.75

18.30

10.01

7.27

5.93

5.14

4.63

4.28

4.03

6.06

6.19

4.77

4.00

4.25

5.28

5.42

18.42

10.12

7.40

7.52

4.43

4.58

4.18

18.53

10.24

4.92

4.34

4.50

18.64

10.36

7.65

6.33

5.56

5.07

4.73

4.50

4.75

18.76

10.48

7.78

6.46

5.70

5.22

4.89

4.66

5.00

18.87

10.61

7.91

6.60

5.85

5.37

5.05

4.82

8.04

8.17

5.25

18.99

10.73

6.74

5.99

5.52

5.21

4.99

5.50

19.10

10.85

6.88

6.14

5.68

5.37

5.16

5.75

19.22

10.98

8.30

7.02

6.29

5.84

5.54

5.33

6.00

19.33

11.10

8.44

7.16

6.44

6.00

5.70

5.50

6.25

19.45

11.23

8.57

7.31

6.60

6.16

5.87

5.68

6.50

19.57

11.35

8.71

7.46

6.75

6.32

6.04

5.85

6.75

19.68

11.48

8.85

7.6

6.91

6.49

6.21

6.03

7.00

19.80

11.61

8.99

7.75

7.07

6.65

6.39

6.21

11.74

11.87

7.25

19.92

9.13

7.90

7.23

7.39

6.82

6.56

6.40

7.50

20.04

9.27

8.06

6.99

6.74

6.58

7.75

20.16

12.00

9.41

8.21

7.55

7.16

6.92

6.77

8.00

20.28

12.13

9.56

8.36

7.72

7.34

7.10

6.95

8.25

20.40

12.27

9.70

8.52

7.88

7.51

7.28

7.14

8.50

20.52

20.64

12.40

9.85

9.99

8.68

8.05

7.69

7.87

7.47

7.33

8.75

12.53

8.84

8.22

7.65

7.52

9.00

20.76

12.67

10.14

9.00

8.39

8.05

7.84

7.71

12.80

12.94

13.08

9.25

20.88

10.29

9.16

8.56

8.23

8.03

7.91

9.50

21.00

10.44

9.32

8.74

8.41

8.22

8.10

9.75

21.12

10.59

9.49

8.91

8.59

8.41

8.30

9.65

9.82

10.00

21.25

13.22

10.75

9.09

8.78

8.60

8.49

10.25

21.37

13.35

10.90

9.26

8.96

8.79

8.69

10.50

21.49

13.49

11.05

9.98

9.44

9.15

8.98

8.89

10.75

21.62

13.63

11.21

10.15

9.62

9.33

9.18

9.08

11.00

21.74

13.78

11.37

10.32

9.80

9.52

9.37

9.28

11.25

21.87

13.92

11.52

10.49

9.98

9.71

9.56

9.48

14.06

14.20

11.50

21.99

11.68

10.66

10.16

9.90

9.76

9.68

11.75

22.12

11.84

10.84

10.35

10.09

9.96

9.88

12.00

14.35

14.49

10.08

10.29

22.24

12.00

11.01

10.53

10.29

10.16

12.25

22.37

12.16

11.19

10.72

10.48

10.35

12.50

22.50

14.64

12.33

11.36

10.9

10.67

10.55

10.49

12.75

22.63

14.78

12.49

11.54

11.09

10.87

10.75

10.69

13.00

22.75

14.93

12.65

11.72

11.28

11.06

10.95

10.90

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning