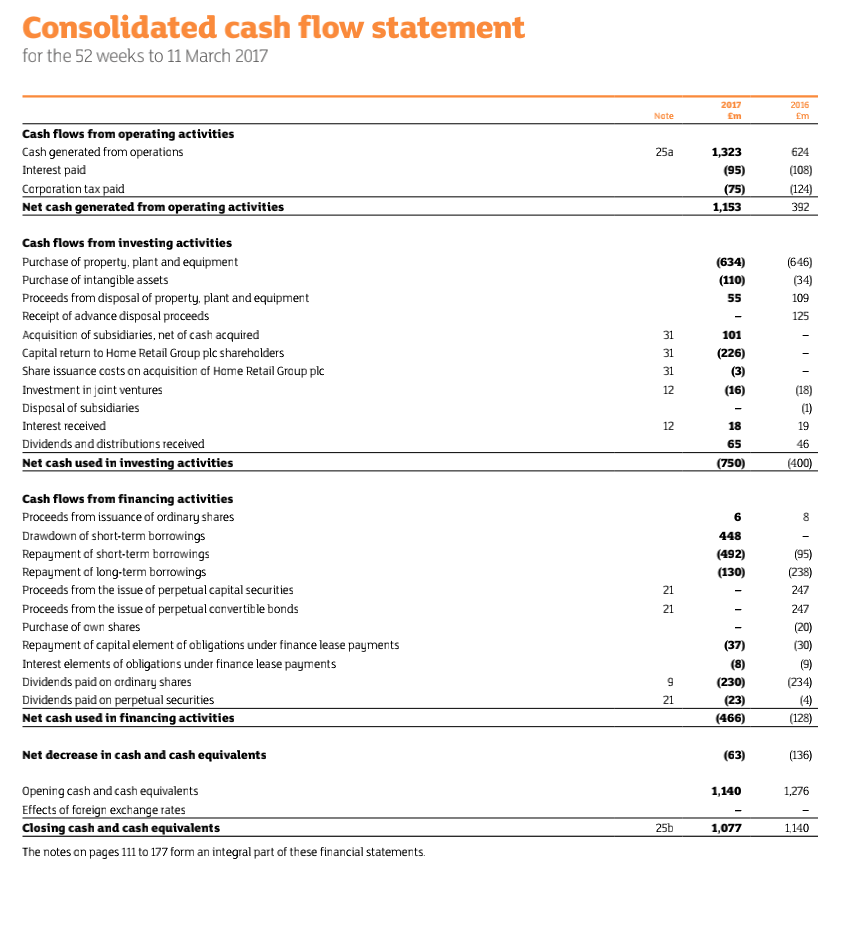

According to the images, answer the following questions: 1. During the year ended March 11th, 2017, how much did Sainsbury’s receive in cash due to sales of plant, property and equipment? a) 55 b) 314 c) 634 d) 466 e) None of the Above 2. During the year ended March 11th, 2017, how much net cash flow did Sainsbury’s generate from operating activities (including interest and taxes paid)? a) (63) b) 1,077 c) 1,323 d) 1,153 e) None of the above 3. In which part of the Statement of Cash Flows does Sainsbury’s classify interest received and dividend received? a) Cash Flows from Operations b) Cash Flows from Investing c) Cash Flows from Financing d) Not classified 4. What amount of long–term borrowings did Sainsbury’s repay during the year? You can ignore capital leases a) 492 b) 130 c) 466 d) 448 e) None of the above

According to the images, answer the following questions:

1. During the year ended March 11th, 2017, how much did Sainsbury’s receive in cash due to sales of plant, property and equipment?

a) 55

b) 314

c) 634

d) 466

e) None of the Above

2. During the year ended March 11th, 2017, how much net cash flow did Sainsbury’s generate from operating activities (including interest and taxes paid)?

a) (63)

b) 1,077

c) 1,323

d) 1,153

e) None of the above

3. In which part of the Statement of Cash Flows does Sainsbury’s classify interest received and dividend received?

a) Cash Flows from Operations

b) Cash Flows from Investing

c) Cash Flows from Financing

d) Not classified

4. What amount of long–term borrowings did Sainsbury’s repay during the year? You can ignore capital leases

a) 492

b) 130

c) 466

d) 448

e) None of the above

5. What is the difference between the Net profit for the financial year and “Net cash generated from operating activities (CFO)”?

a) Net profit is 776 greater than CFO

b) Net profit is 776 smaller than CFO

c) Net profit is 946 smaller than CFO

d) Net profit is 170 greater than CFO

e) None of the above

6.Did Sainsbury generate enough cash flow from operations to fund their investing activities?

a) Yes

b) No

7. What was the amount of cash that Sainsbury’s paid for their finance lease obligations(capital obligation plus interest) during the year ending March 11th, 2017?

a) 37

b) 8

c) 45

d) 130

e) 466

8. How much cash did Sainsbury borrow during year ended March 11th, 2017?

a) Zero

b) 172

c) 492

d) 448

e) None of the above

9. Which of the following statements is true regarding Sainsbury's indirect method Cash Flow from Operations?

a) Sainsbury subtract a decrease in their inventory

b) Sainsbury add-back

c) Sainsbury recognized a loss on disposal of properties

d) Sainsbury add-back an increase in their trade receivables

e) None of the above

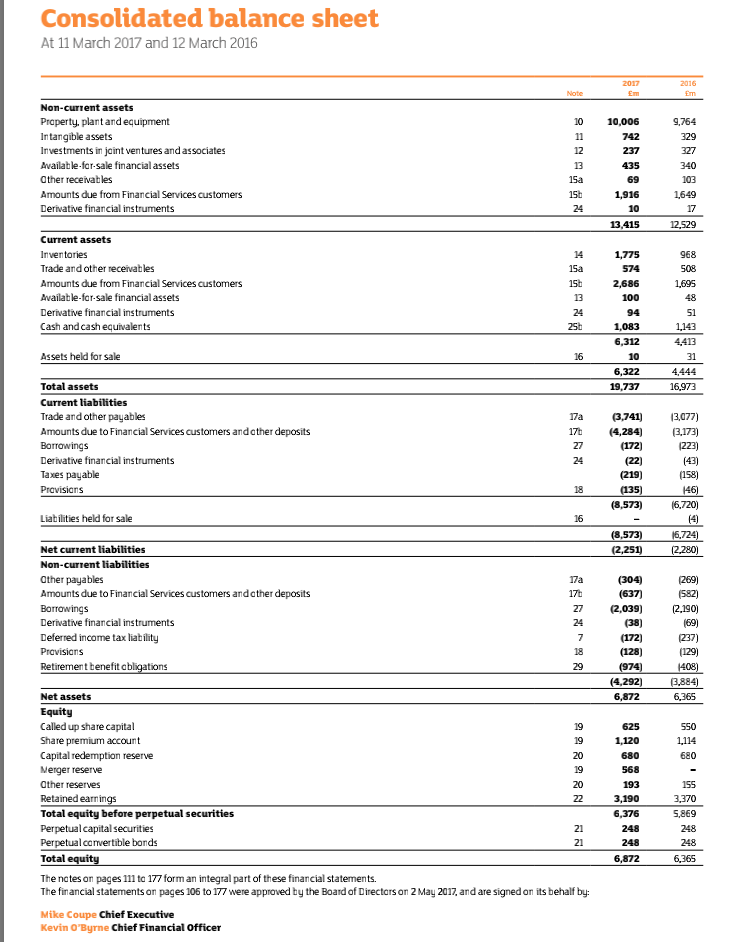

10. During the year ending March 11th, 2017, how does the closing balance for Cash in the Statement of Cash Flows compare with that in the Balance Sheet?

a) Same

b) Different by 6, due to foreign exchange translation

c) Different by 6, due to overdraft

d) Different by 1,077 due to both foreign exchange translation and overdraft

e) None of the above

Part B

Compare the cash generation and uses of Sainsbury’s in 2017 relative to 2016. In particular, comparatively assess the strengths and weaknesses of each part (CFO, CFI and CFF).

Trending now

This is a popular solution!

Step by step

Solved in 2 steps