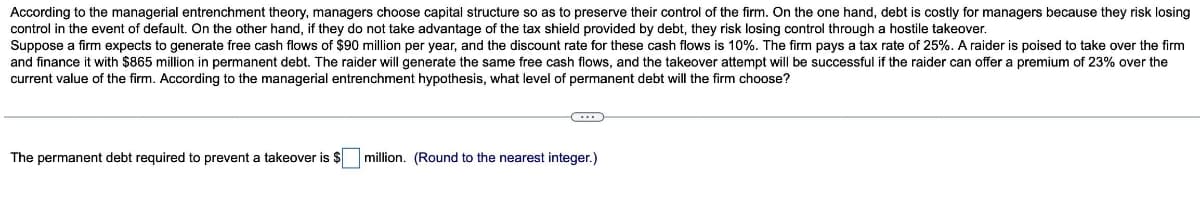

According to the managerial entrenchment theory, managers choose capital structure so as to preserve their control of the firm. On the one hand, debt is costly for managers because they risk losing control in the event of default. On the other hand, if they do not take advantage of the tax shield provided by debt, they risk losing control through a hostile takeover. Suppose a firm expects to generate free cash flows of $90 million per year, and the discount rate for these cash flows is 10%. The firm pays a tax rate of 25%. A raider is poised to take over the firm and finance it with $865 million in permanent debt. The raider will generate the same free cash flows, and the takeover attempt will be successful if the raider can offer a premium of 23% over the current value of the firm. According to the managerial entrenchment hypothesis, what level of permanent debt will the firm choose? The permanent debt required to prevent a takeover is $ million. (Round to the nearest integer.)

According to the managerial entrenchment theory, managers choose capital structure so as to preserve their control of the firm. On the one hand, debt is costly for managers because they risk losing control in the event of default. On the other hand, if they do not take advantage of the tax shield provided by debt, they risk losing control through a hostile takeover. Suppose a firm expects to generate free cash flows of $90 million per year, and the discount rate for these cash flows is 10%. The firm pays a tax rate of 25%. A raider is poised to take over the firm and finance it with $865 million in permanent debt. The raider will generate the same free cash flows, and the takeover attempt will be successful if the raider can offer a premium of 23% over the current value of the firm. According to the managerial entrenchment hypothesis, what level of permanent debt will the firm choose? The permanent debt required to prevent a takeover is $ million. (Round to the nearest integer.)

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter12: Valuation: Cash-flow Based Approaches

Section: Chapter Questions

Problem 6QE: Suppose you are valuing a healthy, growing, profitable firm and you project that the firm will...

Related questions

Question

H2.

Transcribed Image Text:According to the managerial entrenchment theory, managers choose capital structure so as to preserve their control of the firm. On the one hand, debt is costly for managers because they risk losing

control in the event of default. On the other hand, if they do not take advantage of the tax shield provided by debt, they risk losing control through a hostile takeover.

Suppose a firm expects to generate free cash flows of $90 million per year, and the discount rate for these cash flows is 10%. The firm pays a tax rate of 25%. A raider is poised to take over the firm

and finance it with $865 million in permanent debt. The raider will generate the same free cash flows, and the takeover attempt will be successful if the raider can offer a premium of 23% over the

current value of the firm. According to the managerial entrenchment hypothesis, what level of permanent debt will the firm choose?

The permanent debt required to prevent a takeover is $

million. (Round to the nearest integer.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage