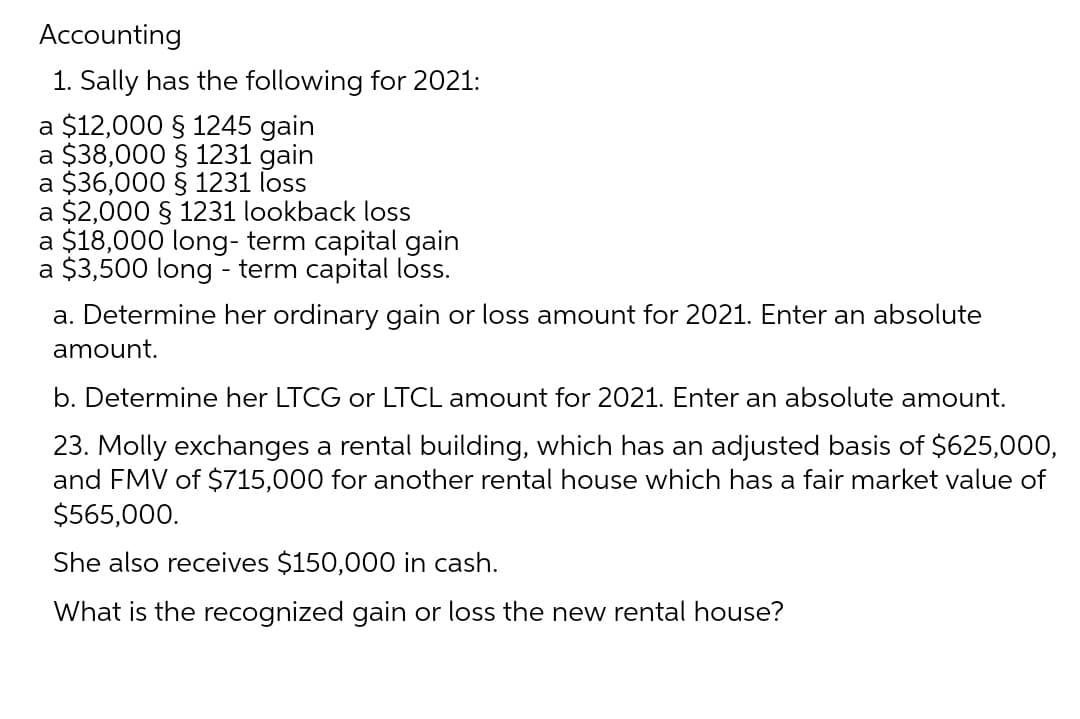

Accounting 1. Sally has the following for 2021: a $12,000 § 1245 gain a $38,000 § 1231 gain a $36,000 § 1231 loss a $2,000 § 1231 lookback loss a $18,000 long-term capital gain a $3,500 long-term capital loss. a. Determine her ordinary gain or loss amount for 2021. Enter an absolute amount. b. Determine her LTCG or LTCL amount for 2021. Enter an absolute amount. 23. Molly exchanges a rental building, which has an adjusted basis of $625,000, and FMV of $715,000 for another rental house which has a fair market value of $565,000. She also receives $150,000 in cash. What is the recognized gain or loss the new rental house?

Accounting 1. Sally has the following for 2021: a $12,000 § 1245 gain a $38,000 § 1231 gain a $36,000 § 1231 loss a $2,000 § 1231 lookback loss a $18,000 long-term capital gain a $3,500 long-term capital loss. a. Determine her ordinary gain or loss amount for 2021. Enter an absolute amount. b. Determine her LTCG or LTCL amount for 2021. Enter an absolute amount. 23. Molly exchanges a rental building, which has an adjusted basis of $625,000, and FMV of $715,000 for another rental house which has a fair market value of $565,000. She also receives $150,000 in cash. What is the recognized gain or loss the new rental house?

Chapter14: Property Transactions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 30CE

Related questions

Question

Transcribed Image Text:Accounting

1. Sally has the following for 2021:

a $12,000 § 1245 gain

a $38,000 § 1231 gain

a $36,000 § 1231 loss

a $2,000 § 1231 lookback loss

a $18,000 long-term capital gain

a $3,500 long-term capital loss.

a. Determine her ordinary gain or loss amount for 2021. Enter an absolute

amount.

b. Determine her LTCG or LTCL amount for 2021. Enter an absolute amount.

23. Molly exchanges a rental building, which has an adjusted basis of $625,000,

and FMV of $715,000 for another rental house which has a fair market value of

$565,000.

She also receives $150,000 in cash.

What is the recognized gain or loss the new rental house?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT