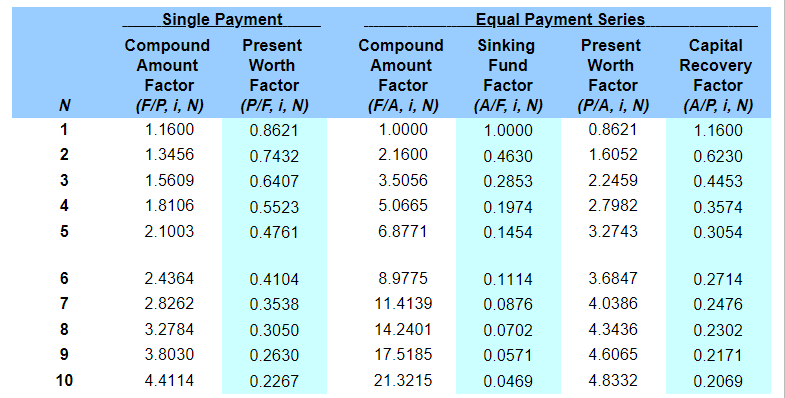

Accounting A plant engineer wishes to know which of two types of lightbulbs should be used to light a warehouse. The bulbs that are currently used cost $42.70 per bulb and last 14,500 hours before burning out. The new bulb (at $57.3 per bulb) provides the same amount of light and consumes the same amount of energy, but it lasts twice as long. The labor cost to change a bulb is$14.00. The lights are on 20 hours a day, 365 days a year. (Assume that the firm's marginal tax rate is 25%.) If the firm's MARR is 16%, what is the maximum price (per bulb) the engineer should be willing to pay to switch to the new bulb? Round the service life of the old bulb to the nearest whole number..

Accounting

A plant engineer wishes to know which of two types of lightbulbs should be used to light a warehouse. The bulbs that are currently used cost $42.70 per bulb and last 14,500 hours before burning out. The new bulb (at $57.3 per bulb) provides the same amount of light and consumes the same amount of energy, but it lasts twice as long. The labor cost to change a bulb is$14.00. The lights are on 20 hours a day, 365 days a year. (Assume that the firm's marginal tax rate is 25%.) If the firm's MARR is 16%, what is the maximum price (per bulb) the engineer should be willing to pay to switch to the new bulb? Round the service life of the old bulb to the nearest whole number..

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images