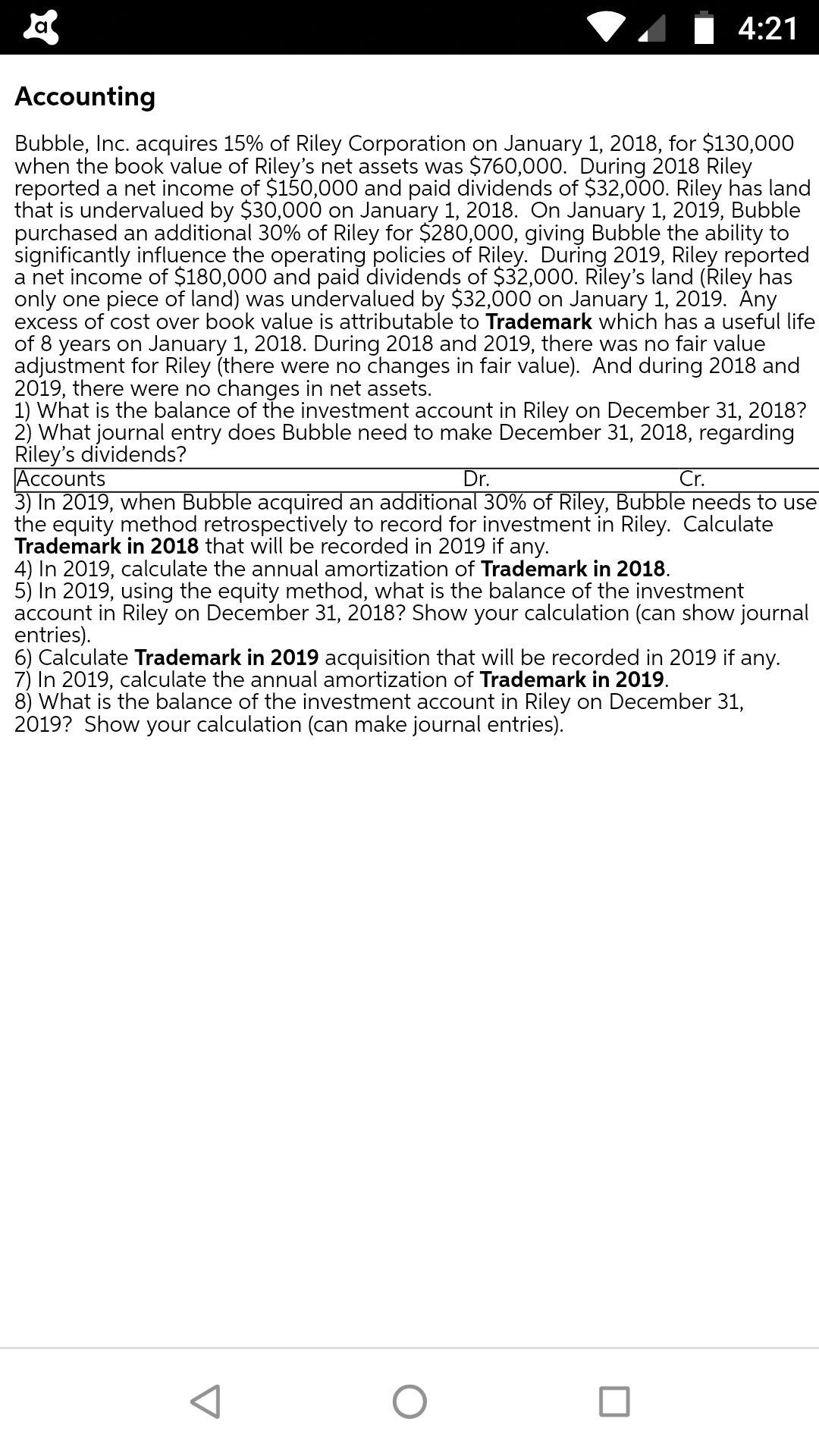

Accounting Bubble, Inc. acquires 15% of Riley Corporation on January 1, 2018, for $130,000 when the book value of Riley's net assets was $760,000. During 2018 Riley reported a net income of $150,000 and paid dividends of $32,000. Riley has land that is undervalued by $30,000 on January 1, 2018. On January 1, 2019, Bubble purchased an additional 30% of Riley for $280,000, giving Bubble the ability to significantly influence the operating policies of Riley. During 2019, Riley reported a net income of $180,000 and paid dividends of $32,000. Riley's land (Řiley has only one piece of land) was undervalued by $32,000 on January 1, 2019. Ány excess of cost over book value is attributable to Trademark which has a useful life of 8 years on January 1, 2018. During 2018 and 2019, there was no fair value adjustment for Riley (there were no changes in fair value). And during 2018 and 2019, there were no changes in net assets. 1) What is the balance of the investment account in Riley on December 31, 2018? 2) What journal entry does Bubble need to make December 31, 2018, regarding Riley's dividends? Accounts 3) In 2019, when Bubble acquired an additional 30% of Riley, Bubble needs to use the equity method retrospectively to record for investment in Riley. Calculate Trademark in 2018 that will be recorded in 2019 if any. Dr. Cr.

Accounting Bubble, Inc. acquires 15% of Riley Corporation on January 1, 2018, for $130,000 when the book value of Riley's net assets was $760,000. During 2018 Riley reported a net income of $150,000 and paid dividends of $32,000. Riley has land that is undervalued by $30,000 on January 1, 2018. On January 1, 2019, Bubble purchased an additional 30% of Riley for $280,000, giving Bubble the ability to significantly influence the operating policies of Riley. During 2019, Riley reported a net income of $180,000 and paid dividends of $32,000. Riley's land (Řiley has only one piece of land) was undervalued by $32,000 on January 1, 2019. Ány excess of cost over book value is attributable to Trademark which has a useful life of 8 years on January 1, 2018. During 2018 and 2019, there was no fair value adjustment for Riley (there were no changes in fair value). And during 2018 and 2019, there were no changes in net assets. 1) What is the balance of the investment account in Riley on December 31, 2018? 2) What journal entry does Bubble need to make December 31, 2018, regarding Riley's dividends? Accounts 3) In 2019, when Bubble acquired an additional 30% of Riley, Bubble needs to use the equity method retrospectively to record for investment in Riley. Calculate Trademark in 2018 that will be recorded in 2019 if any. Dr. Cr.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

Please do answer following question asap.

Transcribed Image Text:Accounting

Bubble, Inc. acquires 15% of Riley Corporation on January 1, 2018, for $130,000

when the book value of Riley's net assets was $760,000. During 2018 Riley

reported a net income of $150,000 and paid dividends of $32,000. Riley has land

that is undervalued by $30,000 on January 1, 2018. On January 1, 2019, Bubble

purchased an additional 30% of Riley for $280,000, giving Bubble the ability to

significantly influence the operating policies of Riley. During 2019, Riley reported

a net income of $180,000 and paid dividends of $32,000. Riley's land (Řiley has

only one piece of land) was undervalued by $32,000 on January 1, 2019. Ány

excess of cost over book value is attributable to Trademark which has a useful life

of 8 years on January 1, 2018. During 2018 and 2019, there was no fair value

adjustment for Riley (there were no changes in fair value). And during 2018 and

2019, there were no changes in net assets.

1) What is the balance of the investment account in Riley on December 31, 2018?

2) What journal entry does Bubble need to make December 31, 2018, regarding

Riley's dividends?

Accounts

3) In 2019, when Bubble acquired an additional 30% of Riley, Bubble needs to use

the equity method retrospectively to record for investment in Riley. Calculate

Trademark in 2018 that will be recorded in 2019 if any.

Dr.

Cr.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning